CDP for financial services: Unify customer data & drive revenue

Customer data platforms (CDP) are now a staple for many financial institutions. Their ability to aggregate customer data is essential for overcoming data silos and setting a foundation for delivering exceptional customer experiences.

Updated on 30 Sep 2025

However, many financial services teams who decide to invest in a CDP face two common challenges:

- Complex setup process and slow implementation. This makes it difficult to see a quick return on investment (ROI) and slows down the overall time-to-value.

- Lack of built-in data activation channels and capabilities. This forces teams to use a combination of different point solutions (each with different credentials, pricing plans, and UIs) to activate their data, leading to complex workflows and expensive martech stacks.

In this guide, we’ll show you how Insider — our industry-leading CDP and cross-channel personalization solution — can help you unify your customer data while overcoming both issues and driving conversions, revenue, and retention as quickly as possible.

Organizations in financial services (Allianz, Garanti BBVA, Etiqa), telecommunications (Vodafone, Inea, Circles.life), beauty and cosmetics (Avon, Mac Cosmetics, Clarins), and many other industries use Insider for centralized customer data management, audience segmentation, behavioral analytics, and data activation across 12+ channels.

To learn more about Insider, book a demo with our team or try the platform yourself.

Fast and guided implementation process

Implementing a CDP can be a difficult task, especially in the financial services sector. From identifying all relevant data sources and stakeholders to setting up the platform and ensuring it’s working correctly, the process often takes tons of effort and engineering time.

We’ve seen many clients struggle during the process, which leads to slow time-to-value and ROI. That’s why we’ve strived to eliminate as many of these setbacks as possible.

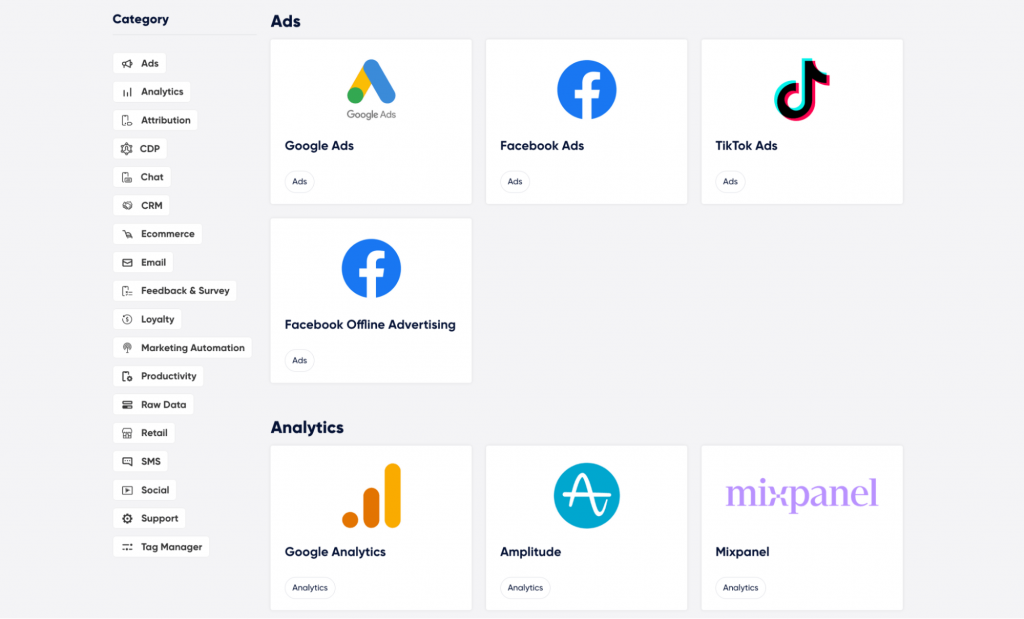

First, our Integration Hub lets you easily connect to 100+ tools across 20+ categories with minimal reliance on technical teams. Some of these solutions include:

- CRMs like Salesforce, Pipedrive, Zoho, and Microsoft Dynamics CRM.

- Email marketing platforms like Mailchimp, ActiveCampaign, and Constant Contact.

- Analytics and attribution platforms like Mixpanel, Amplitude, and AppsFlyer.

- Marketing automation tools like Pardot, Keap, and Marketo.

- Other CDPs like Segment, mParticle, and Tealium.

- Live chat software like Drift and Intercom.

- And many other popular SaaS solutions.

You can also connect to any other online or offline source (e.g., legacy systems) using our flexible API. Put simply, Insider’s versatility lets you seamlessly plug it into your existing data sources, tech ecosystem, and workflows.

During the process, our experienced global support team:

- Helps you set up Insider with no extra setup charge. Our team ensures you’re by involving the right stakeholders in the process, bringing together the right data points (, integrating with all key solutions, and much more.

- Shows you how the platform works based on your needs. They also analyze your current analytics data to give you ideas for implementing marketing strategies right away, which helps you generate ROI as fast as possible.

- Migrates customer journeys to our platform. If you have any automated campaigns or journeys in other platforms — e.g., email welcome flows, SMS alerts, or cross-channel survey campaigns — our team will migrate them to our customer journey builder for you.

- Answers and resolves questions quickly. As a global company with 26 offices on six continents, we can provide fast support to businesses all over the world. Plus, our teams are all trained and working in-house, so you can be sure that your queries will be handled by people with the necessary know-how and experience.

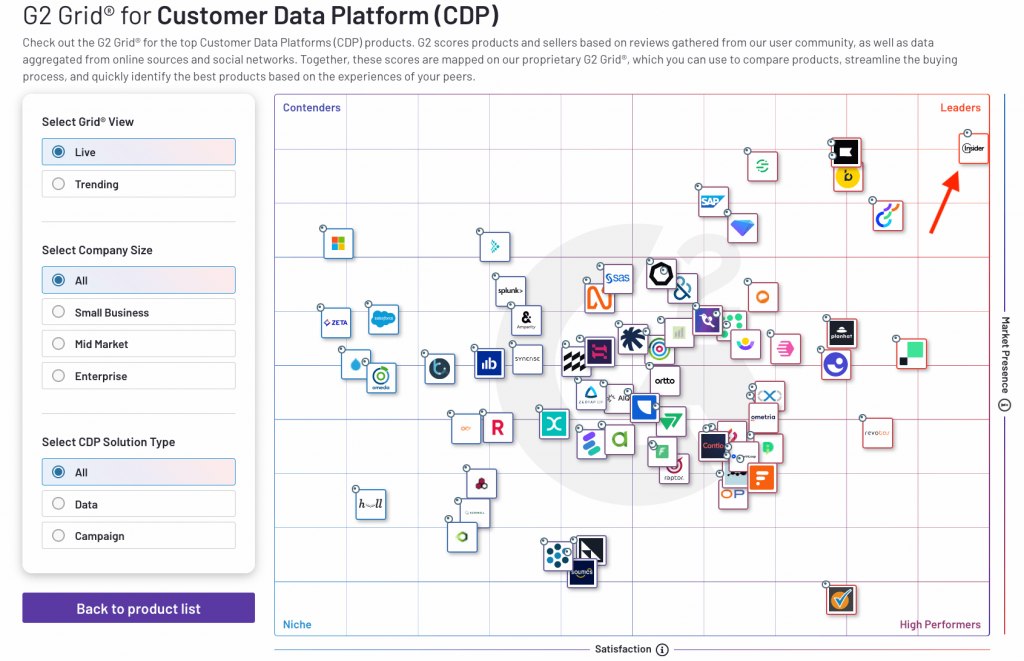

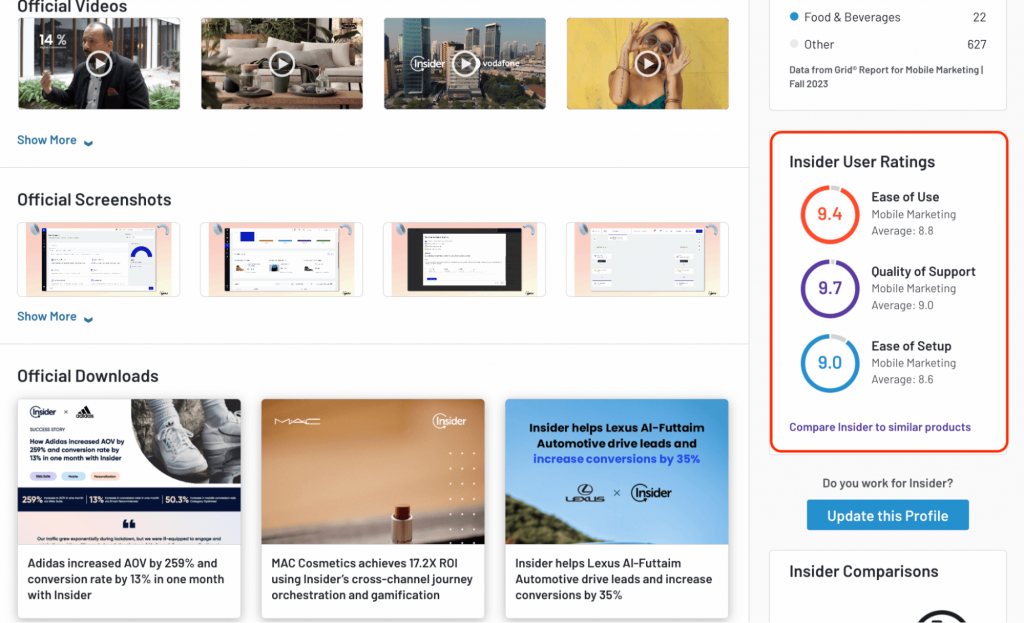

Thanks to the versatile setup options and best-in-class support team, customers consistently rank Insider as the best CDP in terms of ease of setup, ease of use, and quality of support.

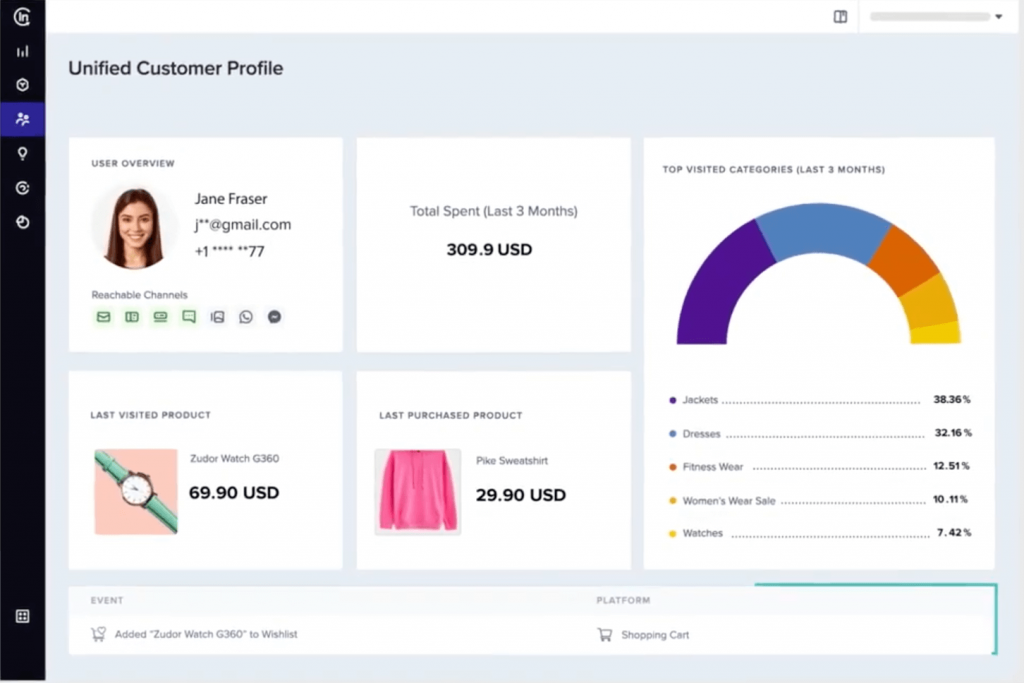

Detailed 360-degree customer profiles

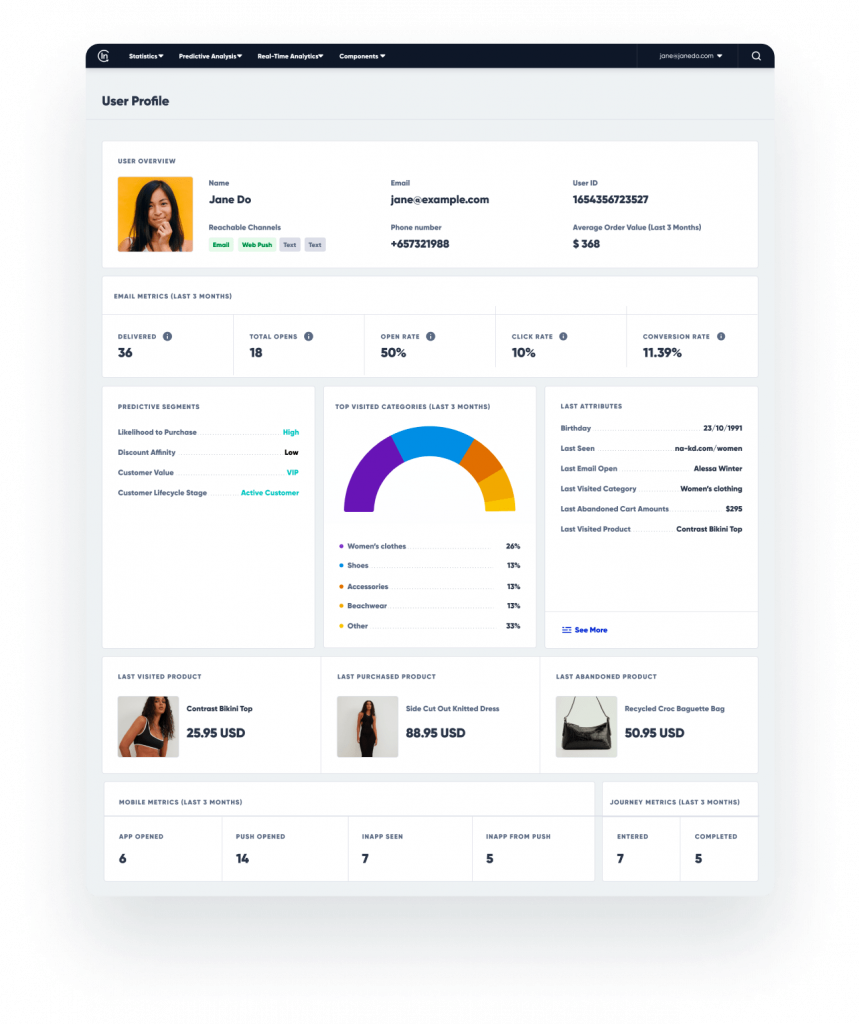

Once set up, our CDP automatically creates 360-degree profiles of all your customers. These profiles can aggregate essential first-, second-, and third-party data, including:

- Names, demographics, and contact info.

- Predictive characteristics, like likelihood to purchase or engage.

- Behavioral data, like interactions with your website or messaging channels.

- Last purchased, visited, and abandoned products.

- Survey responses and other first-party data.

We store this unified information for five years but that period can be extended depending on your business needs. Plus, our platform automatically updates these profiles in real-time as customers continue to interact with your brand online (e.g., via your site, mobile app, or emails) and offline (e.g., at your branch offices).

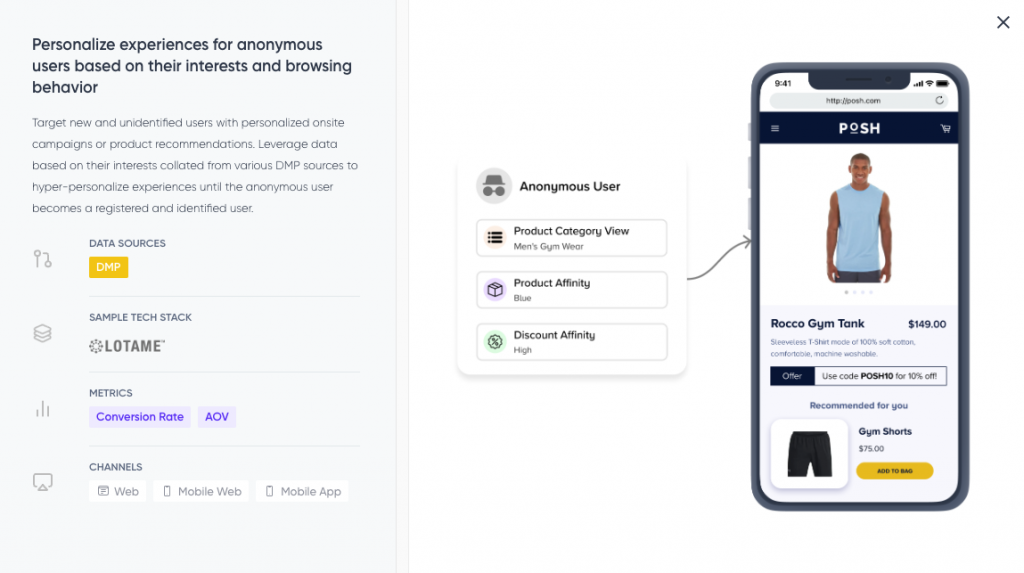

Our CDP even creates unified profiles for all anonymous visitors who browse your site. This enables you to employ anonymous visitor personalization — the process of tailoring the on-site experience to people who haven’t shared contact information with you yet.

By doing that, you can drastically reduce the time and money it takes to convert new visitors into leads and customers.

Powerful segmentation and behavioral analytics

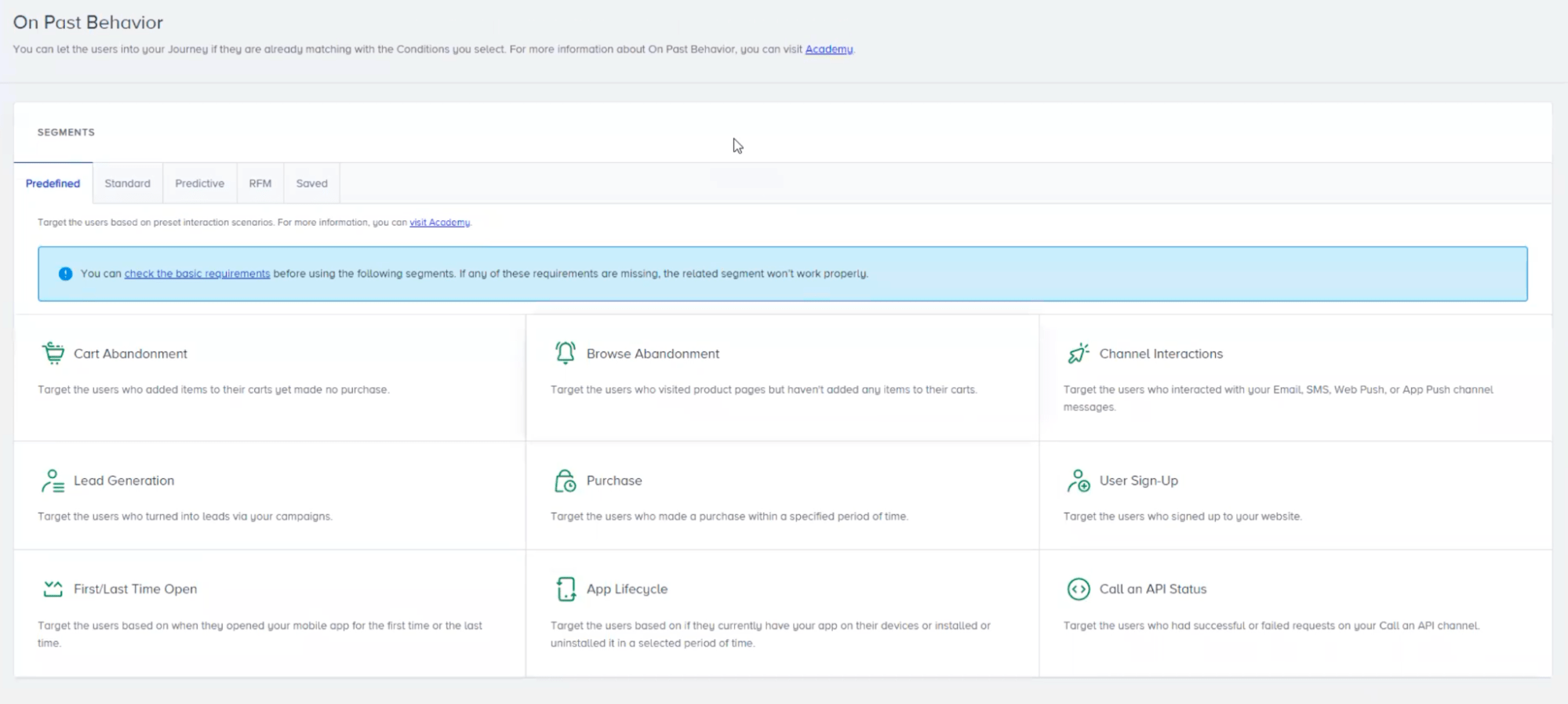

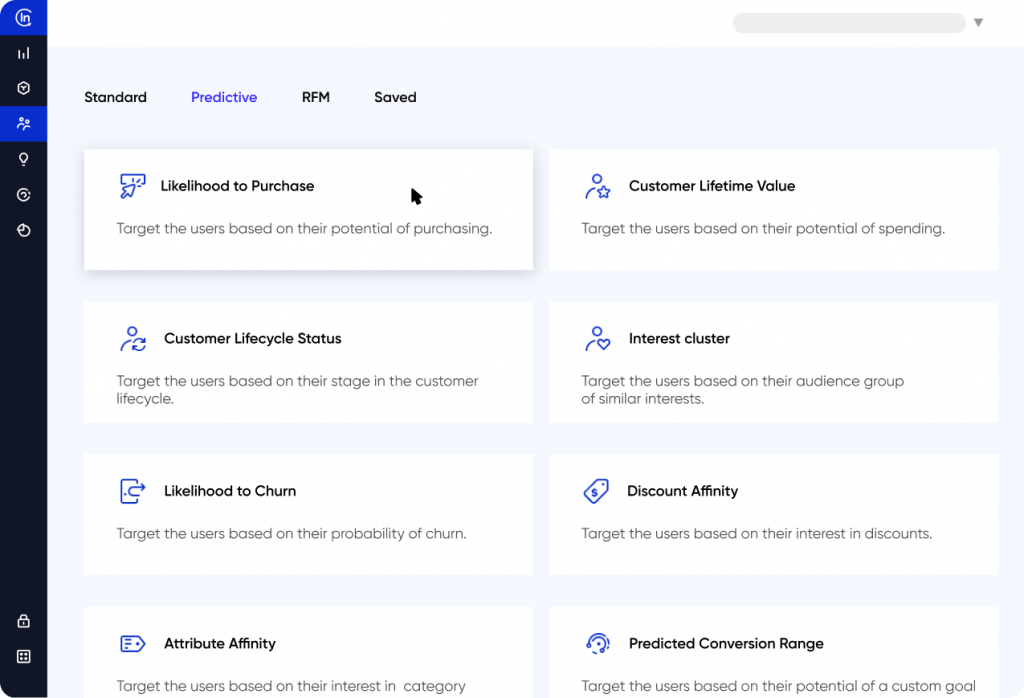

With your data unified, you can start segmenting your audiences to find the right customers to target with your marketing efforts. Insider helps you do this with 120+ attributes, including traits, behaviors, and preferences across three different audience types:

- Standard, which include characteristics like locations, demographics, devices, operating systems, and more.

- Predefined, which include leads, cart and browser abandoners, mobile app users, customers who’ve interacted with your brand on a specific channel, and more.

- Predictive (powered by our AI algorithms), like customers with a discount affinity, with a high likelihood of buying or engaging on a specific channel, and more. For more details, check out our in-depth guide to predictive marketing.

Insider also makes it possible to use your unified data to perform detailed analyses of your audiences and come up with granular, actionable insights for your campaigns.

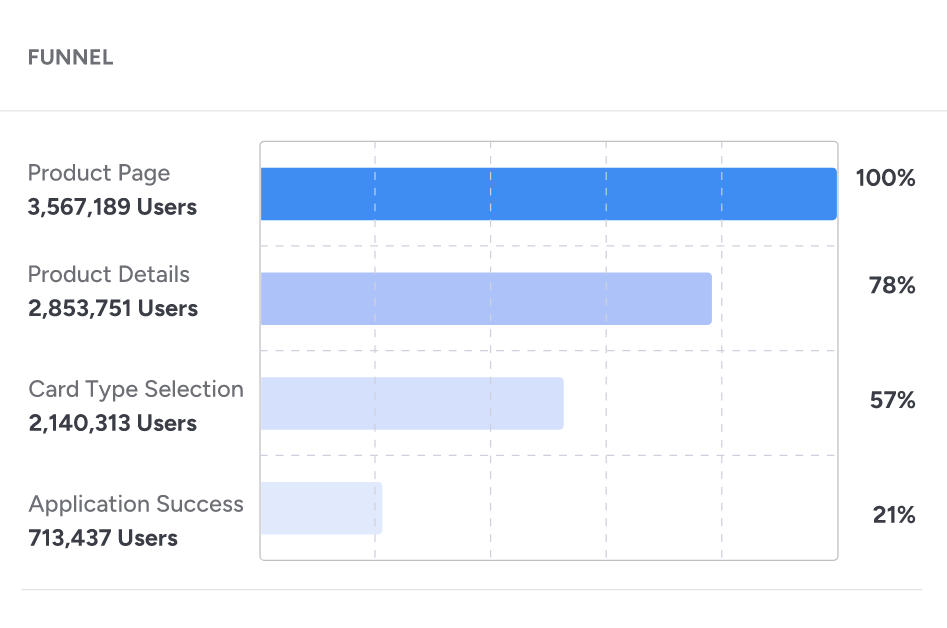

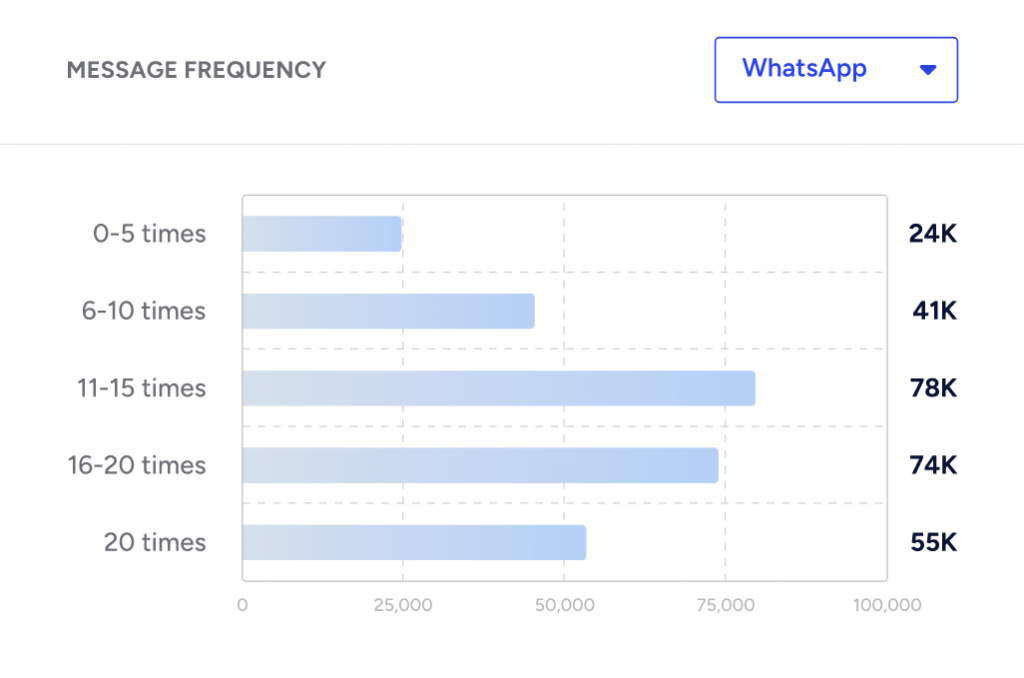

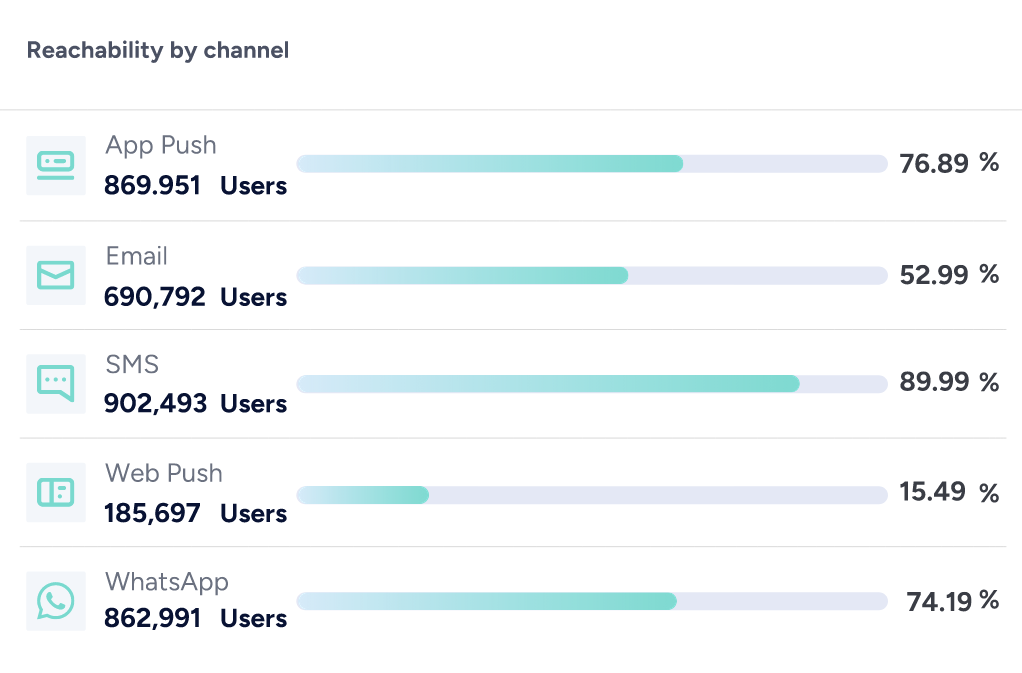

For example, using our behavioral analytics capabilities, you can:

- Build funnels around goals, such as lead collection, survey responses, loan and card applications, and other key conversions. Our funnels will show you where most drop-offs occur, so you can focus on the areas that need attention.

- Analyze message frequency for different types of customers (e.g., inactive, loyal, VIPs, and more). This can help you determine the optimal messaging frequency per channel.

- Analyze channel reachability for different segments. This can help you plan your campaigns around the touchpoints customers are actually using, so you can maximize every interaction.

In short, Insider’s segmentation and behavioral analytics enable you to power your decision-making, customer targeting, and overall business strategy with reliable insights.

Built-in channel access, personalization capabilities, and marketing automation

Up to this point, we’ve covered the more classic CDP use cases — data unification, segmentation, and analytics. While important, these activities don’t cover the process of data activation, i.e., actually using your unified data to create personalized campaigns that drive revenue.

This is an area where traditional CDPs struggle as they don’t have built-in activation channels and personalization capabilities. Instead, they rely on passing their data to third-party systems, like email platforms, push notification tools, personalization software, and so on.

As a result, marketers must constantly navigate between different solutions in order to build, manage, and analyze their campaigns. This overcomplicates their workflows and increases the total cost of ownership (TCO) of the entire martech stack.

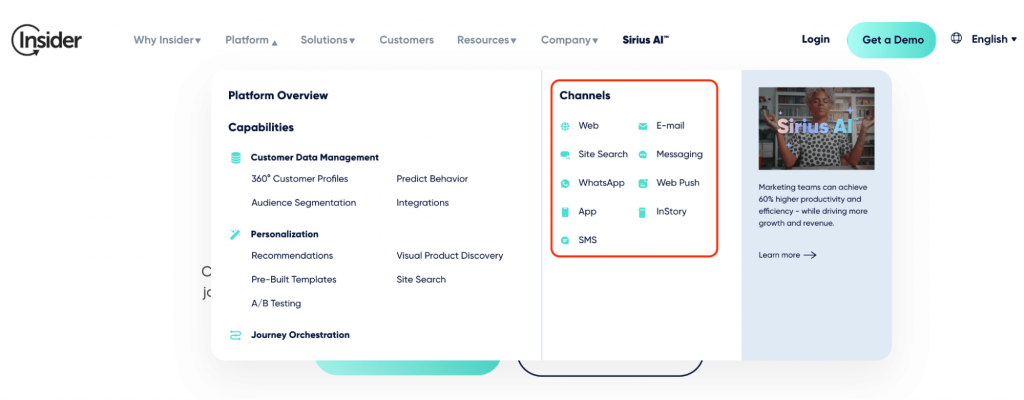

Insider avoids that issue by bringing together 12+ activation channels, advanced personalization capabilities, and a customer journey builder under the same umbrella as our enterprise CDP.

In fact, Insider is also a leader in various categories based on reviews from customers and industry experts, including:

- Mobile marketing software by G2.

- Personalization engines by Gartner.

- Omnichannel marketing platforms by IDC.

Versatile channel access

Insider enables you to reach your customers where they’re at by supporting a variety of channels, including:

- Websites and mobile apps.

- Email.

- SMS.

- WhatsApp.

- Push notifications.

- Online ads (e.g., on Google, Facebook, and TikTok).

- And more.

This means you can drastically reduce the number of point solutions you’re using in favor of a truly unified marketing platform. We’ve seen plenty of companies do this to reduce their martech stack’s complexity and TCO.

At the same time, you don’t have to use all of Insider’s channels and capabilities right away.

For example, one of our biggest clients in the financial services industry (Allianz) started by using Insider’s CDP to unify their data and our push notifications to increase opt-in rates. They saw the fantastic ROI our solution delivered, so they’re planning to expand to other channels (like WhatsApp) and use cases (like journey orchestration).

Advanced personalization

While the ability to reach customers on different channels is important, being able to personalize the experience across all touchpoints is what can skyrocket your ROI.

Insider was built specifically for the personalization era, so it enables you to individualize every touchpoint, including your:

- Website and mobile app: You can tailor everything from content, messaging, banners, and more to each individual customer. This is crucial for improving conversion rates and maximizing your marketing budget. For example, Etiqa Insurance used Insider to personalize their homepage banner, resulting in a conversion rate of over 4.74% (against a sitewide average of 2.17%).

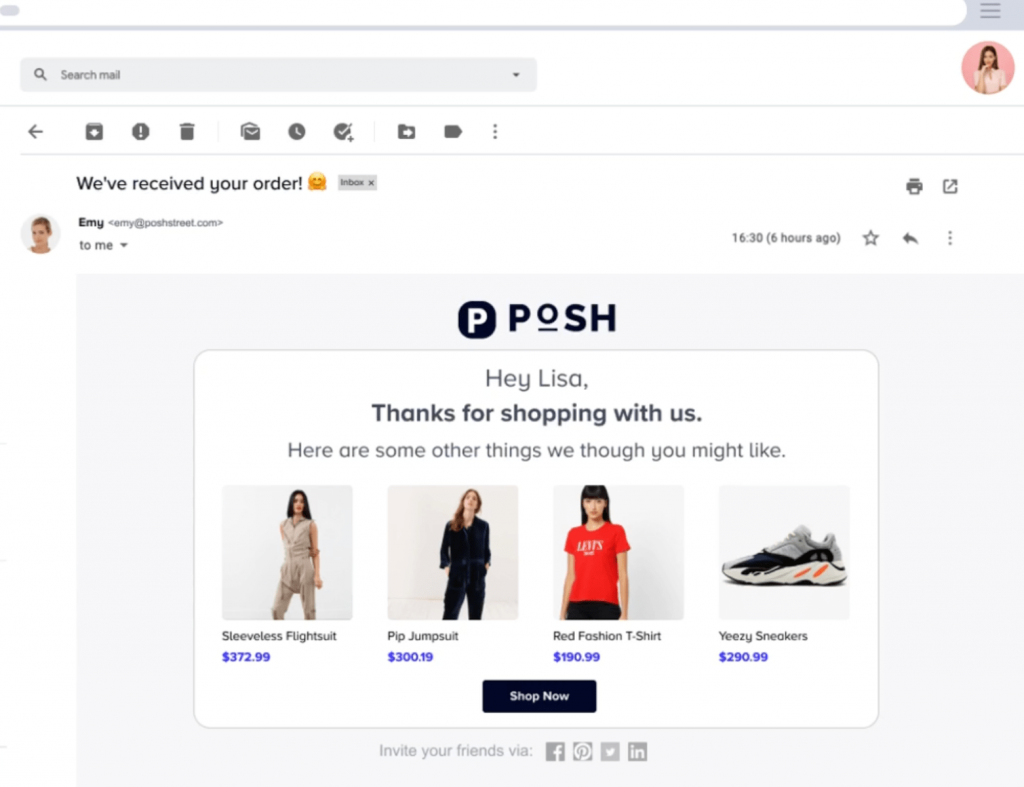

- Email and SMS communications: These two channels have become a must for marketers in many industries, including financial services. Insider enables you to build coordinated flows and campaigns to maximize your efforts across both channels. For example, you can send personalized financial product suggestions or surveys via email, event reminders via SMS, and much more.

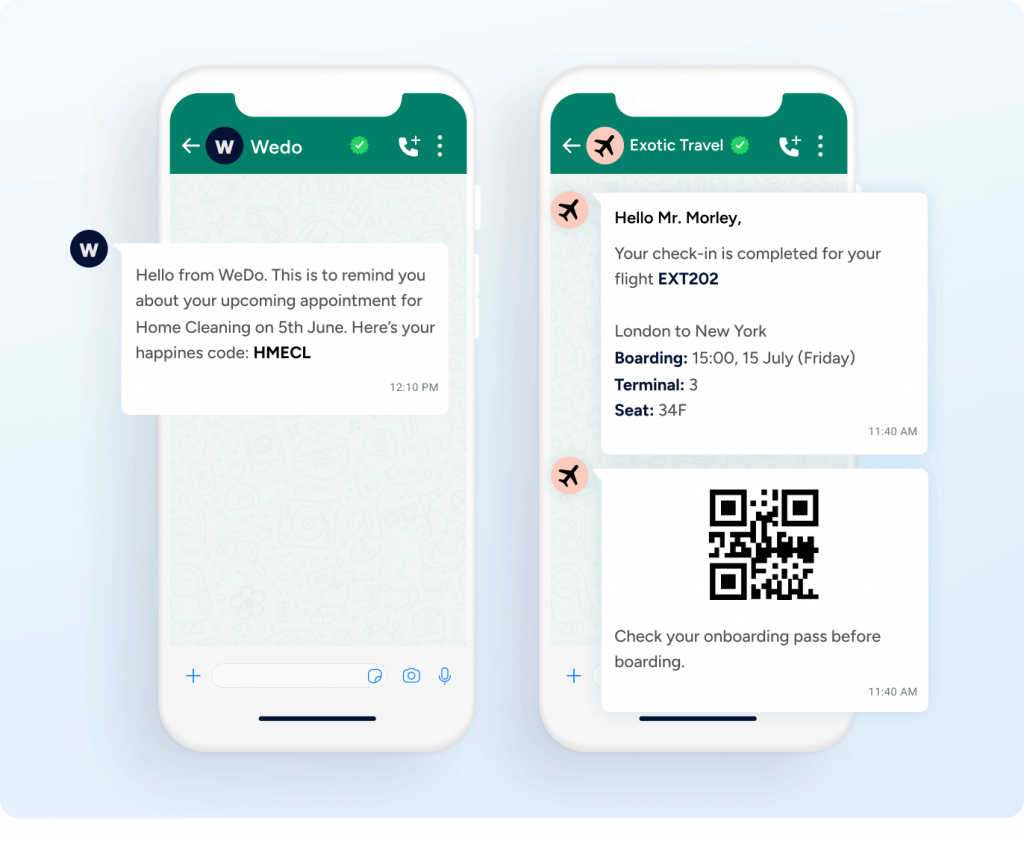

- WhatsApp marketing efforts: Insider makes it possible to take full advantage of WhatsApp’s marketing potential. This includes sending personalized promo messages (e.g., based on what customers browsed on your site), limited-time offers, and event reminders. You can also have two-way conversions to answer customers’ questions and guide them to the best options for their needs.

- Online ads, push notifications, chatbot communications, and more.

Omnichannel campaign orchestration

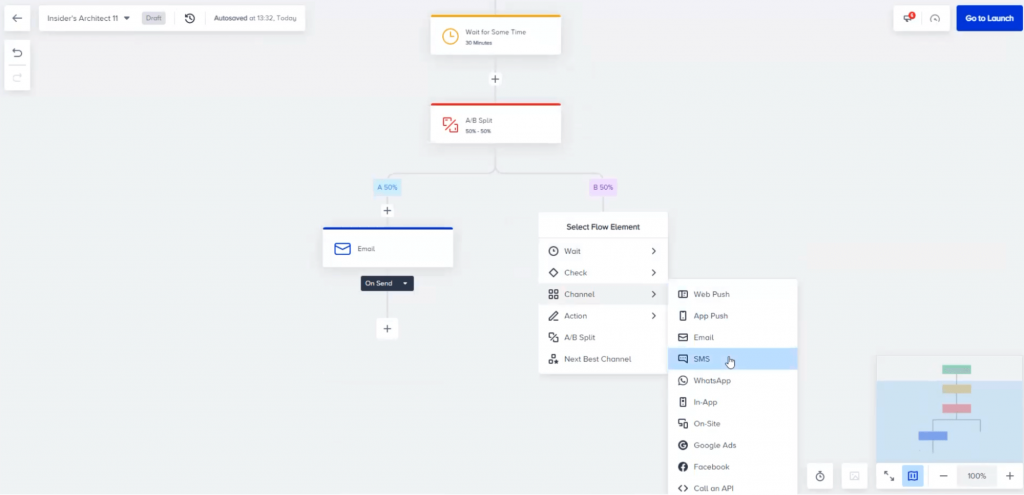

Besides personalizing each touchpoint, Insider lets you tie all channel interactions into a cohesive experience using Architect — our customer journey builder and marketing automation solution.

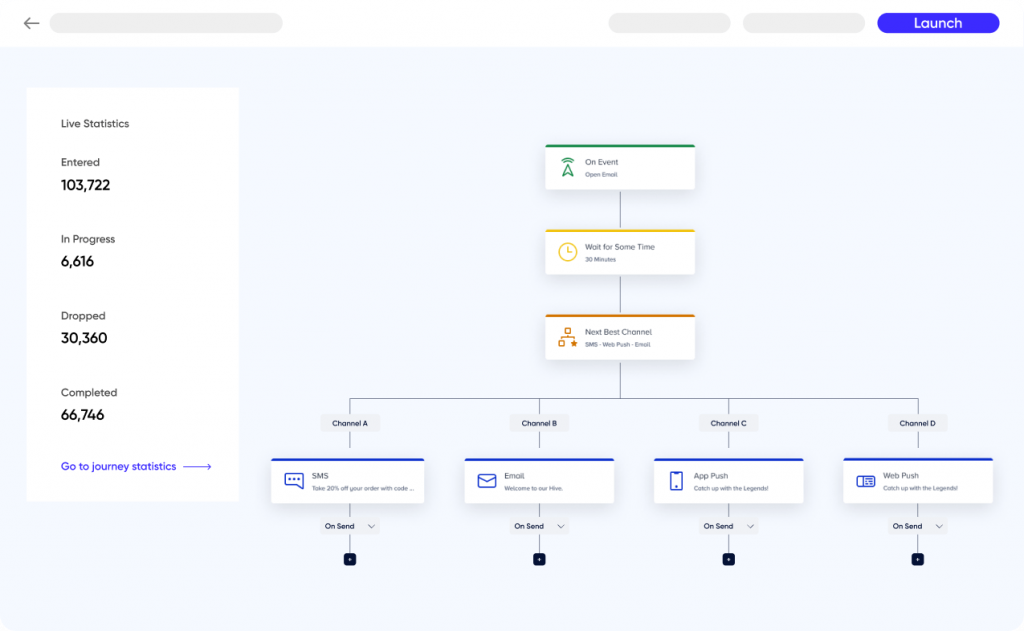

Architect lets you create all sorts of different customer journeys using a simple drag-and-drop editor shown below.

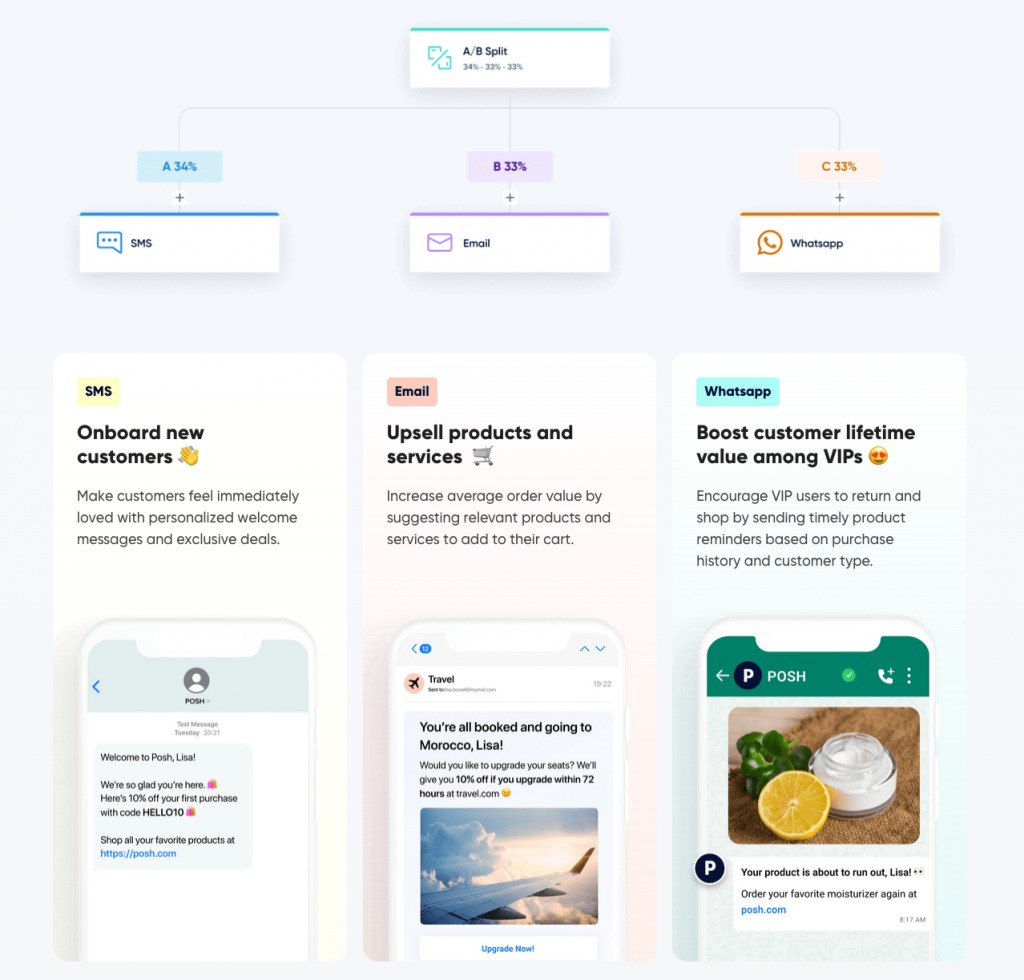

You can easily set the channels and rules (e.g., wait times, conditions, and so on) for each journey, as well as A/B test different messages and journey flows against each other.

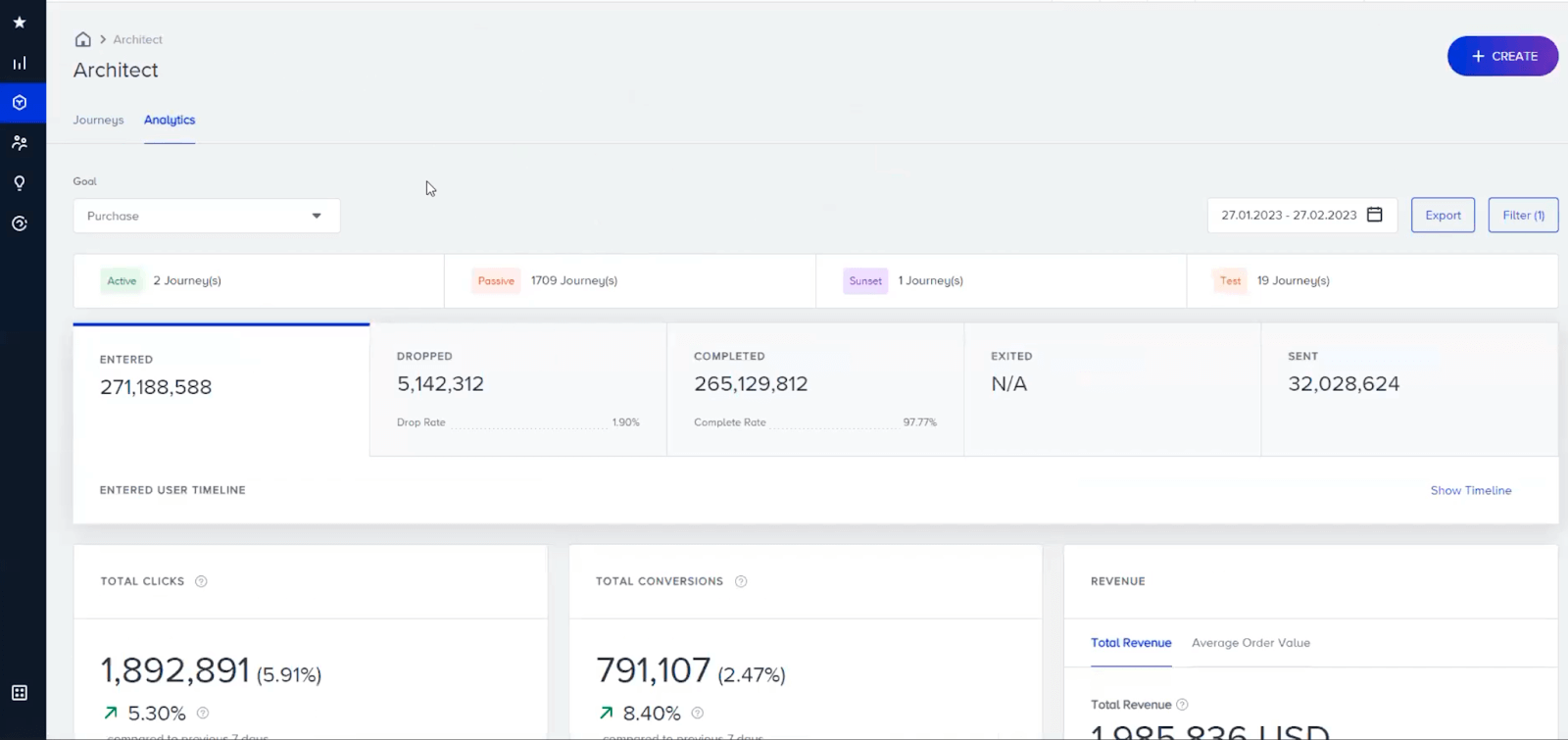

You also have detailed analytics into each customer journey’s performance right inside Architect or in a separate, fully customizable dashboard, like the one shown below.

Put simply, you can use Architect for tons of use cases, including:

- Creating simple email welcome flows for people who just subscribed to your newsletter.

- Running email surveys and following them up with relevant product recommendations across your website and messaging channels. You can even use AMP emails to let customers answer survey questions right in the email.

- Building cart and browser abandonment automations across web push notifications, SMS, and WhatsApp. For example, Vodafone used on-site cart reminders to increase conversion rates by 159%.

- Creating other complex omnichannel marketing automations (e.g., to upsell or cross-sell different financial products) that are personalized to each customer’s preferences.

- And many others.

These consistent experiences across all touchpoints can help you exceed your customers’ expectations and improve key metrics like engagement, revenue, and retention.

Industry-leading machine learning and AI for marketers

Machine learning and AI technologies have experienced a massive advancement to the point of becoming a must for many marketers, including in the financial services industry.

As we mentioned earlier, Insider offers some essential capabilities in this regard, like predictive segmentation and personalized product suggestions. That’s just the tip of the iceberg though, as our platform offers a plethora of other AI-powered features, including:

- Next-Best Channel Selection: This feature analyzes customers’ behaviors and automatically sends messages on the touchpoint they’re most likely to engage on. It’s a great way to save time and effort on your send, while also guaranteeing you’re using the channels your customers like.

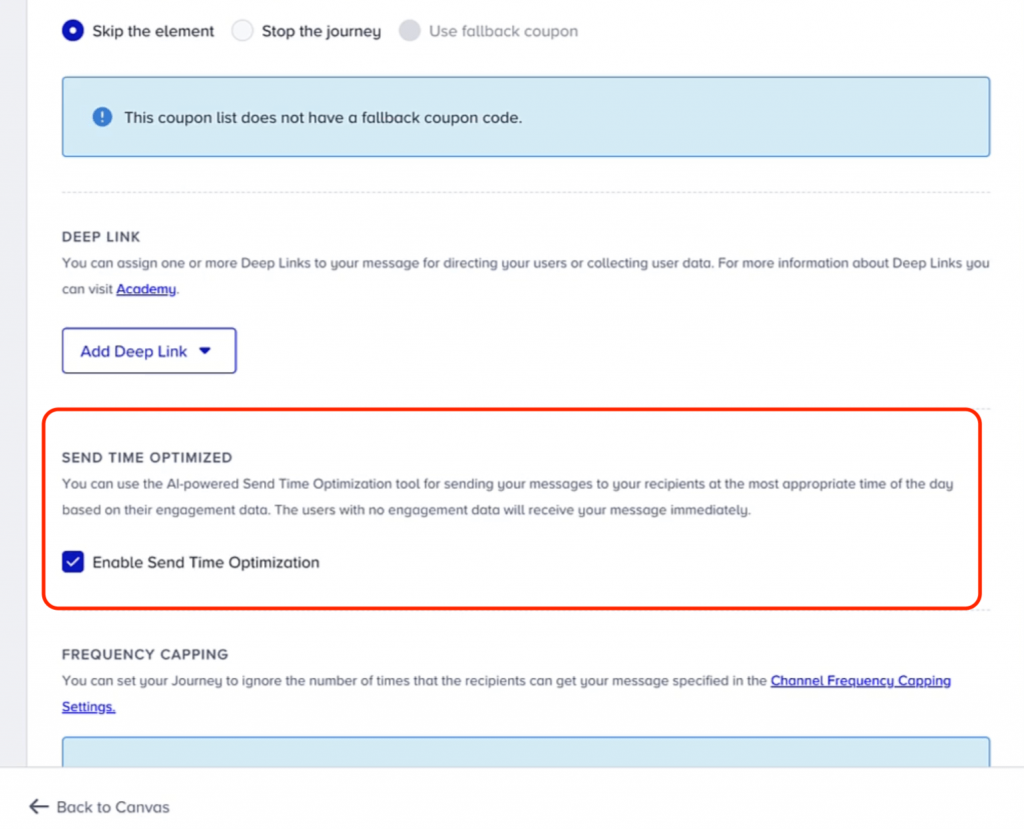

- Send-Time Optimization (STO): Similar to the previous feature, STO also analyzes customer behavior and predicts the most optimal times to trigger each message. STO can be enabled for each individual message in your campaigns.

- A/B Test Winner Auto-Selection: One of the most time-consuming tasks around A/B testing is checking the results, interpreting them, and adjusting your journeys accordingly. This feature takes that off your plate by automatically guiding users to the winning path in an A/B test, based on a metric you select beforehand (e.g., open rates, conversion rates, or revenue).

- Journey creation: Our platform can generate entire customer journeys (or autocomplete journey paths) based on your text prompts. You just need to provide an end goal, like generating more survey responses or preventing churn. This is possible thanks to Sirius AI — our AI solution that combines the power of large language models and machine learning, including predictive, conversational, and generative AI.

- Copy and image generation: You can also provide simple text prompts and our platform will quickly create copy and images for your campaigns. Again, all you have to do is provide the end goal and our platform’s generative AI will do the rest.

- Automate conversations: Sirius AI uses advanced natural language processing to understand the intent and context behind any customer query. This lets you have unstructured two-way conversations on WhatsApp (or via chatbots) while ensuring consistency and confidence in your bot’s tone of voice.

How Allianz used Insider’s financial services CDP to deliver ROI in days

Now that you know how Insider’s platform works, let’s look at a real-life example featuring one of the top financial services companies in the world.

Allianz is a leader in the financial services industry with an extensive network spanning 4,000 agencies, 1,500 branches, and over 7,200 contracted institutions. The company is known for offering digital-first solutions to their customers, which is why they wanted a technology partner that could enable them to deliver personalized, timely, and relevant digital experiences.

Specifically, they needed a platform that could help them deliver better customer experiences without the need for tons of dev support. In order to improve key metrics and make data-driven decisions, they also need to centralize their customer data.

Our platform was just the right solution for the job. By connecting their data, Allianz was able to overcome data silos and uncover useful insights much faster and with much less reliance on technical teams.

Insider also enabled Allianz to build AI-powered segments and deliver tailored customer experiences. For example, they were able to achieve an 80% opt-in rate using our mobile app push notifications.

Overall, the ease of setup and our platform’s versatility enabled Allianz to achieve ROI in days and increase their customer lifetime value (CLTV).

Here’s what their Marketing and Service Design Group Head said about working with Insider:

“Insider gives us the unified customer view we were searching for. The platform offers real-time server-to-server integration and an encrypted identification approach, which gives us the security and freedom to create precise AI-powered segments and use them to build better customer journeys.”

For more examples of how financial services companies benefit from working with Insider, you can check out the following case studies:

- How Garanti BBVA increased conversion rates by 502%.

- How Credissimo generated a 48% conversion uplift with a simple tweak.

- How Etiqua used on-site personalization and uncovered why users were dropping off.

Unify your customer data, predict future behaviors, and deliver personalized experiences with Insider

Insider is an ideal financial services CDP and enterprise marketing platform if you’re looking to:

- Keep your customer data secure by default and comply with data privacy regulations like GDPR.

- Unify customer data from any online or offline source — including CRMs, CMSs, APIs, POS devices, analytics software, and more — and get accurate, 360-degree customer profiles.

- Work with an experienced, global support team that can guide you through the implementation and ensure you’re taking maximum advantage of the platform.

- Simplify your martech stack, and save resources. Insider’s built-in activation channels, personalization tools, and automation capabilities enable you to unify your marketing stack into a single, enterprise-grade platform.

- See a meaningful ROI quickly. Insider’s broad channel support, experienced support team, and extensive templates enable you to unify and activate your data as fast as possible (with minimal reliance on technical teams).

- Personalize every touchpoint and drive customer engagement. You can tailor content, messaging, and financial product recommendations across your website and mobile app, as well as external channels like email, push notifications, SMS, WhatsApp, chatbots, and more.

Click here to book a demo with our team and learn how Insider can help you reach your business goals.

Discover the power of Insider — explore our interactive product demos now.