17 proven strategies to deliver COVID-sensitive experiences for retail banks & insurance companies

Nicolas Algoedt

Nicolas Algoedt

Apr 29, 2020

Nicolas Algoedt

Nicolas Algoedt

Apr 29, 2020

Nicolas Algoedt

Nicolas Algoedt

Apr 29, 2020

Nicolas Algoedt

Nicolas Algoedt

Apr 29, 2020

COVID-19 is expected to have a far-reaching and deep impact on our economy. With only a few establishments unaffected by the COVID-19 crisis, almost all businesses are scrambling to respond to the changing environment.

How It Affects Banks & Insurance Companies?

The 2020 Digital Banking Statistics

17 Proactive Strategies for Digital Marketers in Retail Banks & Insurance Companies

Final Takeaways

Alongside all industries, in the banking sector too a fundamental shift in customer behavior is expected. A decrease in the physical branch visits is certain with an immediate increase in online transactions, peer to peer payments, wallet usages, among others. The countries with the earliest impact of the virus—China and Italy— have already seen a 20% increase in online transactions. It’s up to the banks now to step up their game to convert more of these experiences into positive stories for long-term digital adoption.

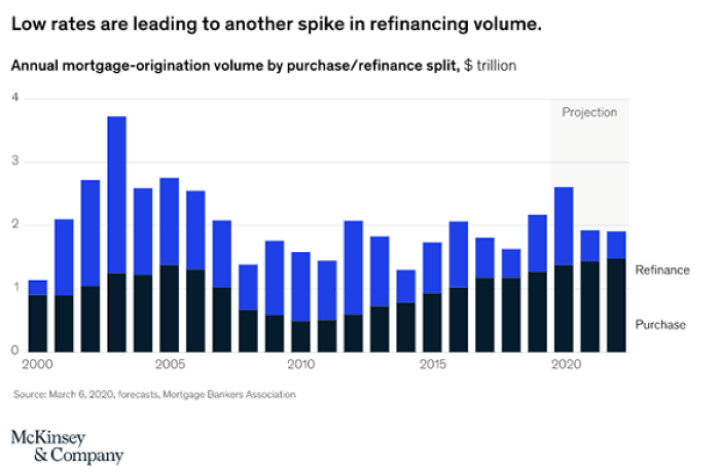

The crisis has also led to an increase in demand for certain banking products. For example, McKinsey has already projected an increase in demand for mortgage refinancing in the US.

How retail banks respond to the Coronavirus pandemic will have a direct impact on its customers, employees, economy and the world at large. Banks manage people’s money, provide loans, guarantee credits, facilitate payments and are one of the most connected institutions to the general public. Facing immediate money requirements and an uncertain future cash flow, people are expected to increase their dependency on banks for their financing and insurance needs.

Insurance companies, on the other hand are already fighting the outbreak on multiple fronts—new claims, changes in demand, investment uncertainties, and more. The biggest issue which has already cropped up is the delay in the processing of claims, which has a serious impact on brand reputation during these times.

A major part of retail banking & insurance services including deposits, credits, payments and health insurance are part of what governments refer to as “essential services”. So it’s important for banks to continue these services to minimize the adverse effects on people. However, managing all these at a much-reduced employee count can be challenging. One way to tackle these challenges with scarce resources goes through embracing digital banking.

While 2020 turned out to be “not a great start” for a new decade,it also bears some positive news as well. For those bankers and especially digital marketers who aim to drive digital banking initiatives, PWC’s financial service technology report gives a ray of direction and hope. Following are three key findings from the United States taken from the report:

An untimely joke going around in social media claims—the biggest digital transformation enabler of this decade won’t be your CEO/CMO/CTO but rather coronavirus. Leaving the sarcasm aside, the fact remains true—the world after corona is expected to be more digital than ever.

Your bank’s responses to coronavirus should not be limited to minimal reactionary steps to keep the business in a stable state. It’s time for retail banks to think proactively to improve and extend their digital capabilities. More importantly, marketers in banking should focus on designing better customer engagement and socially responsible messages.

Here are several low-hanging and effective ways in which you can continue to serve customers, better engage them, build trust, and grow your brand affinity even in times of crisis.

Engage Your Customers Across Channels

1. Keep Your Digital Channels Open

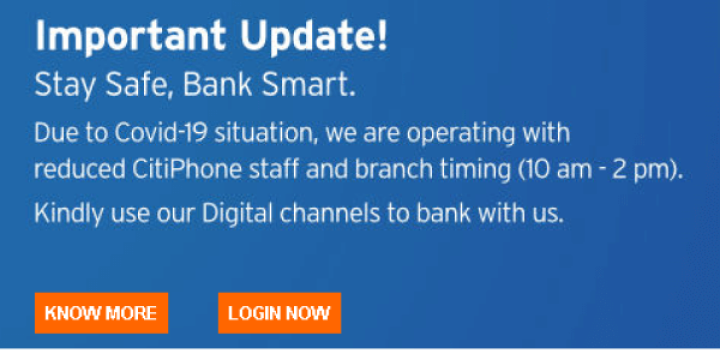

The last thing your customers want to face is not being able to reach your bank. Banks need to keep all their digital channels open and proactively update their customers much before they feel the need to reach out for help, especially in times of crisis.

2. Build a Safety-First Omni-Channel Reachout Plan

It is important that banks inform their customers about safety-related precautions such as:

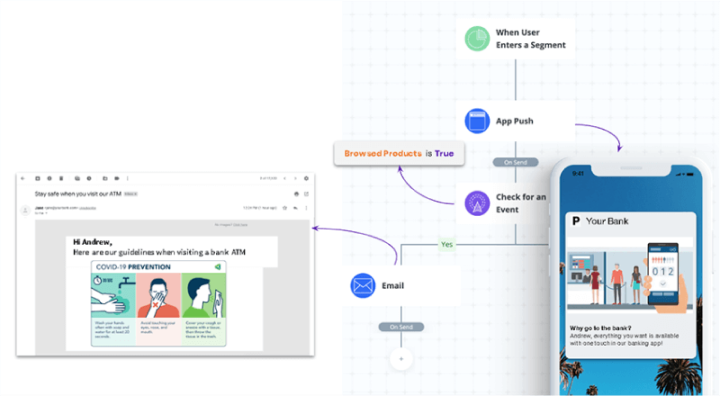

Banks should proactively update their customers about these steps taken at the branch level through digital channels. Emphasis should be given to driving more visits to digital channels than branches and ATMs. Use multi-channel customer journeys to continuously and synchronously engage with the customers.

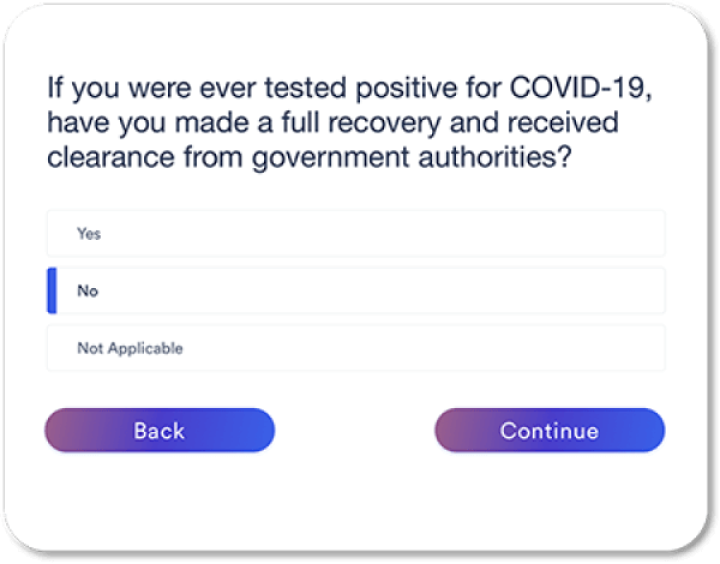

3. Use Web Surveys for Insurance Data Collection

For insurance brands, it’s important to collect COVID-related data like travel history, family infection history, disease symptoms, existing illnesses, and quarantine status for new or renewal customers. Make use of ready-to-use customer survey tools to collect and process this information digitally to a central Customer Data Platform (CDP) and adjust the insurance terms and premiums accordingly.

4. Track NPS Score to Improve Customer Satisfaction

It is always better to reach out to customers via NPS surveys to gauge customer satisfaction levels and prevent potential issues. Analyze and prioritize the feedback and make sure any dissatisfaction is taken care of before it becomes an issue. Also, in the long run, this might improve brand loyalty among your customers.

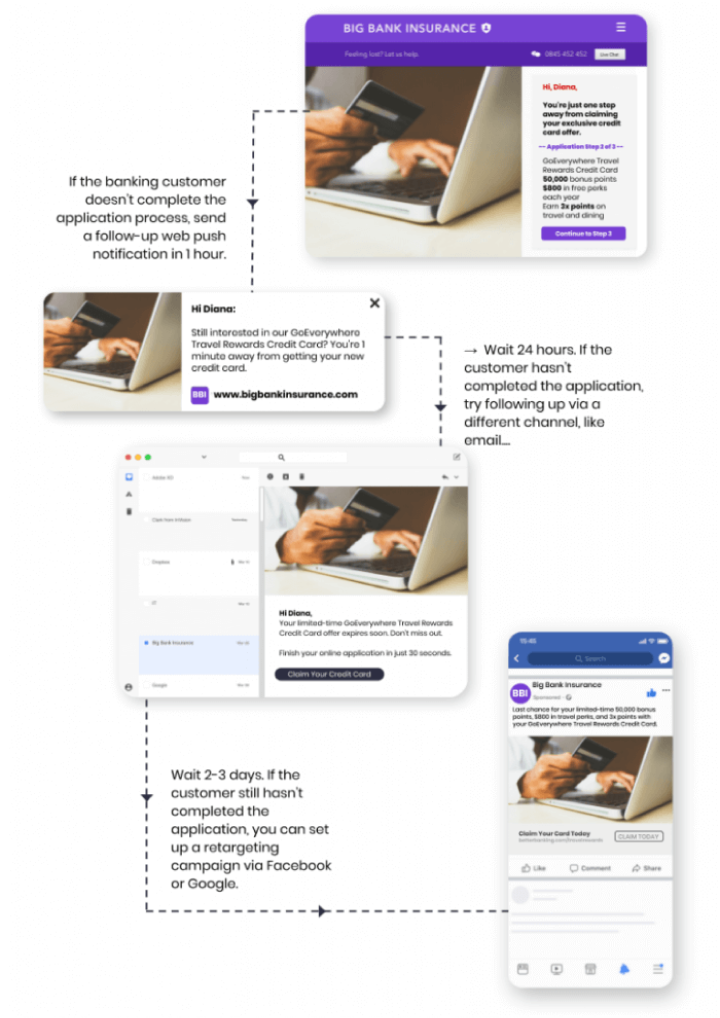

5. Design Relevant and Helpful Customer Journeys

Banks need to be prepared to meet these potential customers wherever they are—yes, even on messaging apps. According to PwC’s report, the “new normal” for financial services institutions is to meet the demand for being customer-centered, and that means offering seamless omnichannel experiences. Especially at these times when users are bombarded with multiple brands, banks should use customer journey mapping tools to engage with customers beyond the traditional financial channels.

Show Empathy via Personalized and Socially Conscious Messages

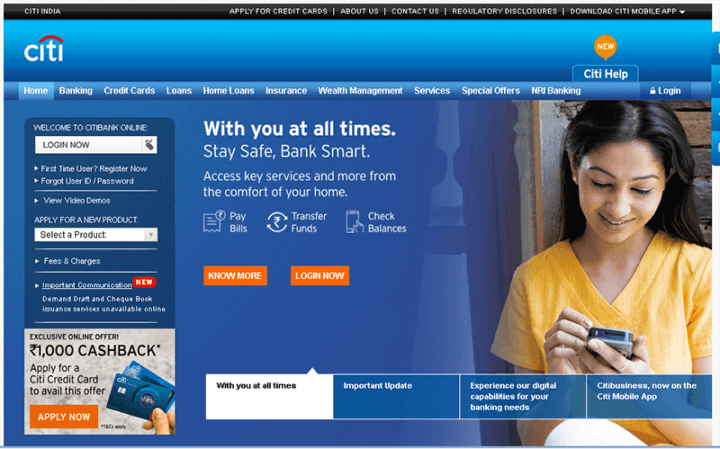

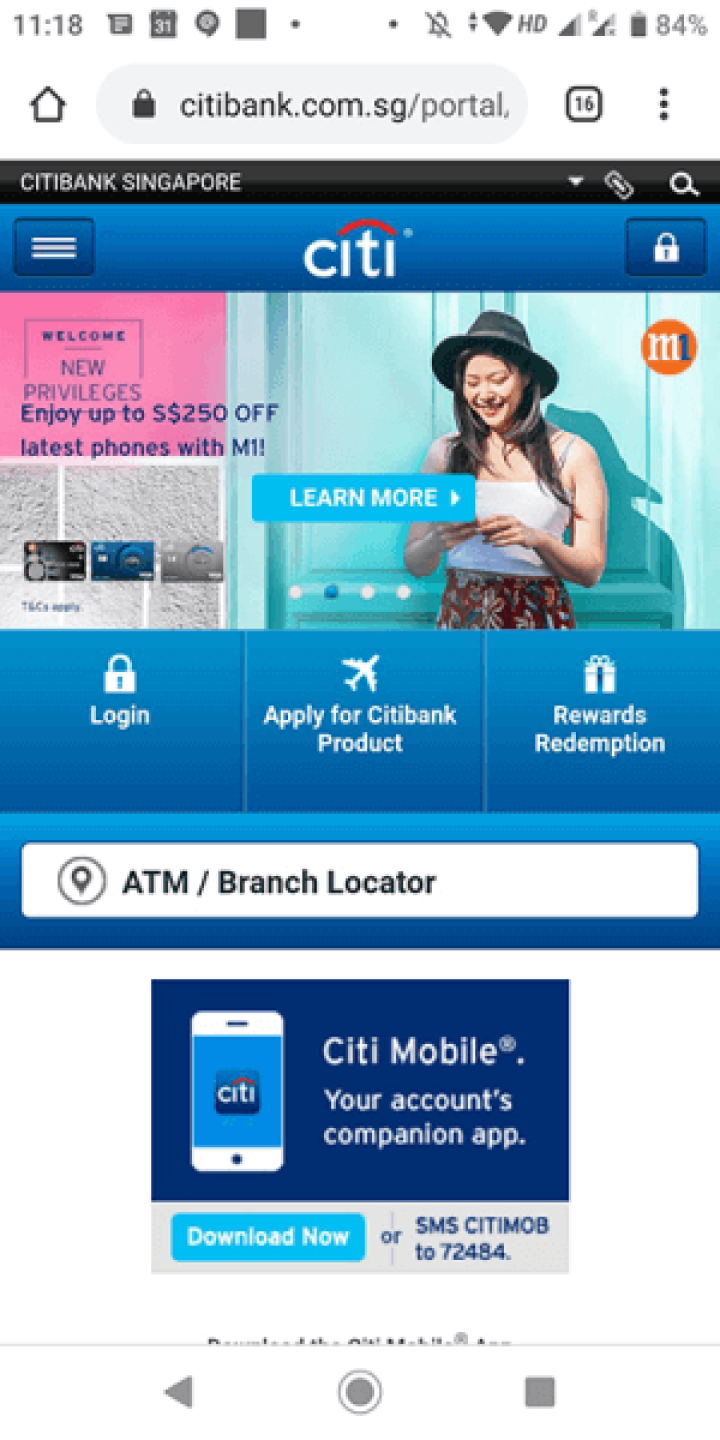

6. Use Personalized Banners and Sidebars

The first step to deal with the coronavirus crisis is to acknowledge it publicly. It would feel odd for users if they see your website without any update on Covid-19. While landing pageIs might take more time to create and deploy, creating a banner or sidebar explaining the immediate steps being taken can be a great help to your customers.

It’s also important to display personalized banners including products and services your customers may need to navigate the crisis. For example, check out Citibank’s personalized banner promoting different ways to utilize their online banking.

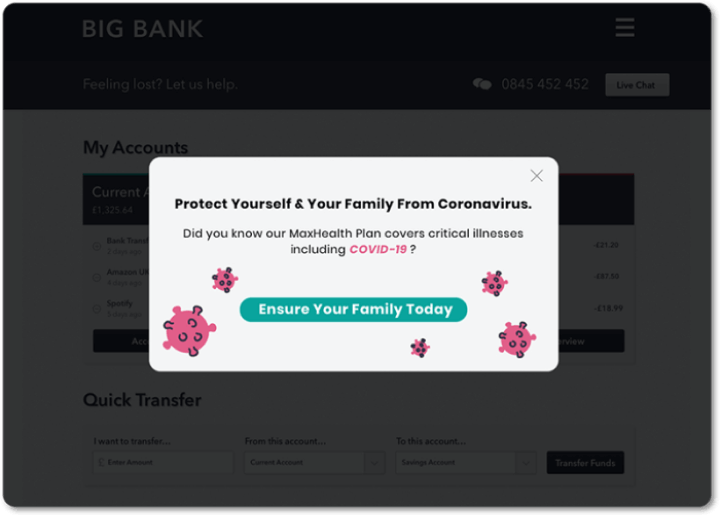

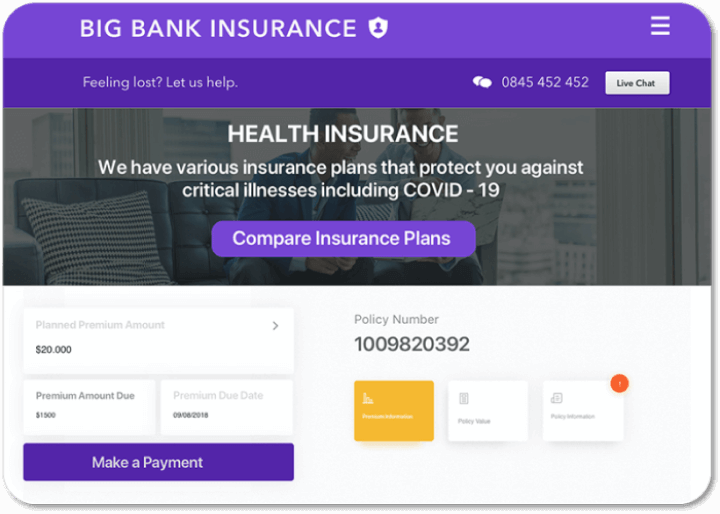

7. Leverage Overlays to Promote Insurance Products

Dynamic overlays on your website can easily catch the attention of users—especially when you have to promote products like life insurance, and health insurance, suitable for COVID-times.

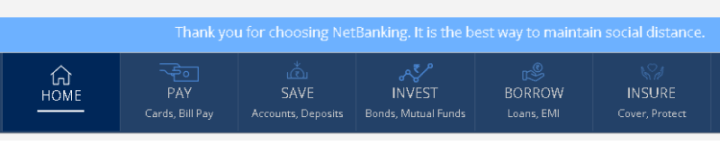

8. Use Text Banners for Promotions and Location-Based Announcements

You can make use of small-sized dynamic banners and include messaging to highlight social distancing related measures, re-opening of specific branches in the location of the user, or the local emergency customer care number. This can also be used to announce the availability of 24/7 customer care,digital support for business users,and priority banking.

9. Give Tailored Advice for the Vulnerable

The effect of the crisis can vary with different customers, some more vulnerable than others. Banks can utilize customer data platforms (CDP) to gather 360-degree information about their customers and segregate the vulnerable ones like self-employed, high-debt, old-age customers. Syncing a CDP with your existing CRM system can help you reach out to them with tailored products and helpful advice. For example, promote senior citizen health insurance plans with suitable discounts for the already identified old-age customer segment who are at high risk.

Educate Users About Online Banking

10. Design Smart Banners to Increase Mobile App Downloads

Most banks nowadays have robust mobile apps capable of doing pretty much anything that is possible via a branch. You can place a smart banner on your web pages to enable users to directly click and download your mobile app.

11. Disincentivize Branch Visits

Encourage your customers to stay home and use online banking for everyone’s safety. Leverage your branch locator pages, ATM listings in Google and more to drive users who are potential branch visitors to online channels.

12. Deliver Digital Banking & Insurance Education

If you already have a knowledge base to educate your users about digital banking or insurance products, this may be the best time to make these pages more accessible. This can be a digital banking guide or an insurance product comparison page with some COVID-related changes as necessary. Use retargeting options to reach out to customers who have not made any transactions even after viewing your page

Innovation During Crisis

13. Create COVID-Sensitive Products & Services

Unlike in the past, banks are diversified to address different needs of customers. In times of crisis these are some of the immediate steps you can consider:

While these initiatives can be of real help to the customers, banks need to make sure they reach the right beneficiaries. Utilizing interest clusters and predictive audiences based on AI are some of the proven ways banks can explore.

14. Leverage the Power of Storytelling

Banks can package their existing products to help their customers during crisis. They can promote products like refinancing mortgage loans, short term personal credits without documentation, health insurance policies, and more. Using highly-engaging personalized stories, just like you would see them on social media, on your websites, you can help visitors discover the products they need immediately much faster.

Make use of InStory designs from Banking ebook

15. Bring Back Customers With Tailored Product Recommendations

Trying to sell something by taking advantage of the crisis should be avoided at all cost. However, this doesn’t mean banks should overlook those ways in which banking and insurance products can help their customers during the crisis. For example, reach out to those customers without any proper insurance coverage with suitable insurance product recommendations.

16. Lead Community Initiatives via Digital Banking

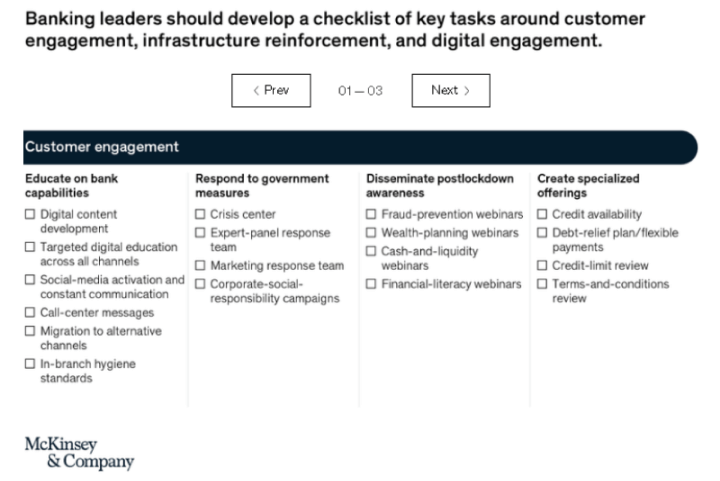

We already have great examples from China on how banks can engage and lead the community outreach. A recent checklist by McKinsey lists the additional tasks banking leaders should undertake during the COVID-19 crisis. This includes digital banking education, spreading lockdown awareness, responding to government measures and helping the public with personal credit support.

Focus on Employee Reachout via Digital Channels

17. Keep Your Employees Safe and Informed

While it is important to keep in touch with your customers during this period, it is also vital to support your employees. Provide them with the necessary cross-training in digital technologies, infrastructure help, remote working tools and more.

Use channels like email and messaging apps to continuously relay information about the COVID outbreak, changes in banking regulations from central banks and government advisories that affect banks. This gives your employees and customer service teams the much-needed information while they engage with your customers via digital channels. Make use of workflow automation tools like Insider’s Architect wherever possible to do this efficiently and effectively.

Retail banks & insurance companies being the main touchpoints and key essential services for billions of people around the globe need to rise above the crisis. Digital banking & promoting insurance products serve as the best bet for banks to navigate the crisis. Banks need to be more creative with digital services more than ever. Don’t forget that the world will go back to normal one day. Until then, we need to stay digital and stay safe.

Written by

Nicolas Algoedt

Passionate about new technologies and e-commerce, Nicolas has held various position at leading e-commerce and tech companies including Groupon, Microsoft and Bwin.