Etiqa has been protecting customers in Singapore with a range of insurance solutions since 1961. As the insurance arm of Maybank group, Etiqa is a licensed life and general insurance company regulated by the Monetary Authority of Singapore (MAS) and governed by the Insurance Act.

The dedication of the company to being a digital and innovative insurer has led to the development of new products and services, such as the first online insurance savings plans for customers, and the delivery of a customer-centric experience. Etiqa makes insurance solutions customer-centric by placing people over policies.

Etiqa Insurance wanted to segment their customers more accurately in order to deliver more individualized and relevant onsite experiences on the web and mobile web. The foundation of the insurance industry is trust, and customer experience is a crucial factor in that trust. Delivering hyper-personalized experiences was key to delighting Etiqa’s customers.

To engage the website visitors with the most relevant content and experiences, the team at Insider recommended the use of an onsite experiment feature that would customize the homepage banner with products based on the user’s previous browsing history.

In just a month, Etiqa Insurance observed conversion rates north of 4.74% from Q4 2020 to Q1 2021 against the sitewide average of 2.17%.

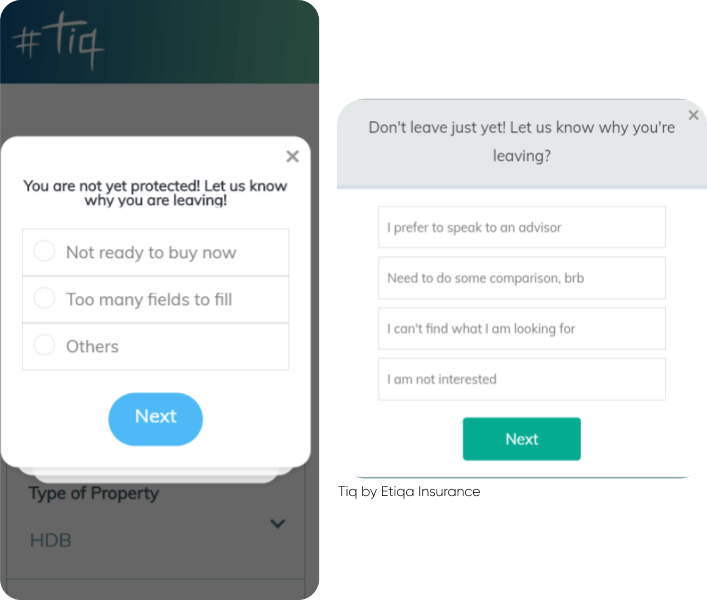

Etiqa Insurance observed that a good chunk of their users was dropping off without completing a purchase. They wanted to understand the factors that were contributing to the high drop-off rate and wanted to implement a solution that could gather customer feedback.

The growth consultants at Insider suggested implementing an exit-intent survey overlay. These overlays would display when a user showed signs of leaving the site and contained a few questions to better understand what they were looking for.

From these exit intent surveys, Etiqa insurance gathered the following insights 27% of users wanted to speak with an advisor. 17% of users said that their current policy had expired

Making use of this ongoing data flow, Etiqa was able to personalize the next steps in the customer journey and also send better qualified leads to insurance advisors so they could personalize the experience for customers.

Other feedback provided included cost concerns and specific information customers were looking for such as COVID-19 coverage and policy related information. Etiqa was able to use the data collected to inform their marketing campaigns, ensure different channels of communication are made available and that COVID-19 and policy related information are easily searchable on the website.

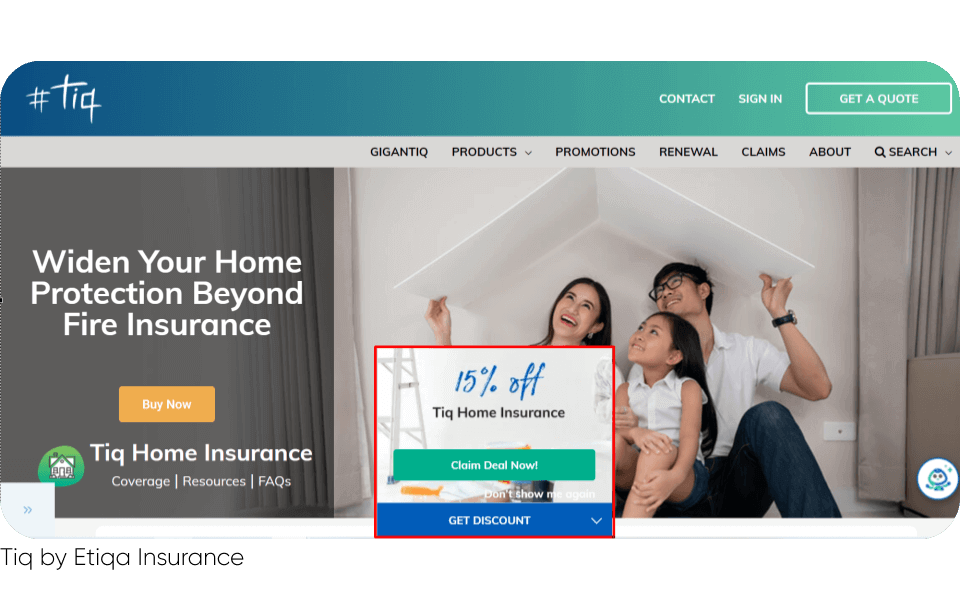

Etiqa Insurance had a lot of seasonal offers that they wanted to promote, and they required an onsite solution that could deliver these offers to their visitors. This was necessary to drive engagement and boost revenue.

The team at Insider recommended using side coupons - an onsite overlay that could show promotional content along with a coupon code. Visitors would be targeted with these seasonal promotions on the homepage and when they engaged with the coupons, they would be redirected to the product page.

Etiqa observed high engagement on these coupon overlays and achieved conversion rates in excess of 3% for this campaign.

In the near future Etiqa will look to leverage Insider further for conversion funnel optimization using A/B testing, improving the new customer acquisition by using predictive audiences and driving mobile app usage via app download banners and app pushes. Together with Insider, the insurer aims to work towards their goal of delivering hyper-personalised experiences to their customers across various digital touchpoints.

“Working toward our vision to be the leading digital insurance company in Singapore, our goal was to deliver a hyper-personalised experience to our customers across various digital touchpoints. Beyond enabling us with the right marketing automation tools, Insider was proactive in strategizing and executing campaigns to achieve set KPIs. With Insider, we were able to roll out campaigns at a faster pace, delivering quicker time to value. The excellent service support provided by Insider on top of its powerful platform capabilities is what makes them the perfect partner for any business that seeks to achieve growth with digital excellence. ”

Dennis Liu

Chief Digital & Transformation Officer

Solutions

Essential Guides

Enterprise CDP, Cross-Channel Marketing, Personalized Customer Experience, WhatsApp Marketing, Email Marketing Platforms, Customer Data Integration, Market Segmentation, Journey Orchestration Platforms, Customer Journey Analytics, Recession-Proof CX Strategies, Migrating vs. Remaining

| Cookie | Duration | Description |

|---|---|---|

| __hssrc | session | This cookie is set by Hubspot. According to their documentation, whenever HubSpot changes the session cookie, this cookie is also set to determine if the visitor has restarted their browser. If this cookie does not exist when HubSpot manages cookies, it is considered a new session. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 1 year | This cookies is set by GDPR Cookie Consent WordPress Plugin. The cookie is used to remember the user consent for the cookies under the category "Analytics". |

| cookielawinfo-checkbox-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| Cookie | Duration | Description |

|---|---|---|

| __hssc | 30 minutes | This cookie is set by HubSpot. The purpose of the cookie is to keep track of sessions. This is used to determine if HubSpot should increment the session number and timestamps in the __hstc cookie. It contains the domain, viewCount (increments each pageView in a session), and session start timestamp. |

| bcookie | 11 months | This cookie is set by linkedIn. The purpose of the cookie is to enable LinkedIn functionalities on the page. |

| lang | session | This cookie is used to store the language preferences of a user to serve up content in that stored language the next time user visit the website. |

| lidc | 1 day | This cookie is set by LinkedIn and used for routing. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| __hstc | 11 months | This cookie is set by Hubspot and is used for tracking visitors. It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). |

| _ga | 1 year | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_UA-81205217-1 | 1 minute | This is a pattern type cookie set by Google Analytics, where the pattern element on the name contains the unique identity number of the account or website it relates to. It appears to be a variation of the _gat cookie which is used to limit the amount of data recorded by Google on high traffic volume websites. |

| _gcl_au | 3 months | This cookie is used by Google Analytics to understand user interaction with the website. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| hubspotutk | 11 months | This cookie is used by HubSpot to keep track of the visitors to the website. This cookie is passed to Hubspot on form submission and used when deduplicating contacts. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| bscookie | 11 months | This cookie is a browser ID cookie set by Linked share Buttons and ad tags. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 11 months | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| AnalyticsSyncHistory | 1 month | No description |

| cookielawinfo-checkbox-functional | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-others | 1 year | No description |

| ins-c | 1 day | No description |

| ins-storage-version | 1 year | No description |

| insdrPushCookieStatus | 1 day | This cookie is set by the provider Insider. This cookie is used for web push recieving. |

| RUL | 1 year | No description |

| UserMatchHistory | 1 month | Linkedin - Used to track visitors on multiple websites, in order to present relevant advertisement based on the visitor's preferences. |