Revolutionizing BFSI customer acquisition: 4 strategies to make you the #1 choice for prospects

Some decisions are straightforward and low-pressure for customers to make. But choosing a bank or financial services provider? That isn’t one of them.

Updated on 10 Oct 2025

For customers, finding an institution they trust to manage their hard-earned money is a heavy decision. Research shows that finance and banking are the most sensitive transactions customers make — even above their health — which means their choices are long and considered.

That makes customer acquisition particularly tough in the financial sector, with financial institutions admitting it’s the top challenge they’re facing.

It speaks to the importance of finding the right marketing solutions for financial services providers. When organizations combine a marketing automation platform with strategic tactics, they can widen their reach with data-driven omnichannel marketing, build rapport, foster customer trust, and become the obvious choice in one of the world’s most competitive markets.

Let’s dig into why it’s time to change up your customer acquisition strategies, the role Insider plays as the world’s leading marketing platform for BFSI organizations, and we’ll share four marketing strategies that financial services providers can use to acquire ideal customers.

💡Download our ebook to discover more strategies for driving customer acquisition and retention, increasing upsells and delivering frictionless digital experiences.

Lagging with legacy systems: Why it’s time to embrace digital transformation

BFSI organizations aren’t exactly ‘early adopters’ of technology. On the contrary, they carry the sterotype of being slow to keep up with the latest advances and trends—McKinsey research shows that insurance and banking have the oldest IT systems of any industry.

It makes sense. Change is daunting, especially in industries where privacy and security are so crucial. Overhauling systems and approaches doesn’t just feel overwhelming—it feels risky.

However, organizations that wish to stay competitive can no longer afford to delay and dodge advancements. Today, consumers demand a completely personalized customer experience. An impressive 78% of customers expect personalized support from their bank. Yet, only 44% of banking consumers believe their bank is delivering on that.

That means any BFSI organization that wants to stand out needs to adapt highly personalized, omnichannel journeys if they want to foster trust and land new customers. But, that level of personalization in financial services marketing is impossible to offer with legacy systems and outdated tactics. Organizations need an omnichannel marketing platform that serves as personalization software and a customer journey builder to take their digital marketing for financial services into the modern era.

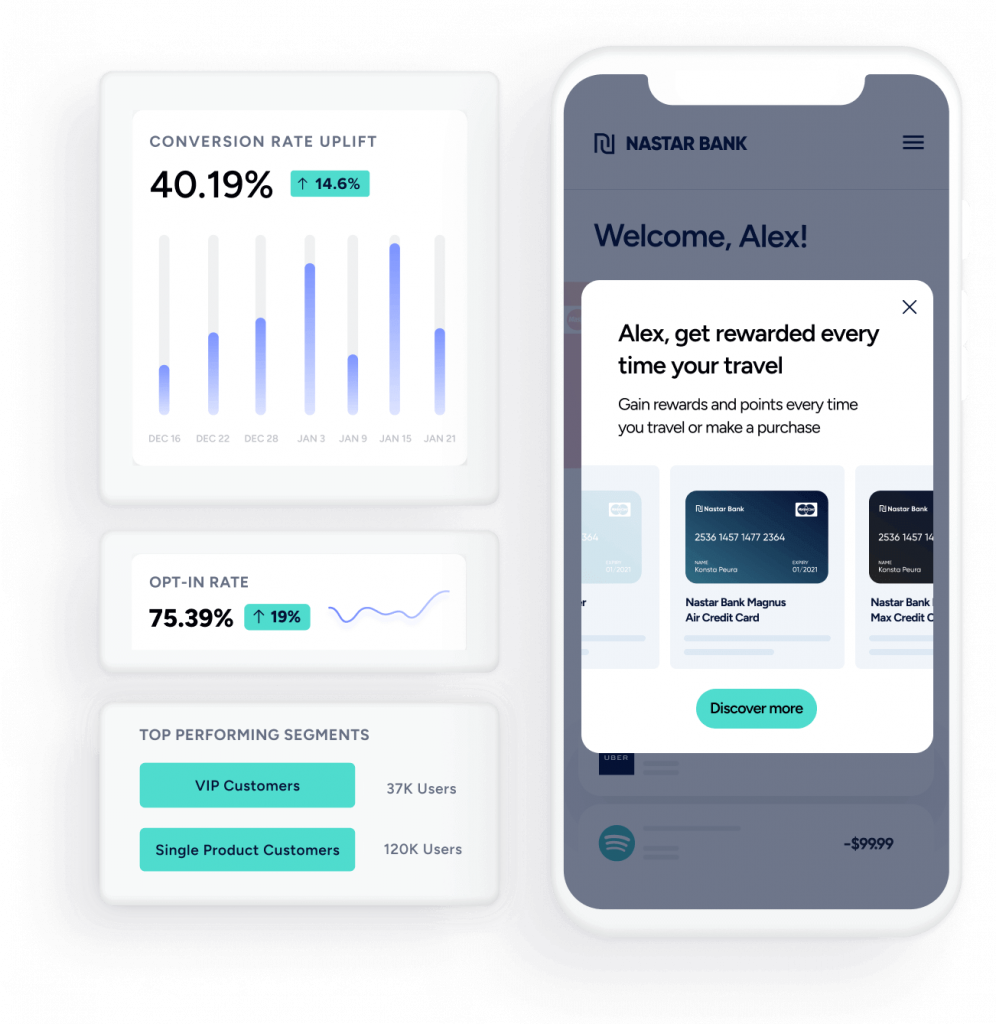

Enter Insider. Trusted by over 1,200 global brands, including Allianz, ING, Credissimo, Etiqa, Garanti BBVA, and many more, Insider was built by marketers for marketers.

We take secure, data-driven digital transformations seriously. That’s why the Insider platform offers a full suite of capabilities to unify customer data, build journeys, and leverage AI to drive customer acquisition and retention, increase upsells, and deliver frictionless digital experiences.

💡Download our ebook to discover how Insider helps world-leading BFSI organizations transform their digital experiences

Marketing strategies for financial services: 4 proven tactics to acquire new customers

There are plenty of personalization engines and other solutions focused on marketing automation for financial services. But much like with anything else, they’re not all created equal.

Insider stands out for its ability to not just get financial organizations in front of prospects, but to engage and convert them. Here are four strategies to help you draw in new customers and how Insider’s features can help you turn them into a reality.

1. Streamline and simplify your forms across every device

From opening an account to applying for a loan to enrolling in online banking, there’s no shortage of forms a prospect might need to fill out. If the process is tedious and time-consuming, they’re more likely to exit your site and never return.

As you think about journey orchestration for your customers, remember that filling out a form should be one of the easiest parts. Insider’s templates and drag-and-drop builder help you easily create forms that translate across desktop, mobile, and tablet. With intuitive navigation and progress bars, you can keep prospects engaged in the form-filling process, reduce your bounce rates, and boost completion.

“Our conversions improved by 48% after improving our loan application form with Insider’s recommendations. Insider’s growth experts are clearly very knowledgeable about designing impactful customer experiences for the fintech industry.”

— Marketing Manager at Credissimo

2. Keep customers hooked with personalized exit intent overlays

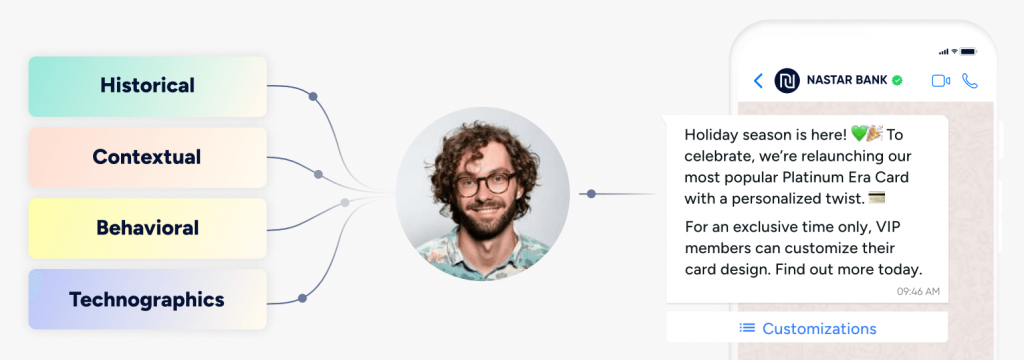

Insider’s CDP stitches together every customer interaction to build a 360-degree customer view you can use to deliver targeted and timely prompts and nudges that keep visitors hooked on your site.

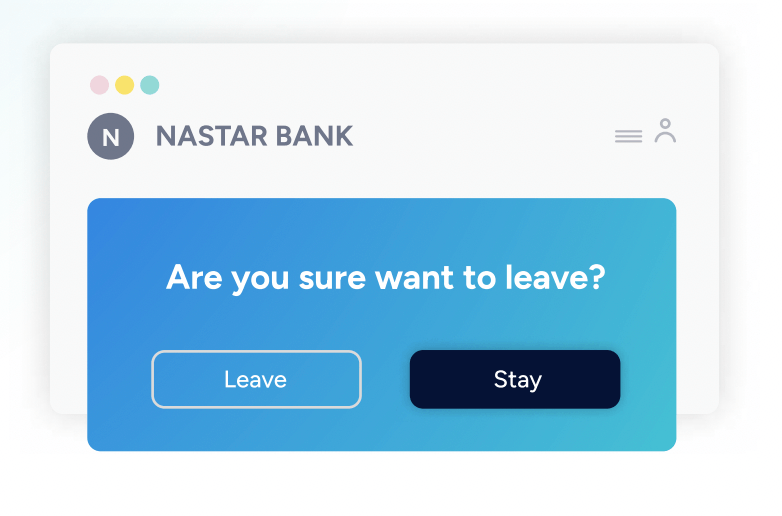

If and when a visitor chooses to leave your website, make them reconsider their decision by launching pop-ups the moment they hit the exit button.

These pop-ups don’t need to be obnoxious or wasted opportunities. Instead, use them as a home for lead collection forms or a space to promote relevant services and products based on anonymous visit data (like their location and onsite interactions).

3. Bring customers back with tailored push notifications

Push notifications might seem simple on the surface, but don’t underestimate them—they pack a mighty punch. Research shows that 47% of users interact with a push notification within an hour of receiving it.

With Insider’s Web Push notifications, you can re-engage customers no matter where they are online. Your message is delivered directly to users’ screens and it’s always viewable, whether the customer is currently on-site or not. You can make these notifications beneficial rather than bothersome by providing timely reminders or highlighting specific services that are relevant to that particular customer.

4. Collect zero-party data with interactive emails

To personalize the customer experience and make the most of omnichannel marketing automation, you need to collect information from your customers. But getting potential customers to part with their data—particularly in a sensitive industry like finance or insurance—can feel like pulling teeth.

With Insider’s AMP for Email, you can provide dynamic, engaging email content that includes interactive elements and gamification (like a “how much house can you afford?” quiz as just one example). That’s an opportunity to learn about customers’ preferences and financial goals without them ever leaving their inbox.

You’ll get valuable insights from customers in a way that feels accessible and fun to them, rather than like a risk or a burden. Use A/B testing and the information you collect to continue to tailor their experience and push them to sign up.

“With every prospect’s circumstances being so unique, we were struggling to provide our prospects with relevant information. Insider has helped us overcome this with first-party data collection through engaging, dynamic emails. Not only are we learning more about our customers, but our customers are actually opening and clicking through the emails, so we’ve seen an increase in CVR too.”

— Director of Marketing at European Insurance Provider

💡Want even more powerful customer acquisition strategies for financial services? Download our ebook

Take the mystery out of marketing strategies for financial services

From SMS marketing to WhatsApp marketing to AI to whatever else is next on the horizon, marketing feels like it’s ever-changing. That’s a lot for any organization to keep up with, but it’s especially challenging in a more rigid industry like BFSI where privacy and security are such pressing priorities.

Fortunately, the above strategies can help you stay compliant, keep pace with the constant changes, and not only acquire new customers but also impress and engage them.

Download our ebook to discover even more strategies to drive acquisition and retention and deliver seamless CX