Katie Morley

Katie Morley

Apr 18, 2024

Katie Morley

Katie Morley

Apr 18, 2024

Things are about to get even bigger in the world of financial services. The already massive sector is projected to surpass $58.69 trillion in value worldwide by 2031. But growth for individual businesses isn’t a sure thing. After all, digital payments, fintech brands, and buy now, pay later offerings are just a few of the latest developments disrupting the industry.

That’s not all. Customer loyalty? That’s on the line, too.

For financial services brands looking to ride this wave of growth and successfully evolve to keep up with shifting consumer preferences and expectations, investing in the customer experience (CX) is quickly becoming a winning strategy. CX leaders are outperforming the competition in the industry—driving higher ROI, ushering in faster growth, and ensuring lower costs.

The good news for finserv brands: Consumers are willing to pay more for better experiences. The bad news: Businesses in the banking, insurance, and investment sectors are under-delivering when it comes to customer experience. They’re falling short of meeting customers’ expectations by 18-20%.

Turning things around requires delivering seamless experiences across channels.

If your current martech stack can’t cut it? Well, then it’s time to switch. That’s something finserv leader Allianz is all too familiar with…

It’s not me—it’s you

Time to break up?

Finding the one at last

You had me at KPI

True love, at last 💘

The future of finserv digital marketing

Keep reading

Like many organizations across industries, Allianz wanted—and needed—more from its martech platform. It saw the writing on the wall. Customer experience was becoming more important than price and product offerings for customers. But its martech system just didn’t get it.

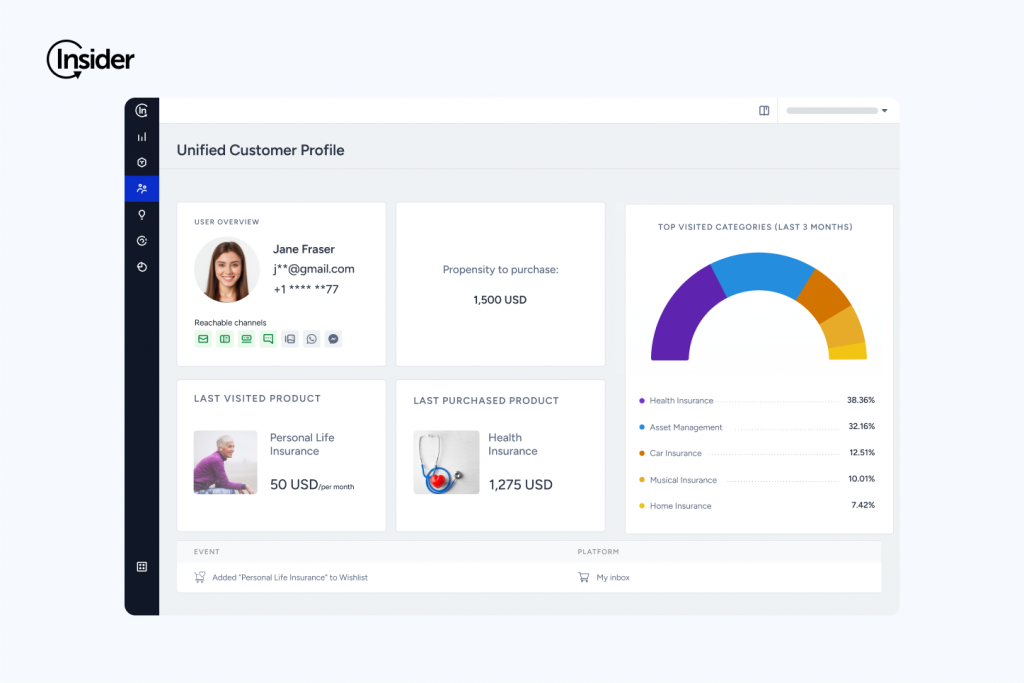

Its old system had issues. So many issues. The team couldn’t get a unified customer view, centralize their data to improve key results, or deliver great customer experiences without IT and dev support getting involved.

“We were looking for a technology partner to enable us to deliver personalized experiences to meet and surpass our customers’ expectations,” explains Allianz’s Marketing and Service Design Group Head. “Data privacy restrictions and the complexity of sales cycles often obstruct insurance marketers from obtaining a holistic customer view.”

Allianz knew what it needed to do—walk away from its old martech stack and find something better. That’s the only way it would be able to truly understand its customers and deliver the kinds of experiences they wanted. “Insider gives us the unified customer view we were searching for,” says Allianz’s Marketing and Service Design Group Head.

“Insider gives us the unified customer view we were searching for. The platform offers real-time server-to-server integration and an encrypted identification approach, which gives us the security and freedom to create precise AI-powered segments and use them to build better customer journeys.” — Marketing and Service Design Group Head at Allianz

When Allianz turned to Insider, our single platform for building individualized, cross-channel customer experience was just the tool it needed to connect data across channels, predict future behavior with AI, and tailor individual—and better—experiences.

Insider helps Allianz get its customers. Really get them. Now Allianz can send the right message to the right customers at the right time, improving renewals and cross-selling, driving customer engagement, satisfaction, and loyalty. More on that part of the (love) story ahead.

Allianz wanted to maximize every opportunity it had to share relevant, timely, and personalized offers with its customers as a way to drive customer lifetime value (CLTV). To do that, it turned to Insider’s AI-powered opt-in and advanced segmentation capabilities.

“The platform learns from customer behavior and identifies which products and services will interest each customer most,” says Allianz’s Marketing and Service Design Group Head. “This powerful intelligence helps us maximize our engagement ratios and deliver relevant, timely experiences.”

By working closely with Insider’s growth experts, Allianz was able to build an app push notification program that successfully encouraged users to opt into future communications, resulting in an incredible 80% opt-in rate—20% higher than the industry average. With an active audience, Allianz could effectively re-engage users just in time for renewals.

Thanks to Insider’s range of personalization tools combined with advanced segmentation capabilities, Allianz is able to maximize customer engagement KPIs and, customer lifetime value.

And it’s not just Allianz who has found its happily ever after with Insider—1,200 brands use our platform to build seamless, omnichannel customer experiences at scale—including Santander, ING, Citibank, Coca-Cola, and Samsung.

“We’ve been able to create and engage our user control groups with high accuracy, improved engagement metrics, and conversion rates across our financial offerings. We’ve also run A/B tests to deliver better customer experiences and ensure strong business results to give us more flexibility and precision.” — Digital Marketing Manager, Garanti BBVA. Read the case study.

“Our experience with Insider has been outstanding from the beginning. It has allowed us to work with a team that is constantly concerned with bringing us new ideas to improve the performance of our site. They’re always there to help us optimize our campaigns and teach us how to use Insider’s tools to help us become independent and scale our expertise and growth.” — Manager of Digital Channels at Coca-Cola. Read the case study.

It’s a challenging time for financial services marketers. New fintech players are changing the game, and consumers are on the prowl: They’re 2X as likely to open a new financial account, 15% of consumers say they’re open to new banking relationships, and 20% are considering switching banks.

Both customer acquisition and retention are at stake. Ensuring seamless customer journeys across channels and touchpoints will be key to bridging the distance between the kinds of experiences customers expect to receive and the quality of interactions brands in the industry are delivering. This is a staggering 18-20% gap, and narrowing it will be key to getting ahead of the competition and winning long-term loyalty.

If your current martech can’t help you achieve this ambitious goal, it’s time to break up and switch to Insider.

You can find out more about how Insider supports financial services brands like yours by downloading The ultimate digital growth guide for banking and insurance marketers. We share tips, tactics, and real-life examples from the world’s most trusted finserv brands on how to drive more growth and revenue.

Written by

Katie Morley

Katie is an award-winning content marketer with over eight years of experience in content strategy, development, and copywriting. As Global Content Director at Insider, she currently oversees content strategy across 26 regions. Fun fact: Katie read 64 books last year (for which she owes a long commute and two week-long holidays where she spent approximately six hours a day with her nose in a book).