Beauty & Cosmetics in 2022: A guide to stellar sales and loyalty

Srikant Kotapalli

Srikant Kotapalli

Apr 27, 2020

Srikant Kotapalli

Srikant Kotapalli

Apr 27, 2020

Srikant Kotapalli

Srikant Kotapalli

Apr 27, 2020

Srikant Kotapalli

Srikant Kotapalli

Apr 27, 2020

If you want to stay competitive in the beauty industry, you need to be on top of the biggest trends in the beauty industry. It sounds simple, and in a way, it is…if you’ve got an infinite amount of time to go through all the available data on 2022 beauty trends.

But the reality is, most of us don’t have that kind of time. But don’t worry—you can still get all the information you need on what’s changing in the world of beauty industry consumer behavior. We’ve rounded up four of the most important beauty consumer insights from top marketing data sources and identified the strategies you need to be using if you want to connect with today’s buyers. Read on to learn more about the biggest consumer drivers in the beauty vertical that you can’t afford to ignore:

Self-care Sundays

How to catch-up the trend?

Beauty for everybody

Inclusivity in beauty marketing

How is the beauty industry adapting to change? By getting personal

Building buyer loyalty in the beauty vertical

Understanding the online beauty industry and how buyers navigate it

What’s ahead for the beauty and cosmetics industry?

The COVID pandemic forced beauty shops around the world to close—and stay closed. Despite these salon closures and the pandemic also forcing people to self-isolate and stay home, consumers still have that human need to look good, because looking good makes us feel good.

So people kept buying beauty products. That didn’t change. But here’s what did change: the types of products consumers bought and the primary reason why they chose these products.

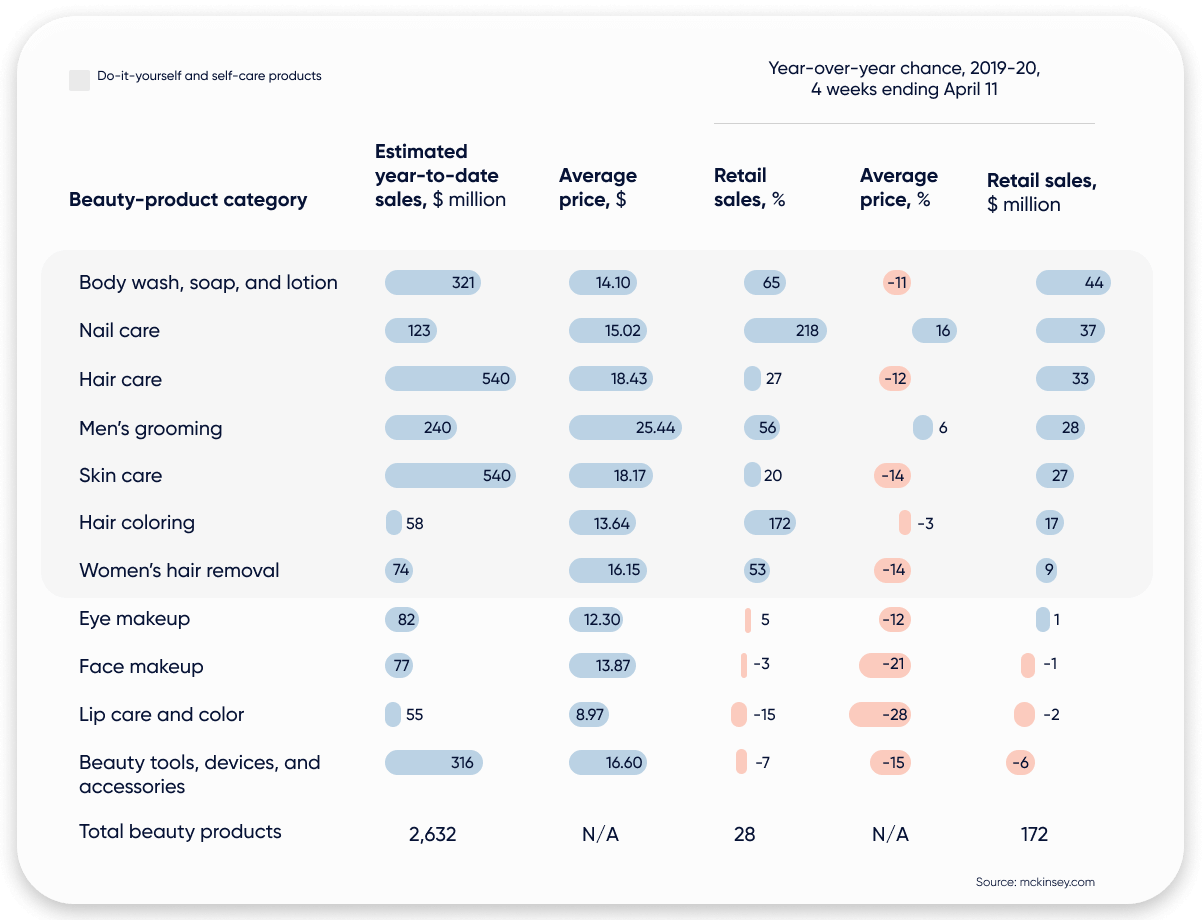

As you can see, the product categories that saw the biggest sales increases were hygiene products like body wash, soap, and lotion, nail care, hair care, men’s grooming, and skin care. These kinds of products go beyond cosmetics and promote a sense of wellness in the user. And as the world sunk into uncertainty and consumers suddenly had a lot more time to themselves, they shifted the focus onto their own well being, physical and mental. Self-care product sales went way, way up, surging 300% year-over-year at Zalando, one of Europe’s largest online retailers.

What we’re seeing is a phenomenon similar to the lipstick effect. The lipstick effect is the observed uptick in cosmetics sales that happens during economically uncertain times. When more expensive luxury goods, like jewelry and electronics, are out of reach for the average consumer, the average consumer instead reaches for goods like makeup: smaller luxury items that make the consumer look and feel good without breaking the bank.

This time, however, consumers aren’t reaching for (as much) lipstick—they’re reaching for at-home hair kits, skin care, and nail polish. So instead of focusing your marketing efforts on how products will make users look, communicate how the products will make them feel. To many, self-care is something new—a newfound focus on putting their own needs first, and from this perspective, discovering these needs and ways to meet them feels like a journey. Guide your buyers along that journey by suggesting products that will make them feel better, not just look better.

Another one of the top beauty industry trends this year is the idea that beauty and cosmetics are for everybody. Gone are the days of the “It Girl;” today, social media platforms like Instagram and TikTok make it possible for anybody to publish content and become an influencer. Be part of the user-generated content revolution by working with influencers and leveraging their vast follower networks of followers.

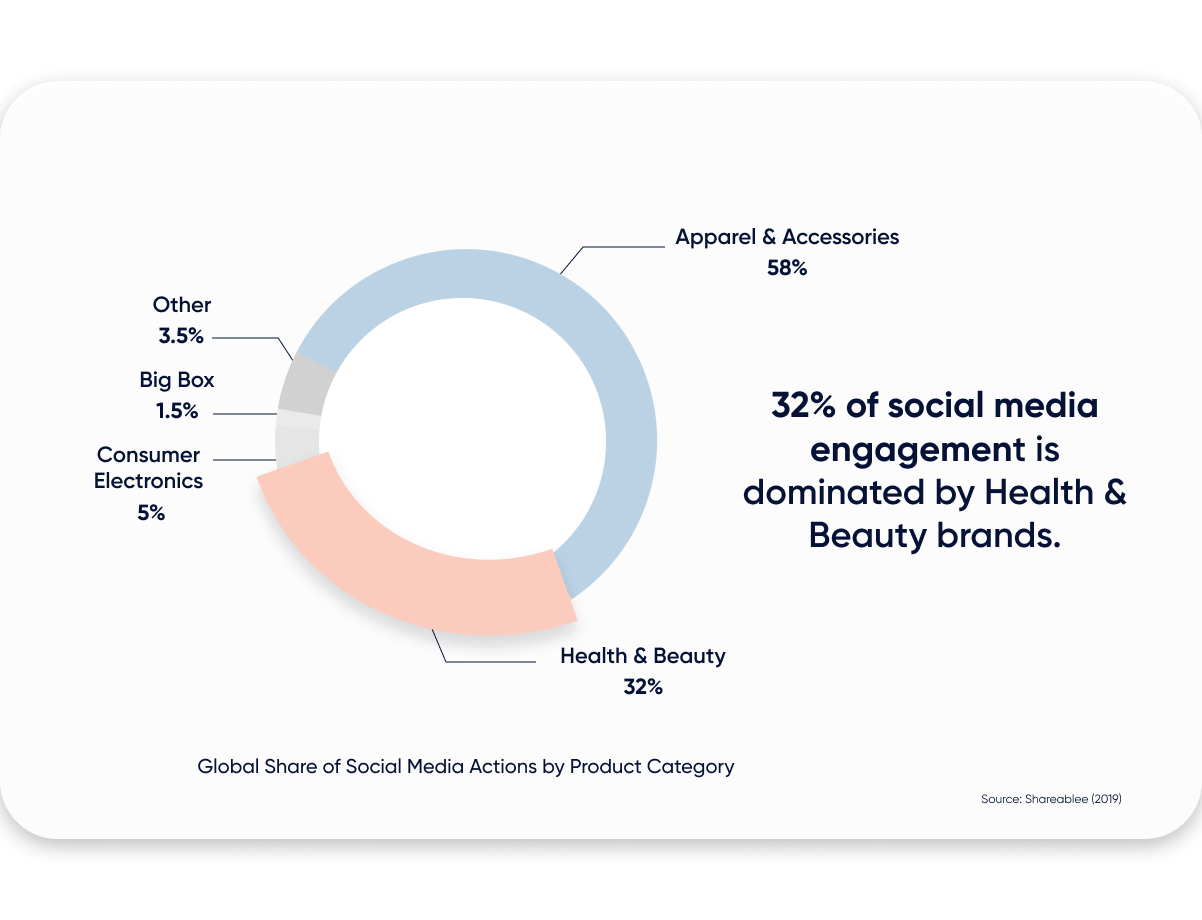

The beauty vertical is right behind fashion as the vertical with the highest amount of social media engagement. Instagram is a great choice for prospecting and retargeting, specifically prospecting to lookalikes of high Customer Lifetime Value (CLV) users and focusing on high Likelihood to Purchase users for retargeting.

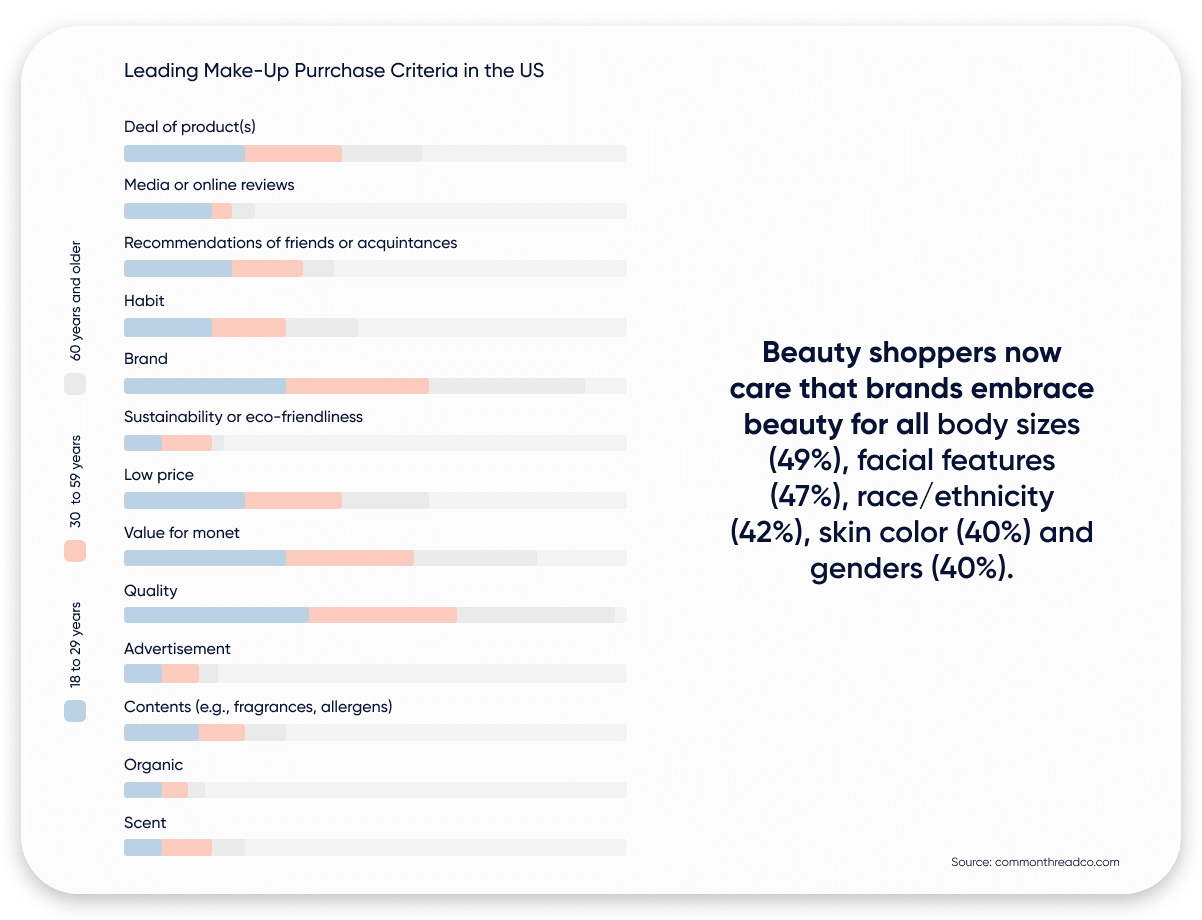

Beauty for all doesn’t just mean accessible beauty content for all…it means people of all races, body types, genders, and skin tones are creating beauty-related content and expecting products meant for them.

When Fenty Beauty hit the market in 2017, it marked a new era for the beauty industry: the era of inclusivity. This era is marked by the growing men’s beauty and skincare segment, a widened demographic age range (beauty is for everybody, from tweens to older adults), and options for all skin colors and types. It’s also marked by the end of the one-size-fits-all approach to marketing. Consumers expect ads and other marketing efforts as diverse as they are, and that includes recommendations and experiences personalized to them.

So how do you personalize your recommendations and the experiences you offer? Here are a few strategies:

As we mentioned above, cosmetics buyers want personalization. Anticipation is a kind of personalization. Think about it—let’s say you buy a bronzing moisturizer developed specifically for sensitive skin. The next time you visit the website where you bought it, you get suggestions for other products specifically formulated for sensitive skin. The website knows you and just like a good friend, knows the perfect products to suggest.

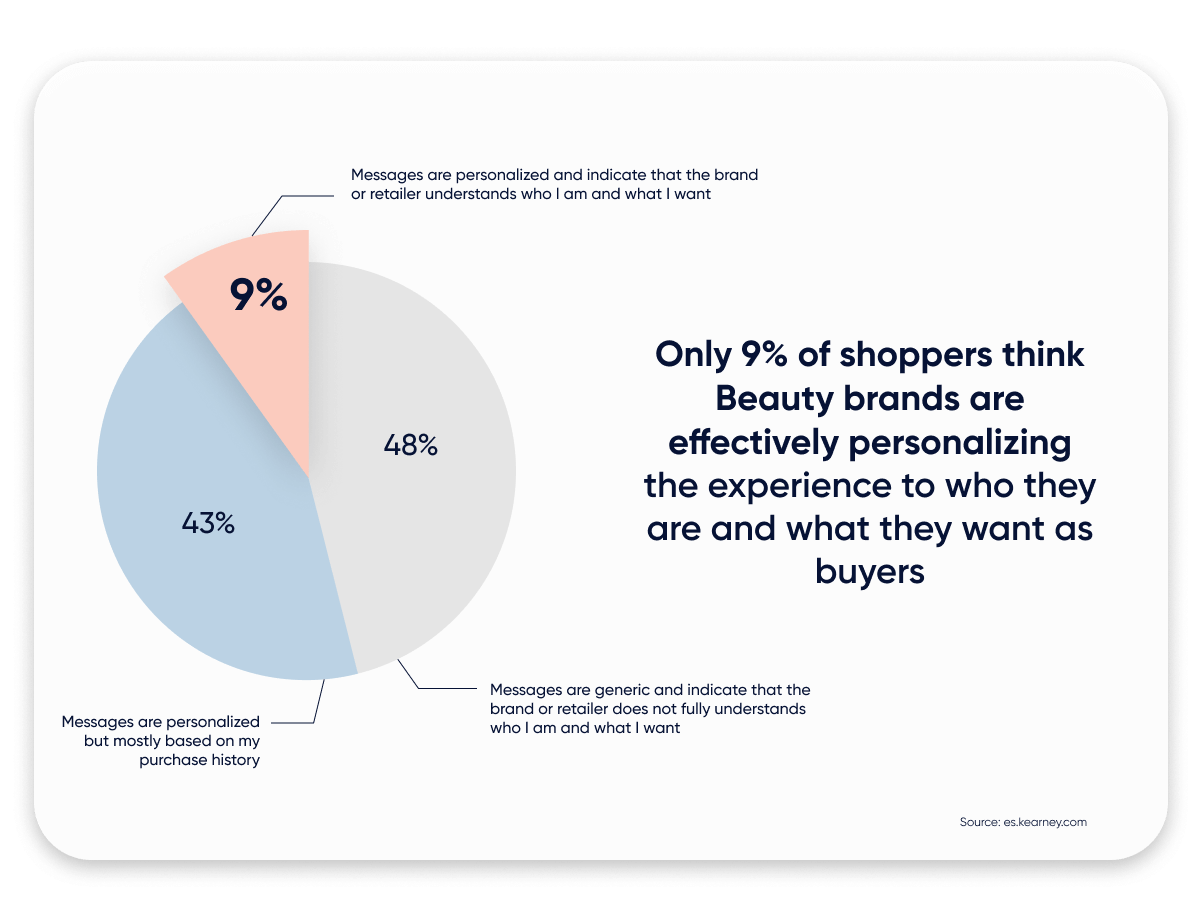

Today’s buyers aren’t wowed by personalization—they expect it. In a world where a buyer is asked to create a personal profile for just about everything they do online, it’s not unreasonable for them to expect your brand to understand their habits, needs, routines, and preferences.

Data shows that this isn’t the case, though. According to Kearney, only 9% of shoppers feel that beauty brands are effectively personalizing the experiences they provide to who buyers are and what buyers want. Close to half (48%) reported that beauty brand messaging feels generic and that brands don’t seem to understand buyers’ identities and wants, and 43% reported that while messaging felt personalized, it was largely based on buying history.

So how can you really get to know your buyers beyond making educated guesses based on what they’ve bought before?

Data.

Building out the kind of robust data infrastructure that makes it possible to create a personalized profile for every customer who buys from you. This is where a properly employed customer data platform (CDP) becomes crucial—buyers leave pieces of information about themselves on every platform they use, and by collecting and storing this data, you can build a three-dimensional profile of each buyer and use this profile to make suggestions they’ll appreciate.

When a cosmetics user finds a product that works for them, they stick with it. So your strategy needs to not only drive users to buy your product, but to keep buying it as well.

In particular for Beauty, replenishing products (whether the exact same product or a different one e.g. buying a new moisturizer), once shoppers have committed to a specific type of product in their beauty routine, they are unlikely to change. The beauty market is very saturated, which presents customers with multiple and increasingly diverse options for purchasing the same products. The first sale may be made by a customer to your business, but if you fail to implement a good replenishment strategy, then you will lose the repeat sales.

Refill in advance and prevent customers from going without, rather than passively waiting for them to return. Send a reminder email to customers 3 months after their purchase if a moisturizer runs out on average in 4 months to replenish the product.

If they do not wish to repurchase the current product, offer an alternative product to try if they are not keen to make the purchase again. Make it easy (preferably one-click) for them to make the replenishment purchase. It is also possible to tailor recommendations to suggest higher price point products to enhance customer lifetime value if done strategically.

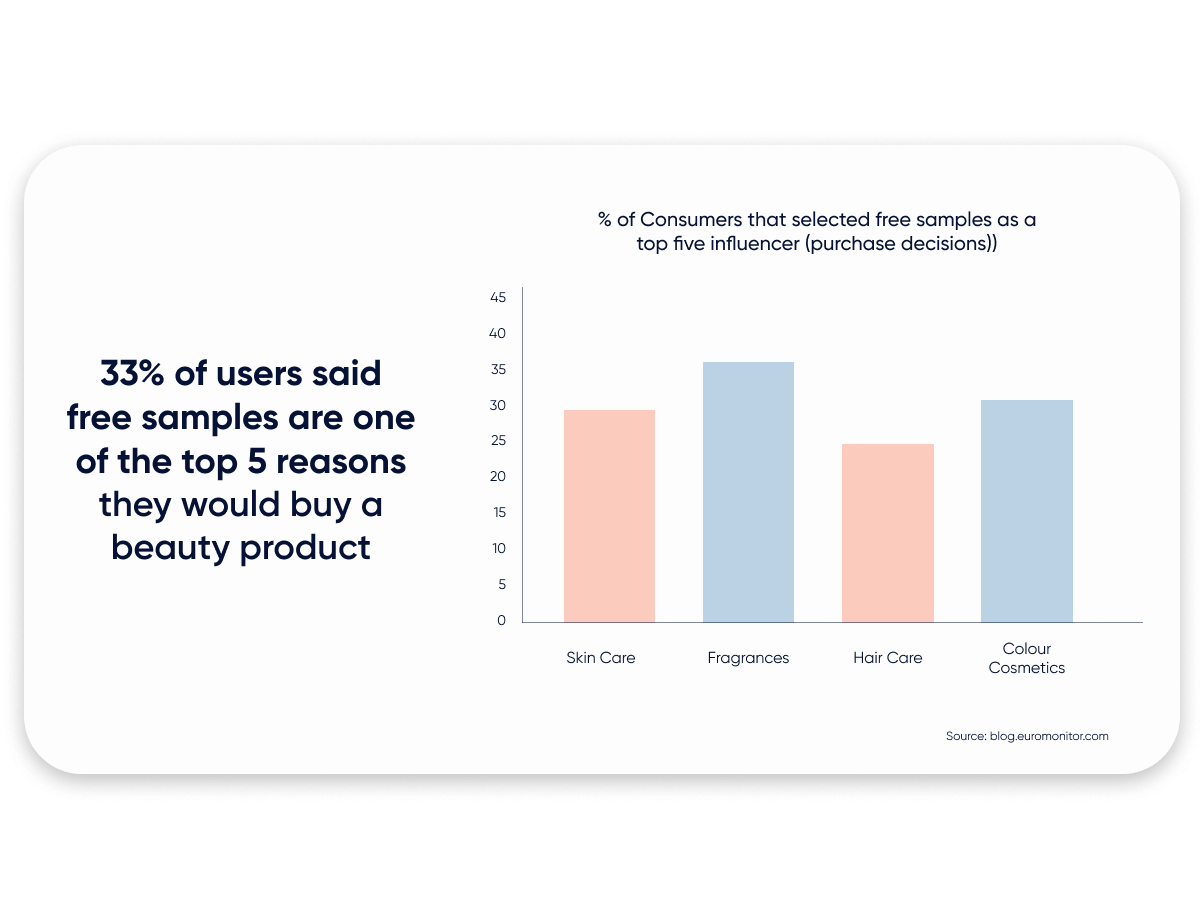

Give them an incentive to be loyal. Points and perks are great, but remember how we said buyers also want personalization? Offer free samples, but don’t just offer free samples—offer personalized free samples. This communicates that your brand knows the buyer well; you’re a friend, not a faceless corporation.

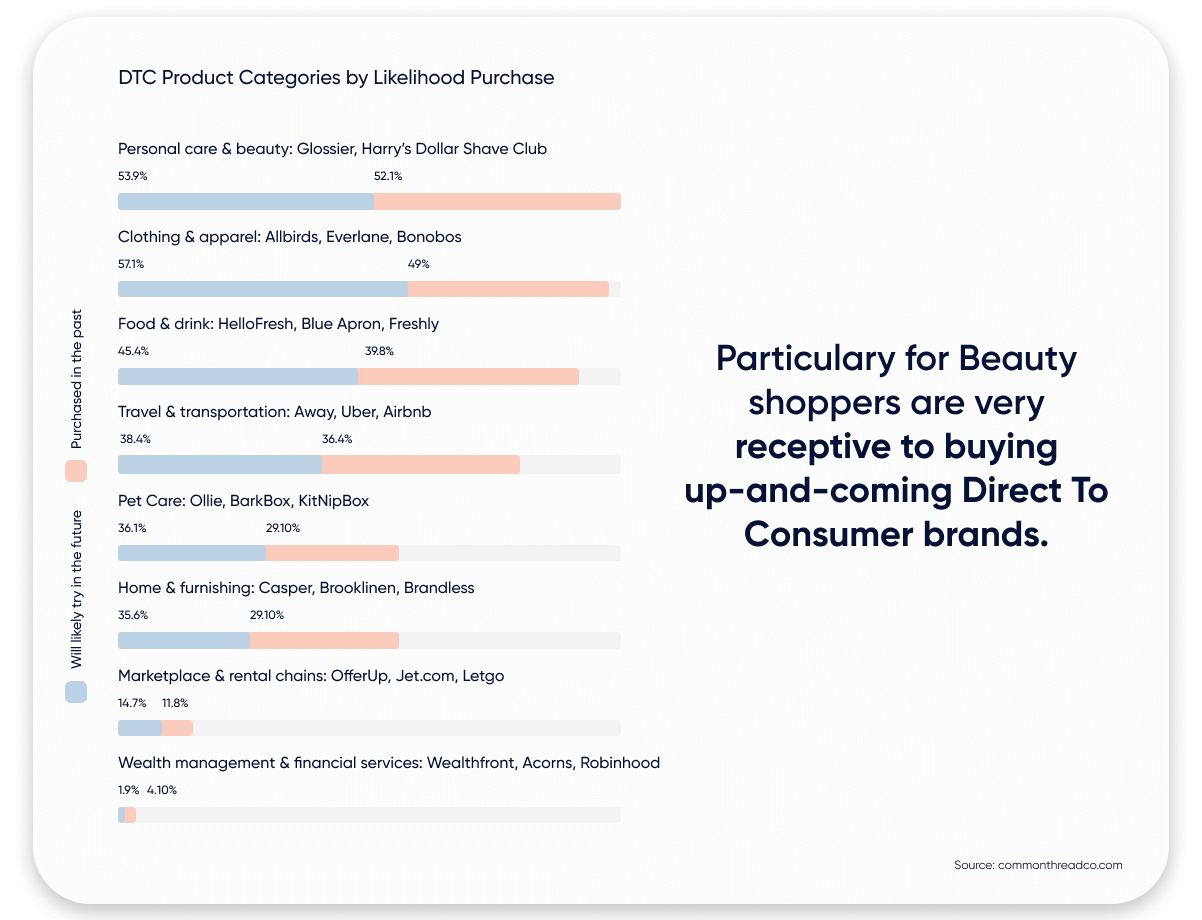

As more and more direct-to-consumer brands emerge, it’s more important than ever for you to build a community of loyal buyers. The beauty industry is one of the industries most impacted by the direct-to-consumer model:

Capitalize on buyers’ eager adoption of this model by adopting some of its elements yourself. Connect with buyers before they run out of a product and preempt a refill with a reminder email or text message. Once they’ve got the message, make it easy—ideally, one click—to get their replenishment on its way. This is also a great spot to recommend other products you offer based on what you know about the buyer.

Building out that community also sets you up for cross-selling. According to Forbes, 36% of beauty product consumers said they are more likely to buy a product if they’ve personally sampled it. Build samples into your marketing strategy by sending trial sizes in your shipments and offering up free samples as incentives for new subscribers.

Free samples are one of the most powerful tools in your buyer retention arsenal: it creates an easy path for cross-selling and upselling. Sampling, paired with your buyers’ fear of missing out (FOMO) on new products, keeps them coming back to your brand again and again.

Understanding your target audience is an ongoing pursuit. If you want to be competitive in the beauty and cosmetics industry, you have to intimately understand what buyers value, why they hold those values, and the specific benefits they’re looking for in the products they choose.

We cover all of these aspects of beauty industry consumer behavior and more in our webinar, Retail industry trends and eCommerce agility. Don’t miss it—if your goal is to give buyers exactly what they want, you need to understand why they want today’s trending products.

For more insights into Beauty and Cosmetics in 2022, get in touch.

Written by

Srikant Kotapalli

Srikant is a seasoned product marketing leader with 15+ years of experience in building and marketing SaaS products. As VP of Product Marketing at Insider, Srikant is responsible for Insider's product positioning, GTM and analyst relations. When not working on product marketing projects, Srikant loves exploring the design and engineering of things