Trusted by leading financial services brands worldwide

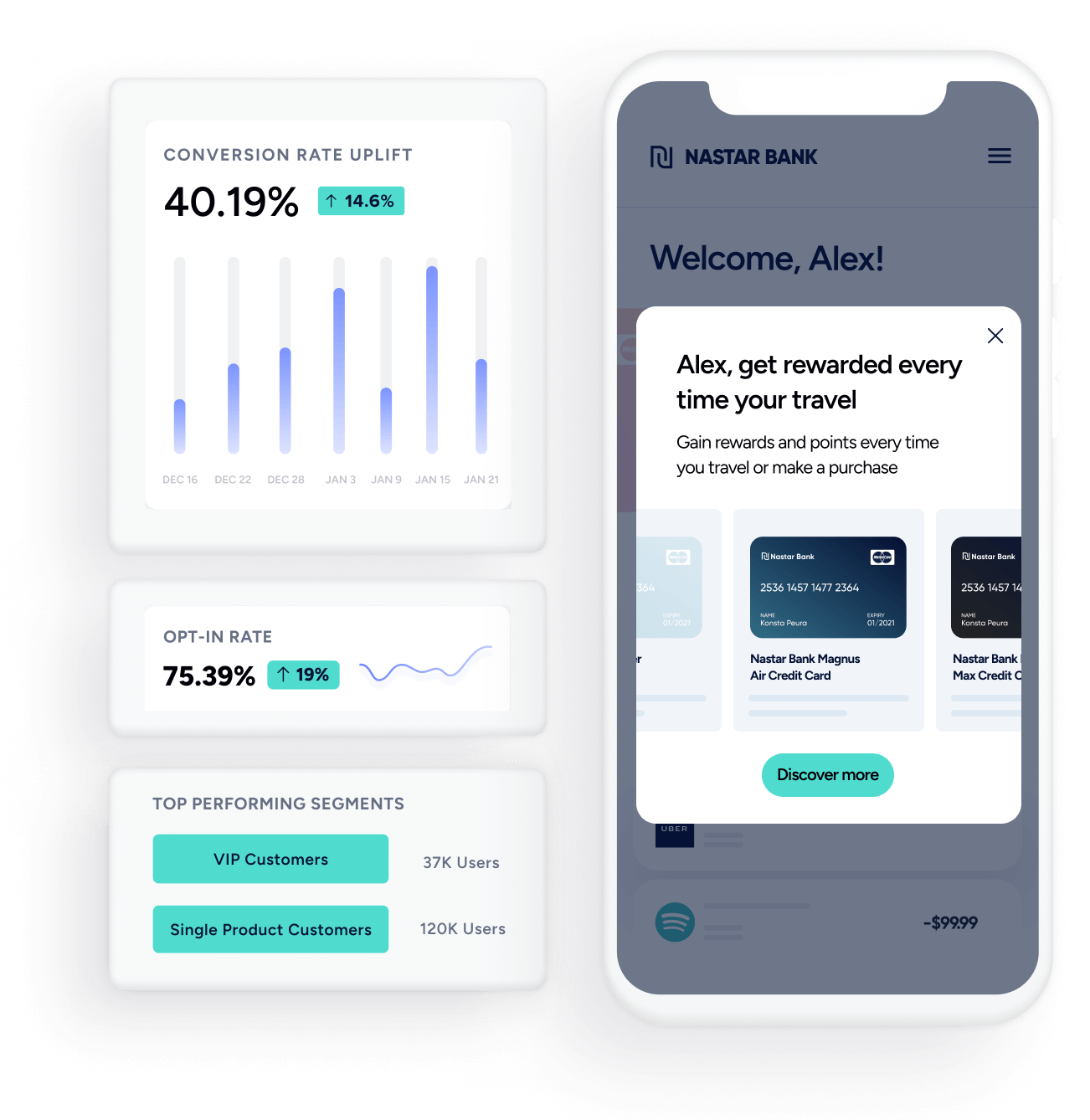

Leverage compliant, unified customer data and AI to accelerate digital transformation. Craft relevant and timely messages across any channel or device to meet the needs, wants, and preferences of your customers.

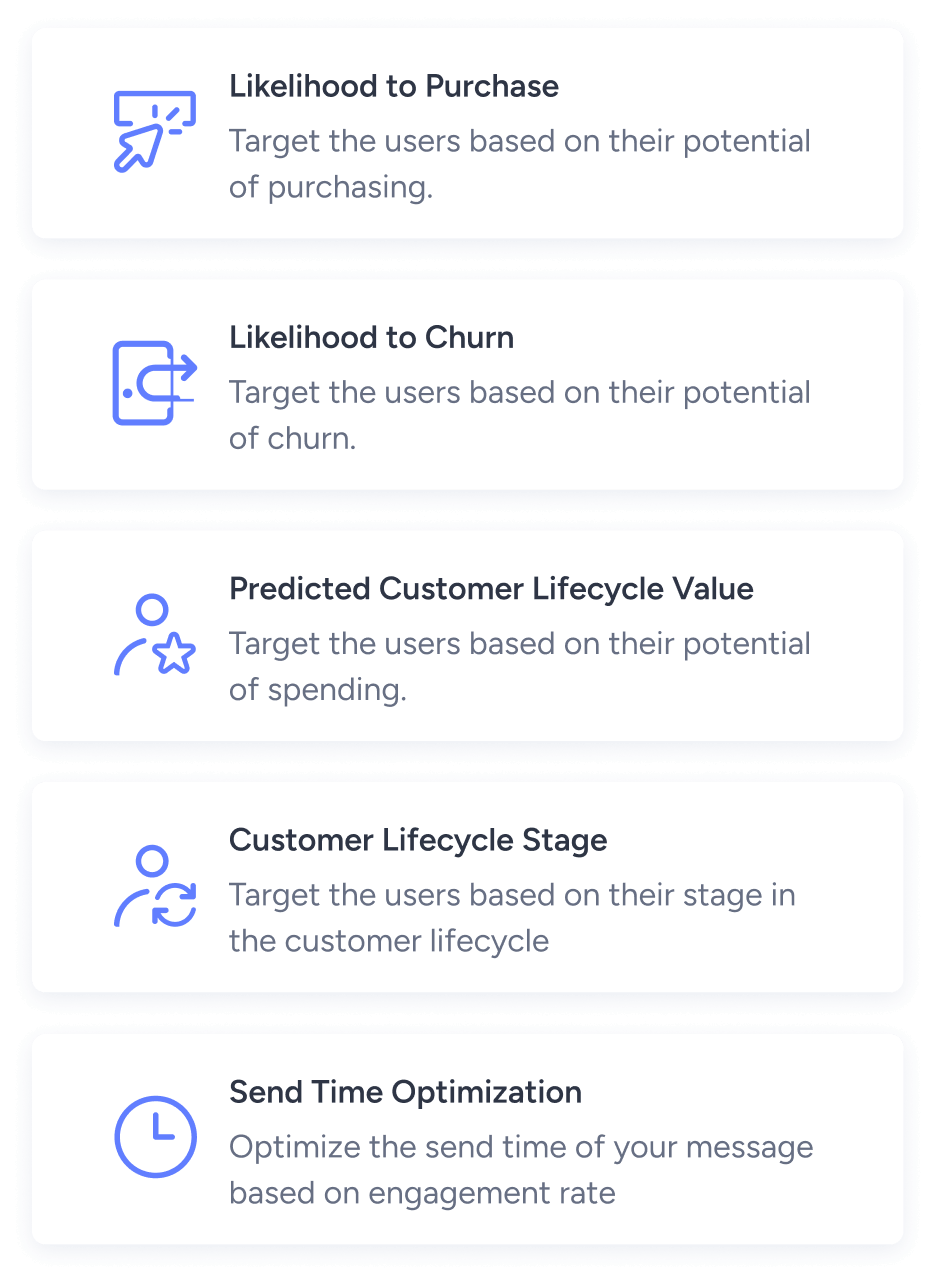

Integrate Insider with third-party tools and in-house systems to unlock insights, make data actionable, and build seamless cross-channel customer experiences. Predict customer interests, discover upsell opportunities, and unify customer profiles — all from one compliant, secure platform.

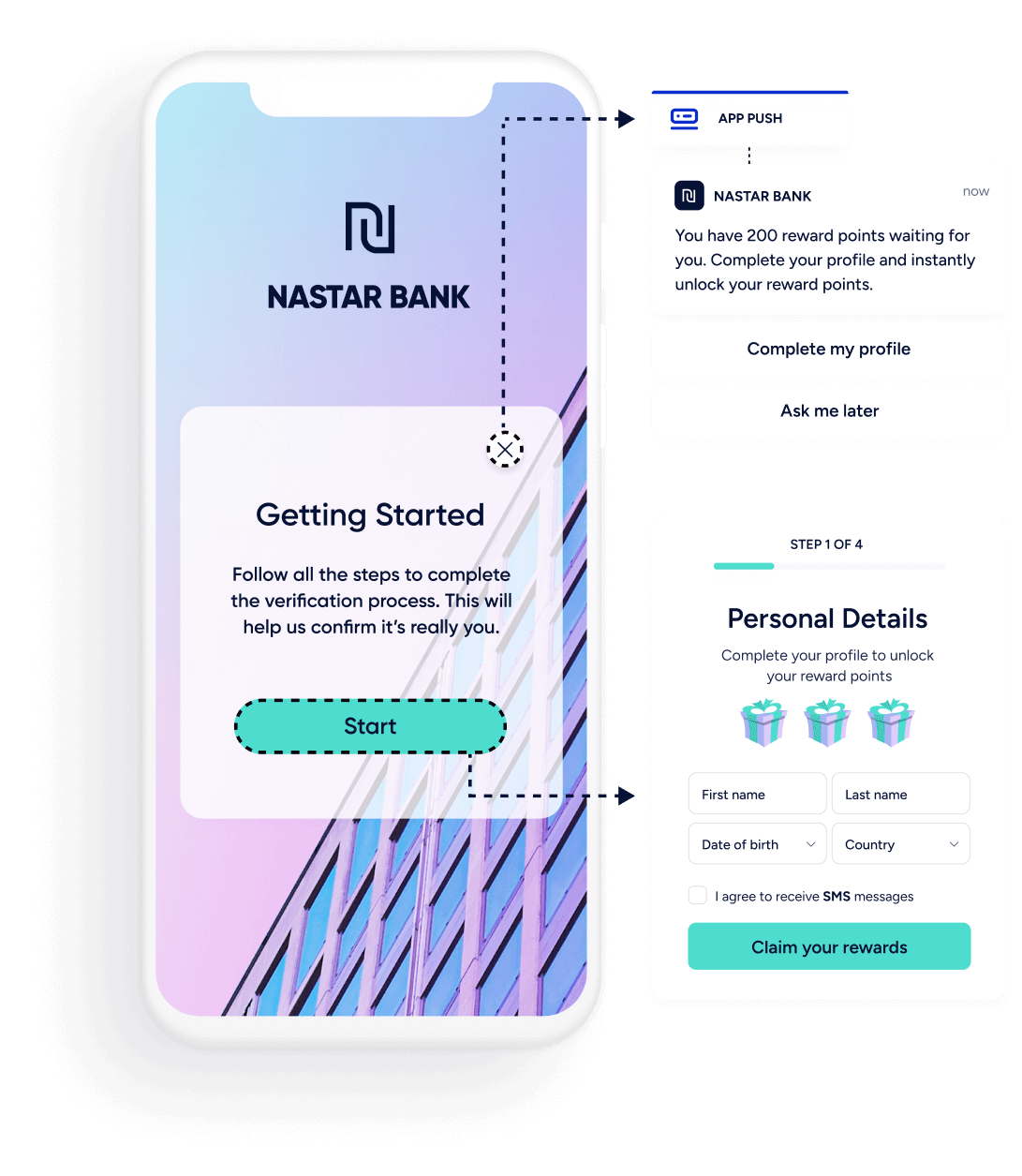

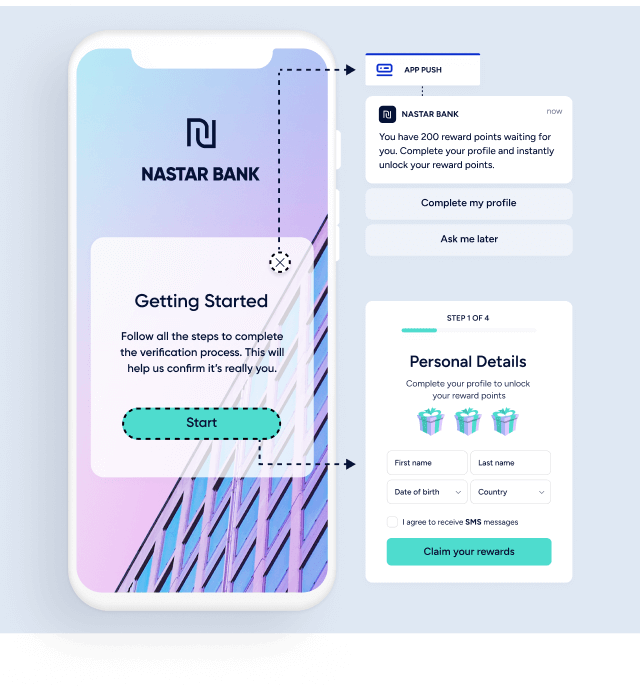

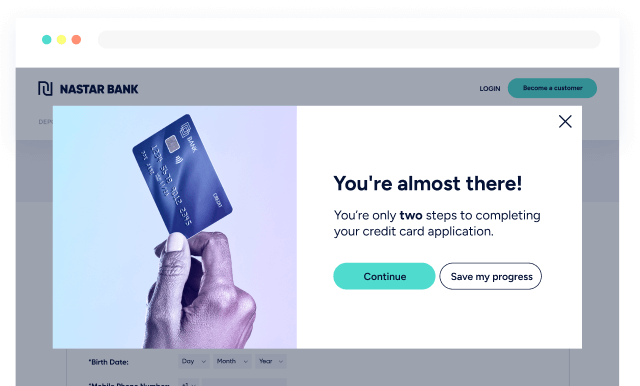

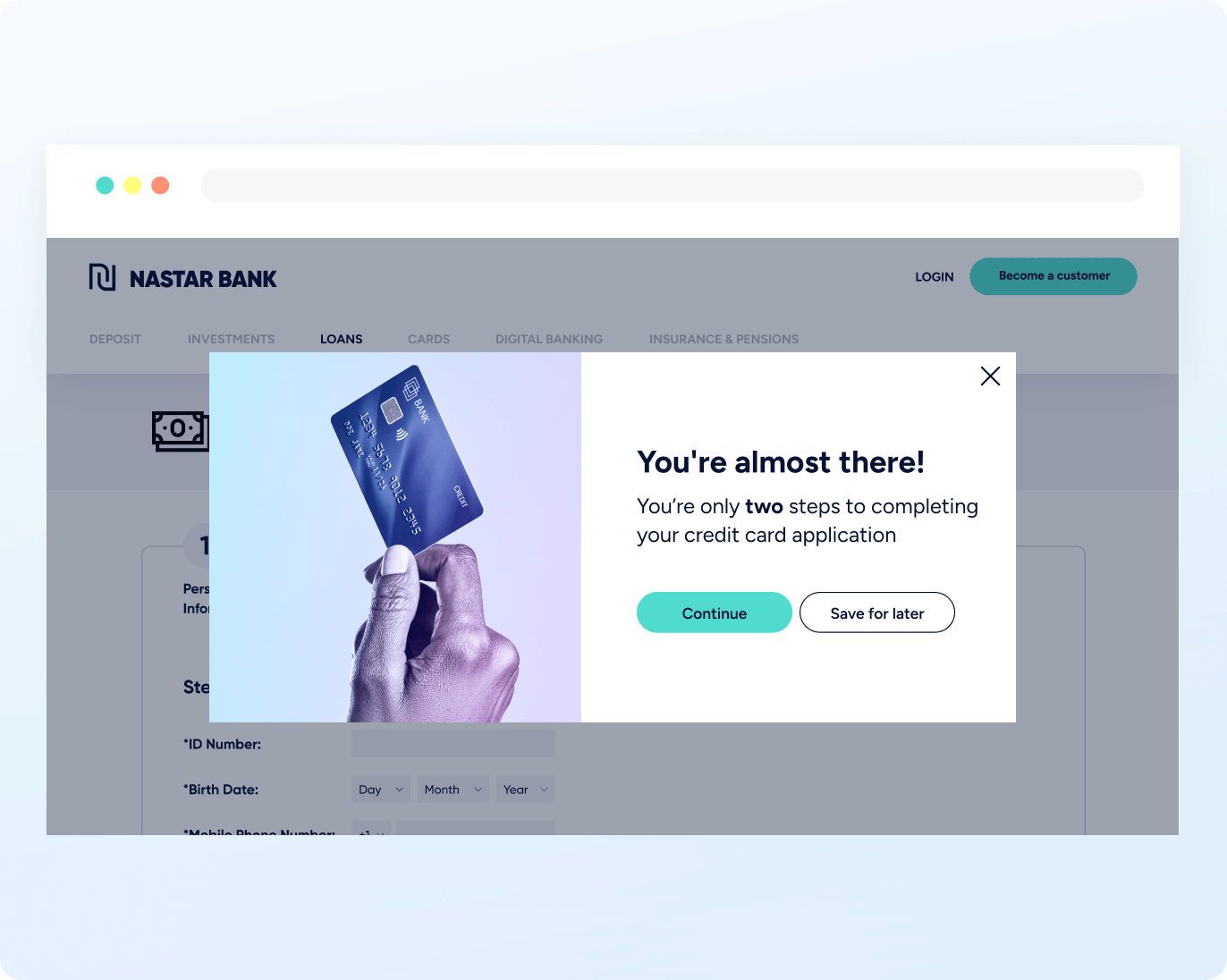

Make each digital banking experience convenient, efficient, and friction-free across every device. Craft gamified Know Your Customer (KYC) processes, build intuitive application forms, and personalize experiences across web, app, and more to drive engagement and boost customer confidence.

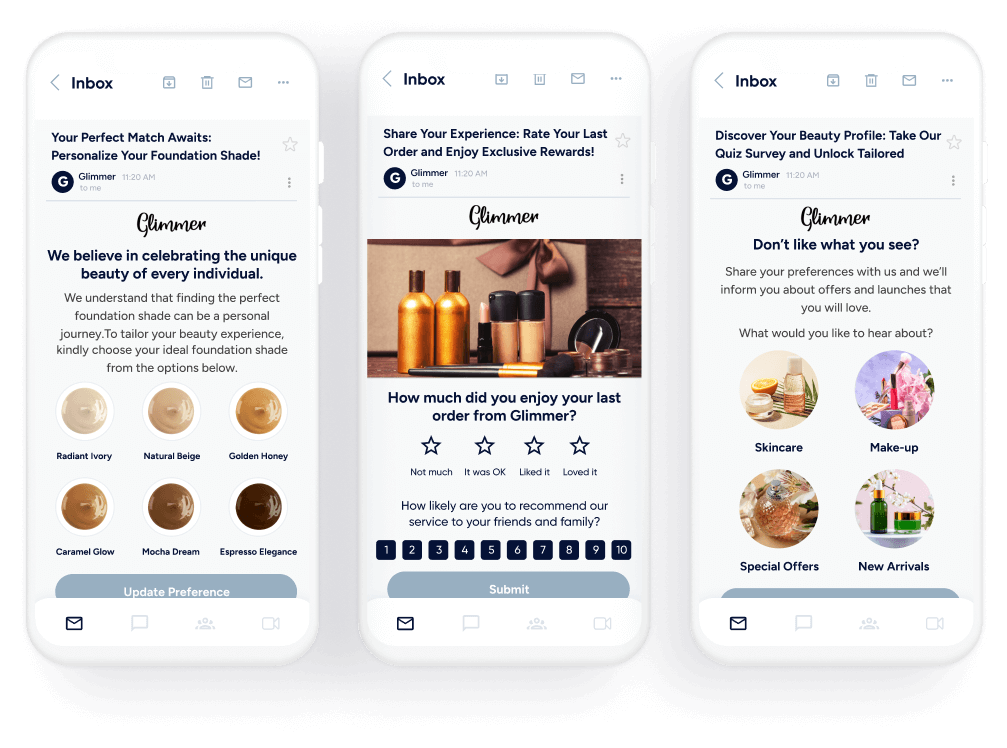

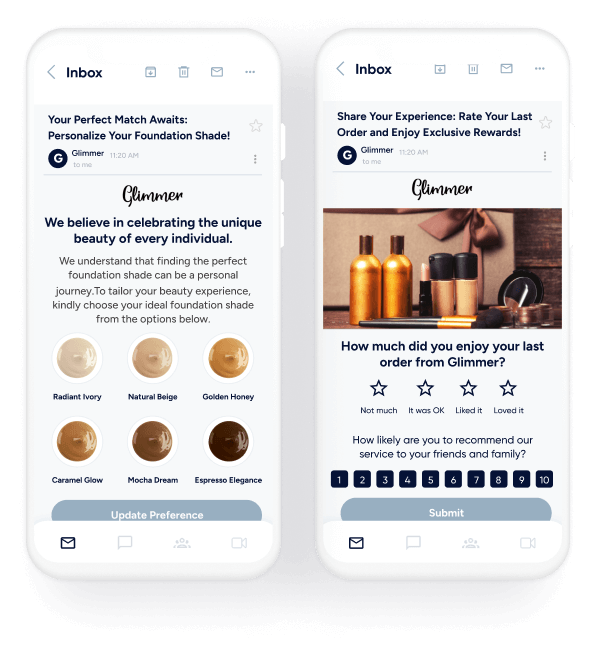

Use engaging, interactive experiences to collect data on your customers’ biggest beauty concerns, skincare routine, or formula preferences.

Leverage gamified surveys, interactive AMP-powered email experiences, and real-time surveys to collect first-party data to help you quickly guide customers to the right products for them.

“What impressed us most is Insider’s AI-powered segmentation capabilities. The platform learns from customer behavior and identifies which products and services interest each customer most. This powerful intelligence helps us maximize engagement and deliver relevant, timely experiences.”

Marketing Group Head

Allianz

Boost form submission rates and minimize bounce rates with AI-backed exit-intent messages, re-engage those who have switched tabs with custom tab messages and emojis, or send timely reminders via mobile channels to increase lead collection.

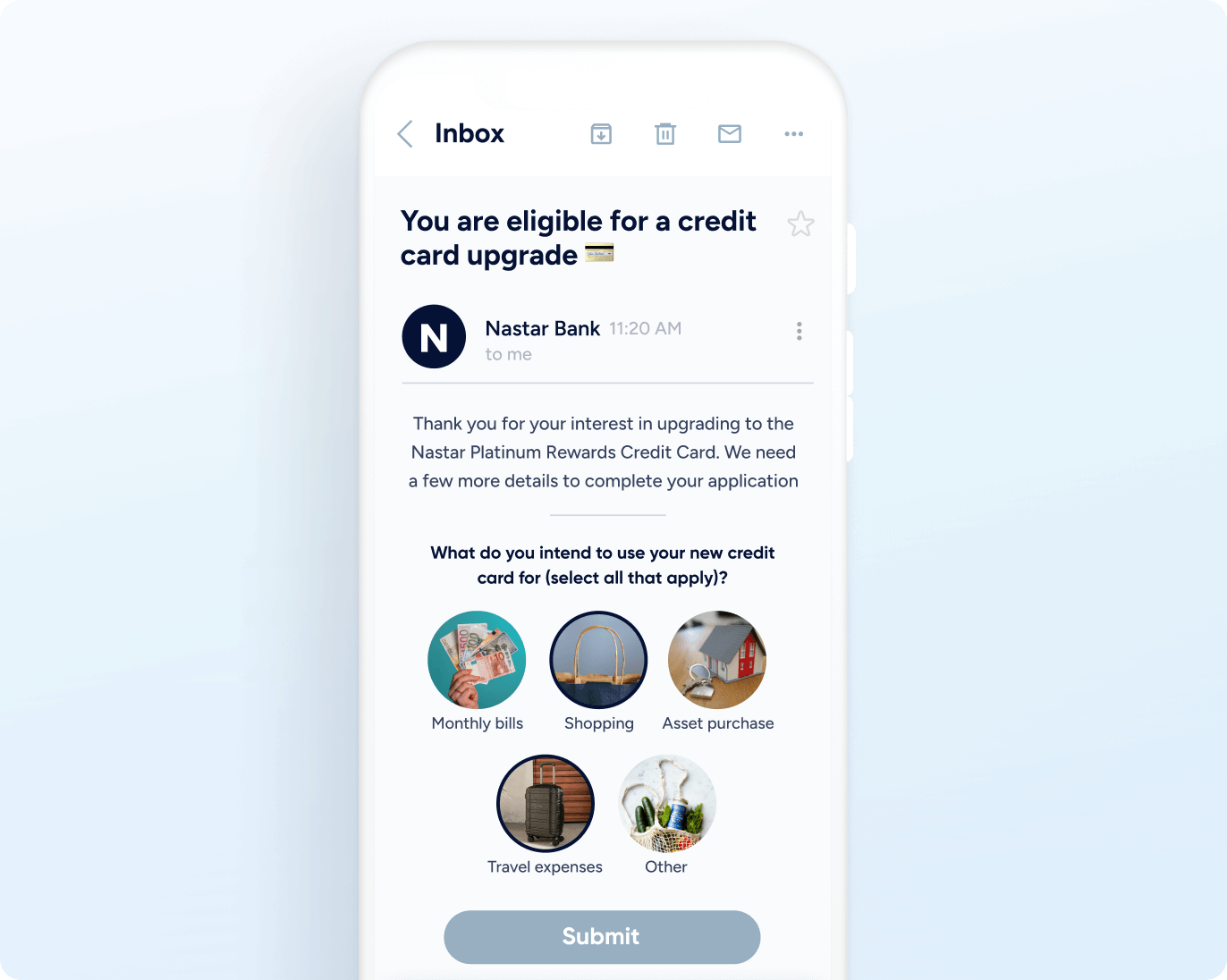

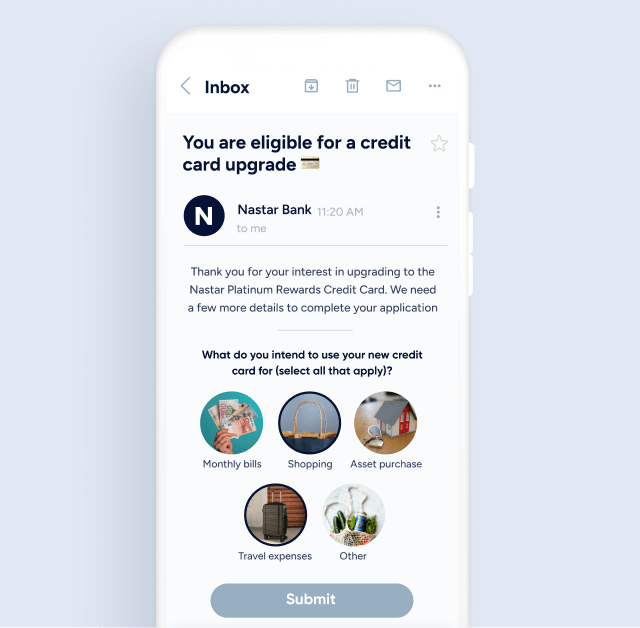

Don’t miss a single opportunity to Know Your Customer better by collecting and consolidating customer data across touchpoints. Leverage AMP forms in email, SMS, and two-way WhatsApp conversations to continuously collect information and deliver more relevant experiences and recommendations.

Insider’s App solution has saved us weeks of time, effort and resources.

“We couldn’t understand why customers would download our app and never use it. Insider’s in-app templates and App Push notifications have enabled us to build a strategy to engage and retain our app users considerably. It’s now our top-performing channel by engagement.”

Digital Product Lead

Leading Bank

Thanks to Insider, we’re no longer struggling to upsell services and products.

“Insider enables us to manage all channels from one platform, which has consolidated our tech stack considerably. We can also automate communications to boost conversions across services and products previously hard to up-sell, including insurance policies and credit cards.”

Head of Digital Transformation

Leading Insurance Brand

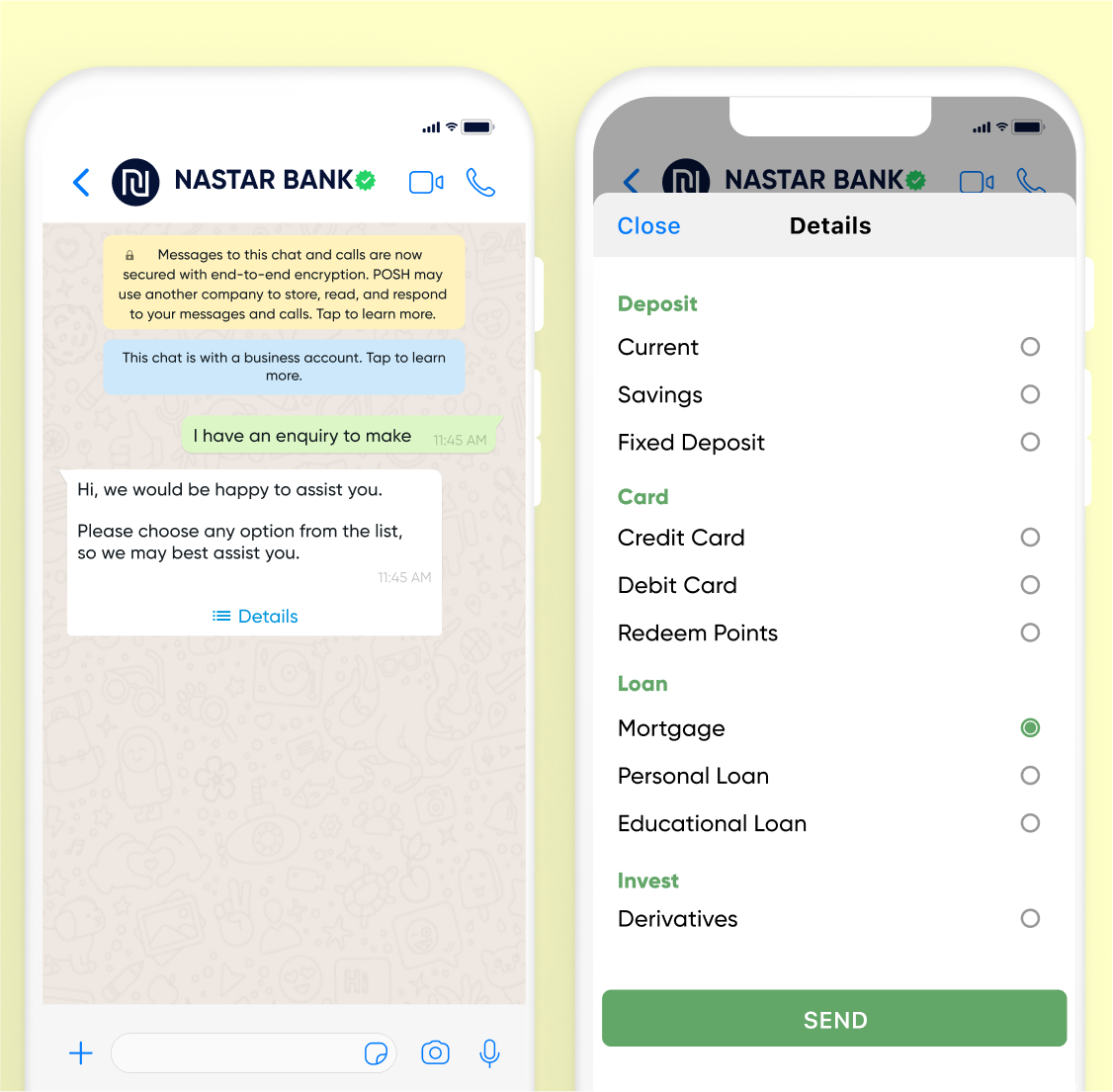

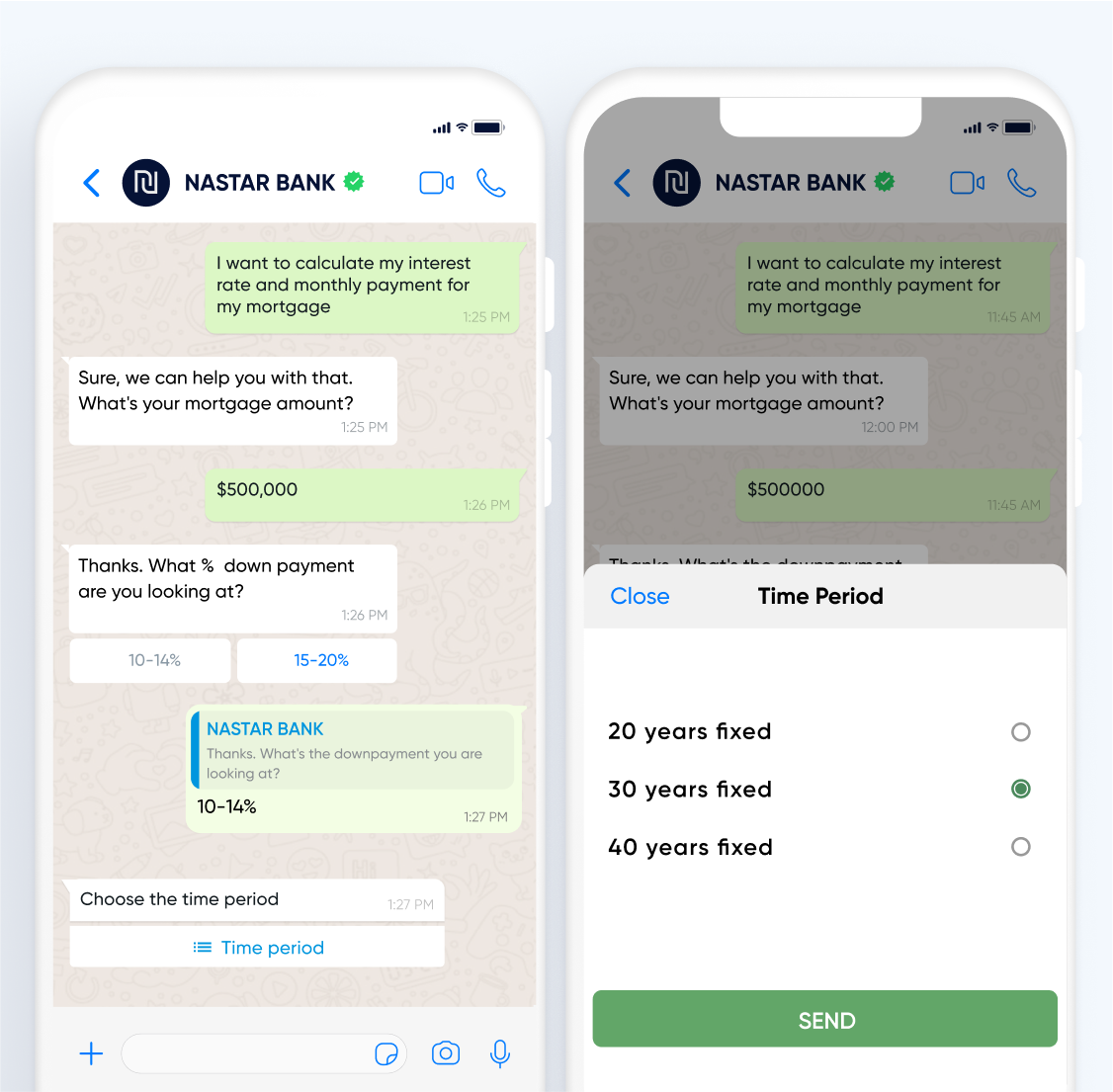

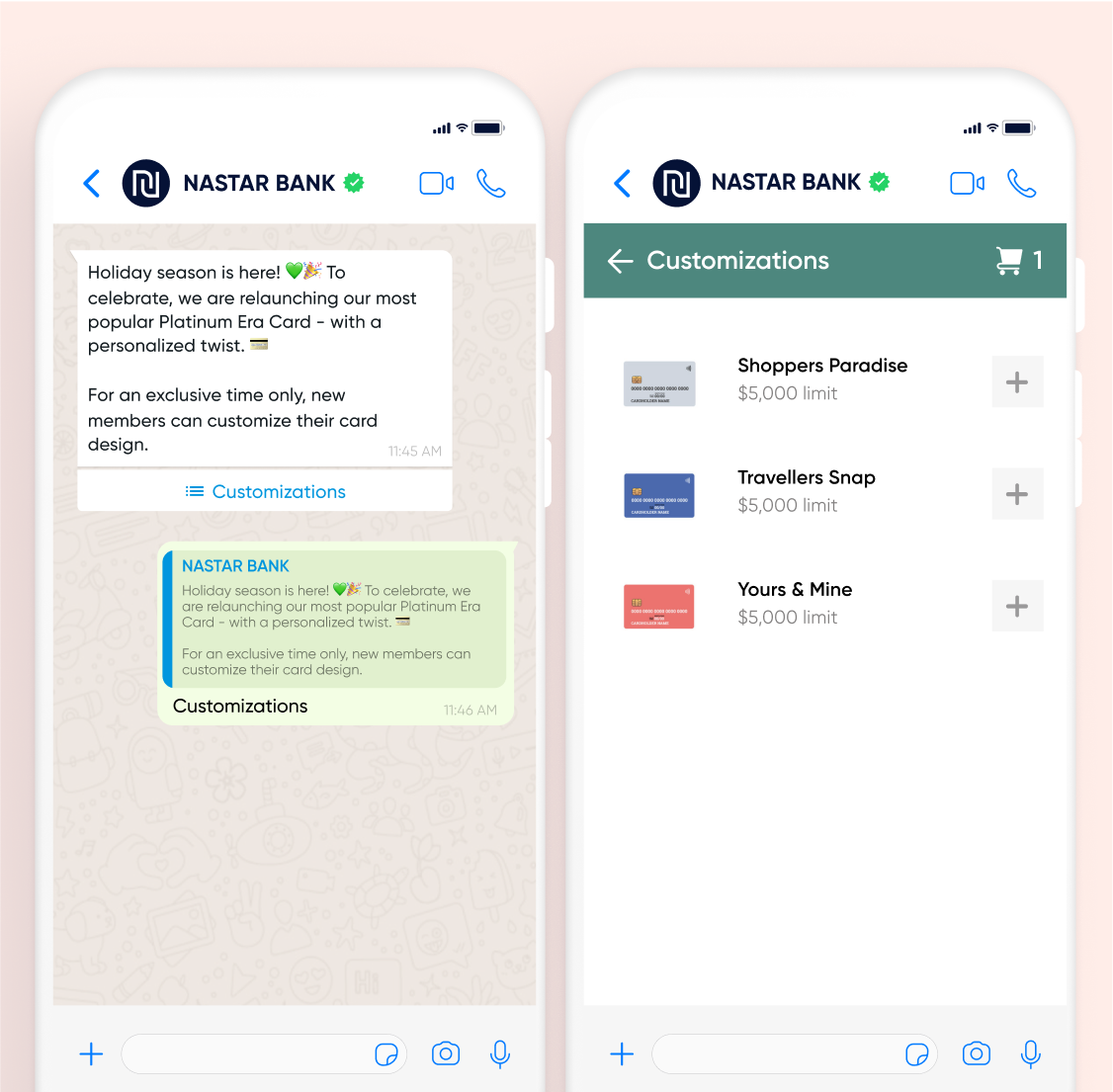

Meet the increasing demand for self-service through the world’s most popular messaging app. Initiate structured and unstructured conversations on WhatsApp for a variety of use cases, including applications, credit card upgrades, insurance enquiries, and more.

Meet the increasing demand for self-service through the world’s most popular messaging app. Initiate structured and unstructured conversations on WhatsApp for a variety of use cases, including applications, credit card upgrades, insurance enquiries, and more.

Meet the increasing demand for self-service through the world’s most popular messaging app. Initiate structured and unstructured conversations on WhatsApp for a variety of use cases, including applications, credit card upgrades, insurance enquiries, and more.

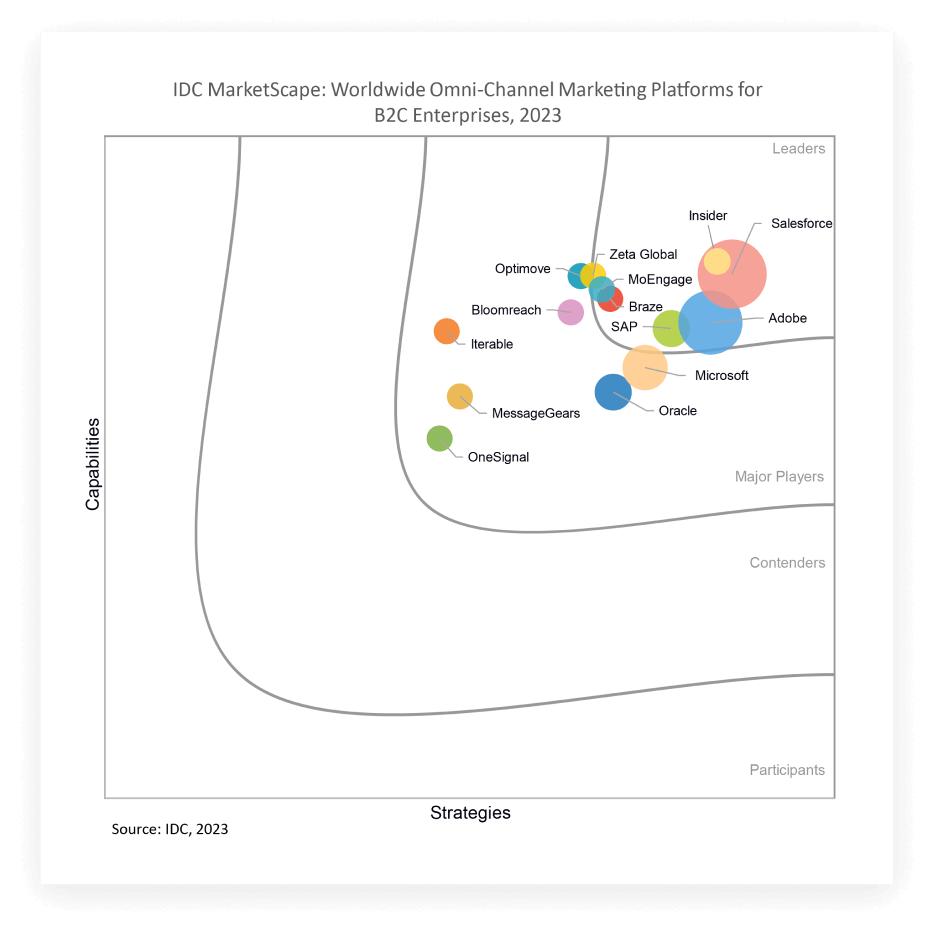

The IDC Marketscape recognizes Insider as the leader that “supports an impressive array of omnichannel marketing tactics including email marketing, website personalization, push notifications, and In-App Messaging.”

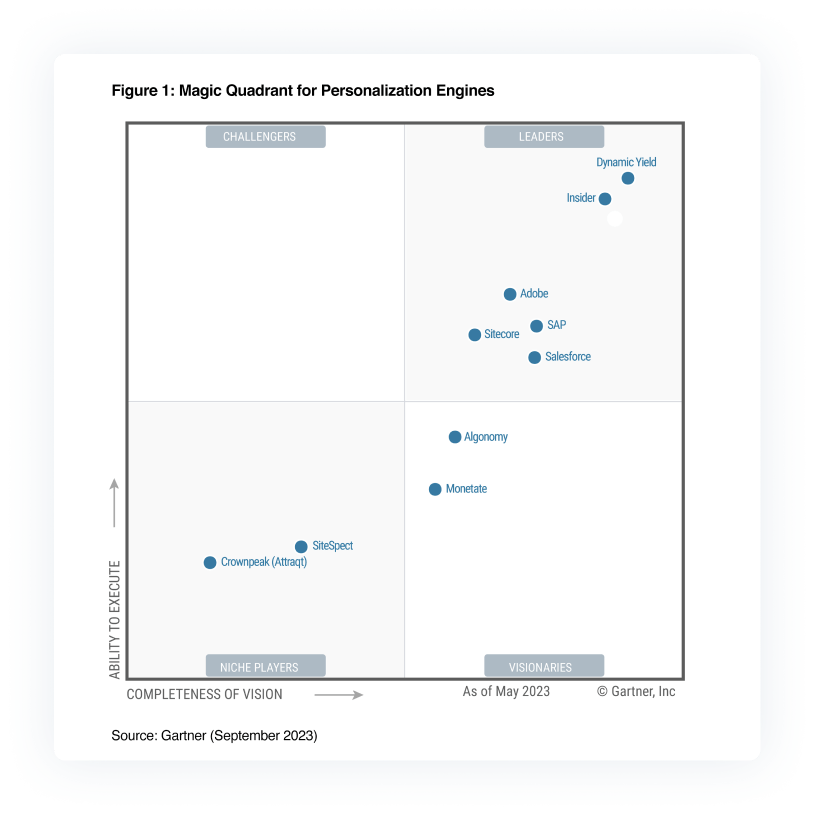

Insider achieved the highest scores in all three personalization use cases—Marketing (3.99/5.0), Digital Commerce (4.11/5.0), and Services and Support (3.94/5.0), in the 2023 Gartner Critical Capabilities for Personalization Engines Report.

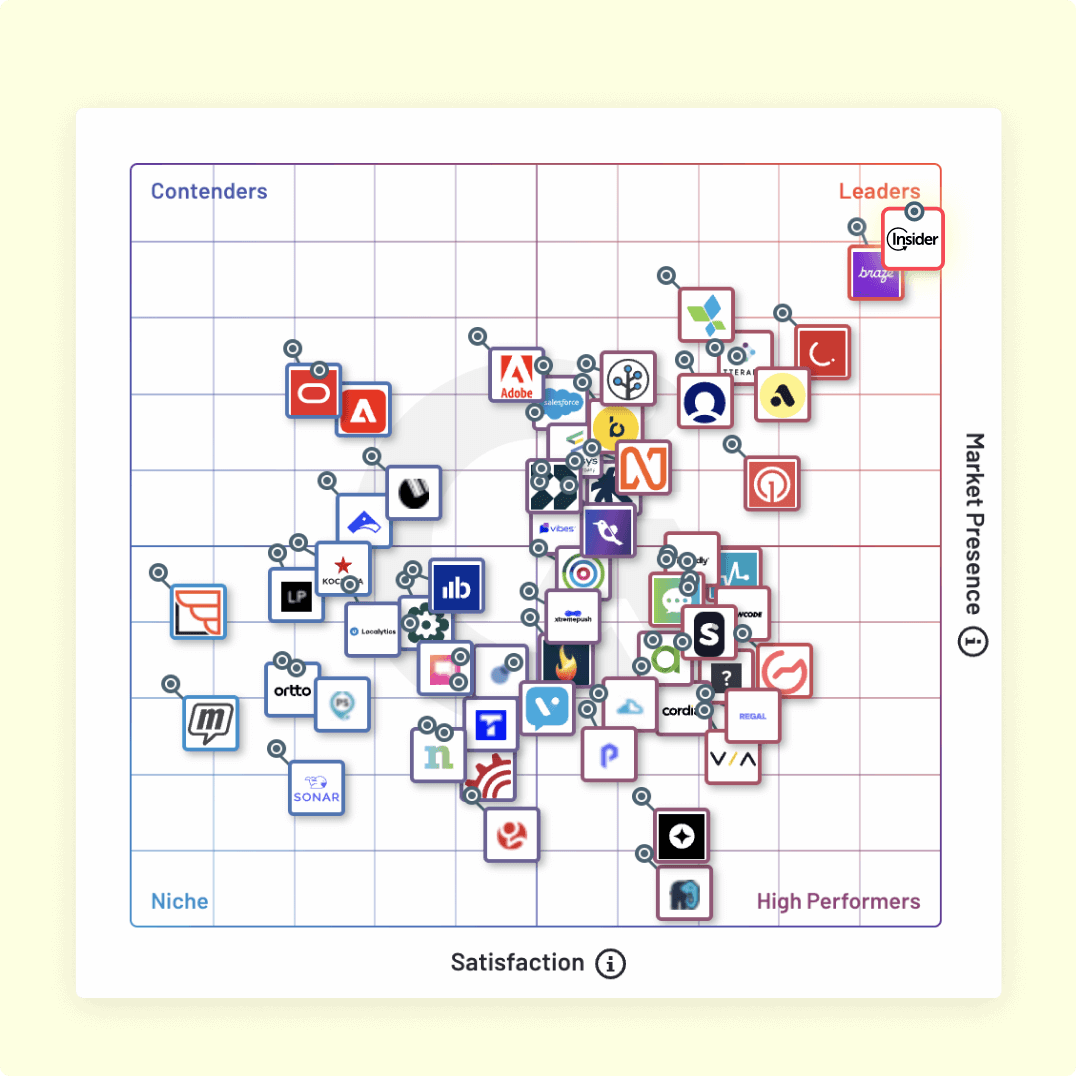

Rated the #2 Best Software in the UK, #3 in EMEA, and #7 globally for Enterprises, we’ve topped the charts with the most #1 rankings in G2’s Summer’24 report. We’re ranked #1 in 6 categories – CDP, Personalization, Mobile Marketing, SMS Marketing and more, while securing top positions in Marketing Automation and Customer Journey Analytics, and E-commerce Search.

Use a financial marketing automation software to leverage a multi-channel approach, combining digital platforms, content marketing, and targeted advertising to reach your audience effectively. Leverage its data analytics to understand customer behavior and tailor your strategies accordingly.

Use marketing automation tools to streamline customer communication, personalize content, and nurture leads. Automate repetitive tasks, such as email campaigns and lead scoring, to enhance efficiency and focus on building relationships.

Marketing automation in financial services enhances customer engagement, automates routine processes, and ensures timely and personalized communication. It improves lead management, conversion rates, and overall customer satisfaction.

Personalization in finance marketing involves tailoring communication and services based on individual customer data and preferences. It ensures a more relevant and engaging experience, fostering trust and loyalty.

Solutions

Essential Guides

Enterprise CDP, Cross-Channel Marketing, Personalized Customer Experience, WhatsApp Marketing, Email Marketing Platforms, Customer Data Integration, Market Segmentation, Journey Orchestration Platforms, Customer Journey Analytics, Recession-Proof CX Strategies, Migrating vs. Remaining

| Cookie | Duration | Description |

|---|---|---|

| __hssrc | session | This cookie is set by Hubspot. According to their documentation, whenever HubSpot changes the session cookie, this cookie is also set to determine if the visitor has restarted their browser. If this cookie does not exist when HubSpot manages cookies, it is considered a new session. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-analytics | 1 year | This cookies is set by GDPR Cookie Consent WordPress Plugin. The cookie is used to remember the user consent for the cookies under the category "Analytics". |

| cookielawinfo-checkbox-necessary | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 1 year | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| Cookie | Duration | Description |

|---|---|---|

| __hssc | 30 minutes | This cookie is set by HubSpot. The purpose of the cookie is to keep track of sessions. This is used to determine if HubSpot should increment the session number and timestamps in the __hstc cookie. It contains the domain, viewCount (increments each pageView in a session), and session start timestamp. |

| bcookie | 11 months | This cookie is set by linkedIn. The purpose of the cookie is to enable LinkedIn functionalities on the page. |

| lang | session | This cookie is used to store the language preferences of a user to serve up content in that stored language the next time user visit the website. |

| lidc | 1 day | This cookie is set by LinkedIn and used for routing. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| __hstc | 11 months | This cookie is set by Hubspot and is used for tracking visitors. It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). |

| _ga | 1 year | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_UA-81205217-1 | 1 minute | This is a pattern type cookie set by Google Analytics, where the pattern element on the name contains the unique identity number of the account or website it relates to. It appears to be a variation of the _gat cookie which is used to limit the amount of data recorded by Google on high traffic volume websites. |

| _gcl_au | 3 months | This cookie is used by Google Analytics to understand user interaction with the website. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| hubspotutk | 11 months | This cookie is used by HubSpot to keep track of the visitors to the website. This cookie is passed to Hubspot on form submission and used when deduplicating contacts. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| bscookie | 11 months | This cookie is a browser ID cookie set by Linked share Buttons and ad tags. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 11 months | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| AnalyticsSyncHistory | 1 month | No description |

| cookielawinfo-checkbox-functional | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-others | 1 year | No description |

| ins-c | 1 day | No description |

| ins-storage-version | 1 year | No description |

| insdrPushCookieStatus | 1 day | This cookie is set by the provider Insider. This cookie is used for web push recieving. |

| RUL | 1 year | No description |

| UserMatchHistory | 1 month | Linkedin - Used to track visitors on multiple websites, in order to present relevant advertisement based on the visitor's preferences. |