16 proven strategies retail banks can use to deliver COVID-sensitive experiences via digital banking

Edwin Halim

Edwin Halim

Apr 1, 2020

Edwin Halim

Edwin Halim

Apr 1, 2020

Edwin Halim

Edwin Halim

Apr 1, 2020

Edwin Halim

Edwin Halim

Apr 1, 2020

COVID-19’s Far Reaching Impact

How It Affects Banks and What Should Be the Response?

The 2020 Digital Banking Statistics

16 Proactive Strategies for Digital Marketers in Retail Banks

Before You Go

COVID-19 is expected to have a far reaching and deep impact on our economy. With only a few establishments unaffected by the COVID-19 crisis, almost all businesses are scrambling to respond to the changed environment. All major sectors like agriculture, manufacturing & services have been adversely affected. In the long term and as the crisis gets normalized, agricultural & industrial sectors are supposed to pick up faster as the customers are then expected to make up for the lost demand by replacing orders in bulk. As far as immediate responses are concerned, the service sector is expected to respond faster due to fewer logistical issues involved.

We have already seen a higher spike in healthcare services, online shopping, retail, content streaming services, food & grocery deliveries, etc. A few non-essential services like airlines, tourism, automotive and oil & gas distribution are expected to take a big hit in the medium term, while the essential services are expected to return to normal soon. These essential services include government services, supermarkets & retail outlets, delivery services, banking & financial services, etc.

A fundamental shift in customer behavior is expected in the banking sector- a decrease in the physical branch visits is certain with an immediate increase in online transactions, peer to peer payments, wallet usages, etc. The countries with the earliest impact of the virus—China and Italy— have already seen a 20% increase in online transactions. It’s up to the banks now to step up their game to convert more of these experiences into positive stories for long-term digital adoption.

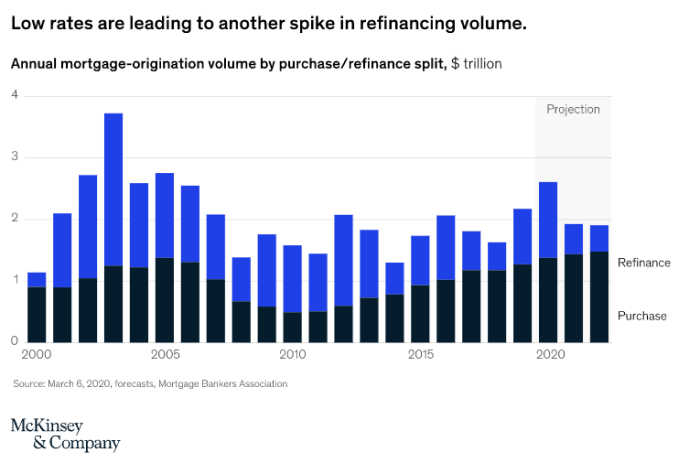

The crisis has also led to an increase in demand for certain banking products. For example, McKinsey has already projected an increase in demand for mortgage refinancing in the US.

How retail banking strategies respond to the Coronavirus pandemic will have a direct impact on its customers, employees, economy and the world at large. Banks manage people’s money, provide loans, guarantee credits, facilitate payments and are one of the most connected institutions to the general public. Facing immediate money requirements and an uncertain future cash flow, people are expected to increase their dependency on banks for their financing and insurance needs.

A major part of retail banking strategies including deposits, credits, payments, etc. are part of what governments refer to as ‘essential services’. So it’s important for banks to continue these services to minimize the adverse effects on people. However, managing all these at a much-reduced employee count can be challenging. One way to tackle these challenges with scarce resources goes through embracing digital banking.

While 2020 turned out to be ‘not a great start’ for a new decade, there are also positive news as well. For those bankers and especially digital marketers who aim to drive digital banking initiatives, PWC’s financial service technology report gives a ray of direction and hope. Following are three key findings from United States taken from the report:

Source: https://www.pwc.com/gx/en/financial-services/assets/pdf/technology2020-and-beyond.pdf

An untimely joke going rounds in social media says—the biggest digital transformation enabler of this decade won’t be your CEO/CMO/CTO but rather Coronavirus. Leaving the sarcasm aside, the fact remains true—the world after corona is expected to be more digital than ever.

Your bank’s responses to Coronavirus should not be limited to minimal reactionary steps to keep the business in a stable state. It’s time for retail banking strategies to think proactively improve and extend their digital capabilities. More importantly, marketers in banking should focus on designing better customer engagement and socially responsible messages.

Here are several low-hanging but effective ways in which you can continue to serve customers, better engage them, build trust and grow your brand affinity even in times of crisis.

Engage Your Customers Across Channels

1. Keep Your Digital Channels Open

The last thing your customer wants to face is not being able to reach your bank. Banks need to keep all their digital channels open and proactively update their customers much before they feel the need to reach out for help, especially in times of crisis.

2. Build a Safety-First Omni-Channel Reachout Plan

It is important that banks inform their customers about the safety-related precautions such as:

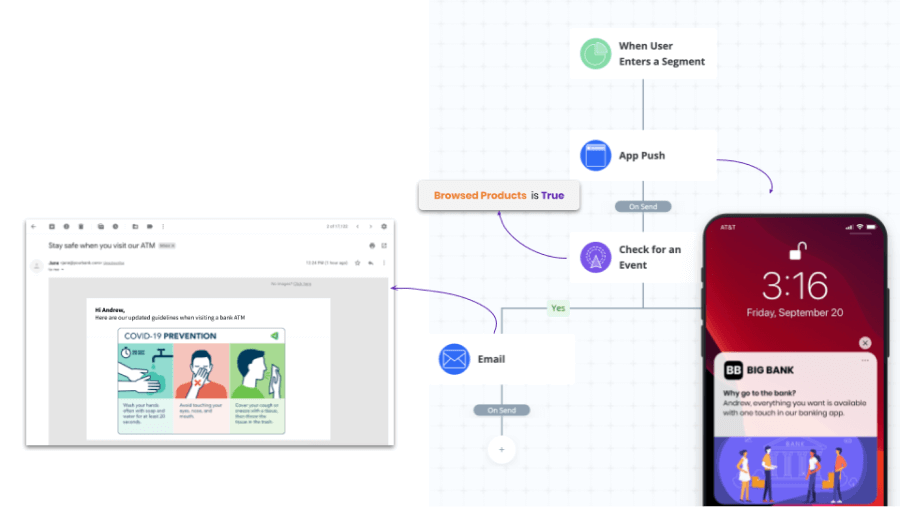

Banks should proactively update its customers about these steps taken at the branch level through digital channels. Emphasis should be given to drive more visits to digital channels than branches and ATMs. Use multi-channel customer journeys to continuously and synchronously engage with the customers.

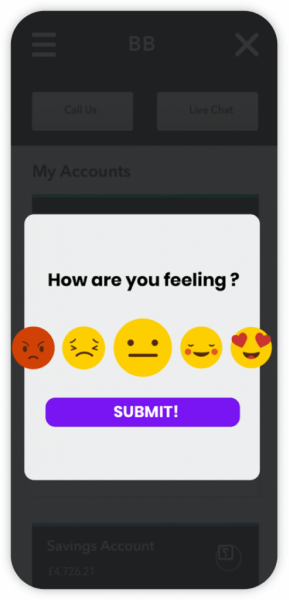

3. Send Customer Surveys for Early Feedback

Most of the queries banks receive can be easily anticipated in advance. It is always better to reach out to customers via surveys to identify potential issues proactively. Analyze and prioritize the feedback and make sure their needs are met before it becomes an issue. It always makes sense to allocate your limited resources to priority requests. Also, in the long run, this may improve brand equity amongst your customers

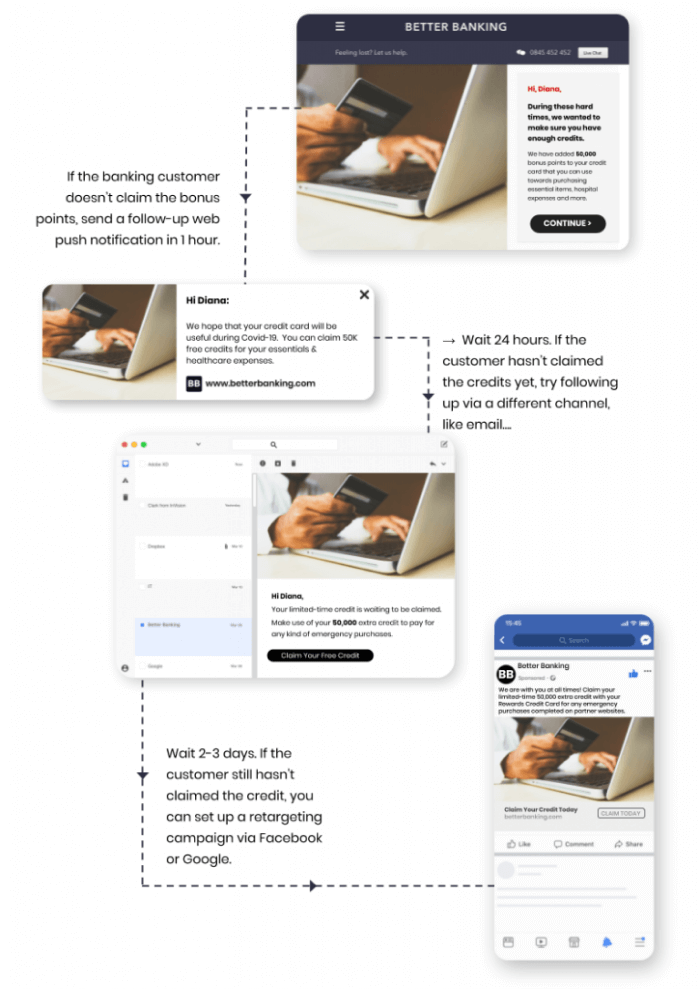

4. Design Relevant and Helpful Customer Journeys

Banks need to be prepared to meet these potential customers wherever they are—yes, even on messaging apps. According to PwC’s report, the “new normal” for financial services institutions is to meet the demand for being customer-centered, and that means offering seamless omnichannel experiences. Especially at these times when users are bombarded with multiple brands, banks should use customer journey mapping tools to engage with customers beyond the traditional financial channels.

Show Empathy via Personalized and Socially Conscious Messages

5. Use Personalized Banners and Sidebars

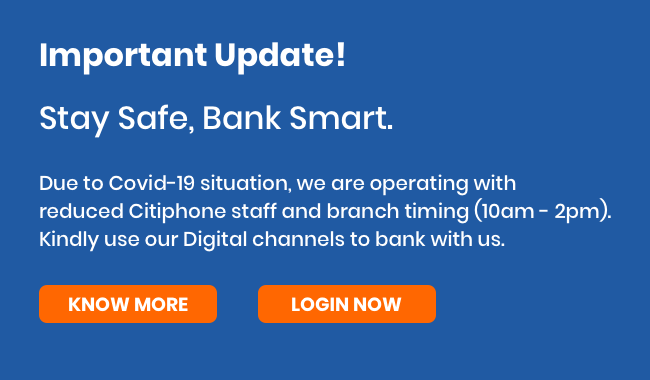

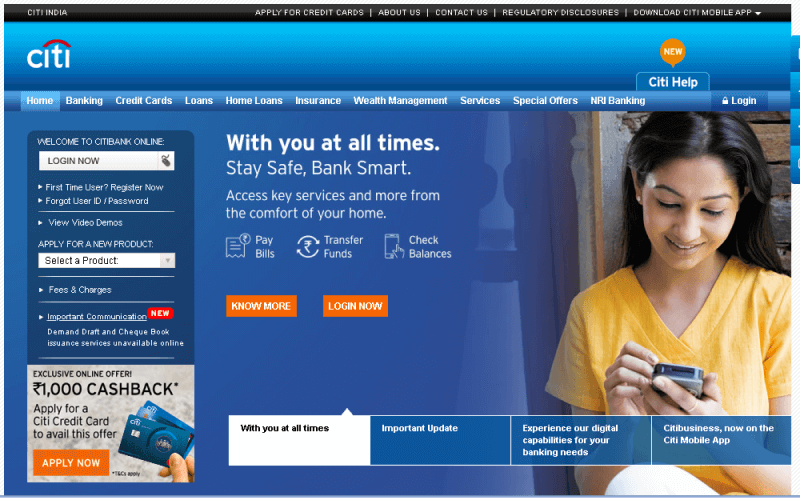

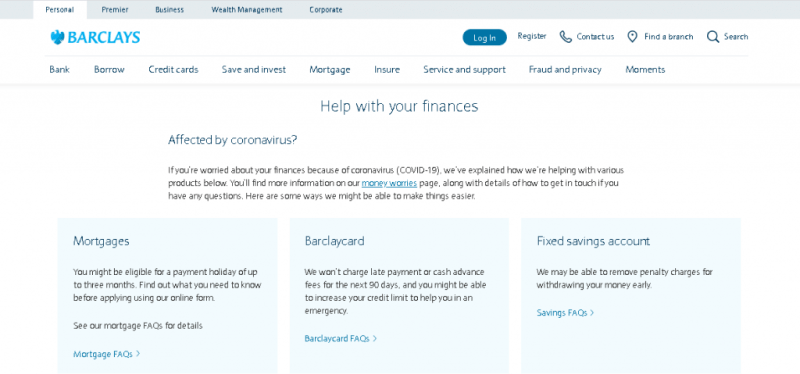

The first step in the face of crisis is to acknowledge it—it would feel odd for users if they see your website without any update on Covid-19.. While landing pages might take more time to create and deploy, creating a banner or sidebar explaining the immediate steps being taken can be of great help to your customers.

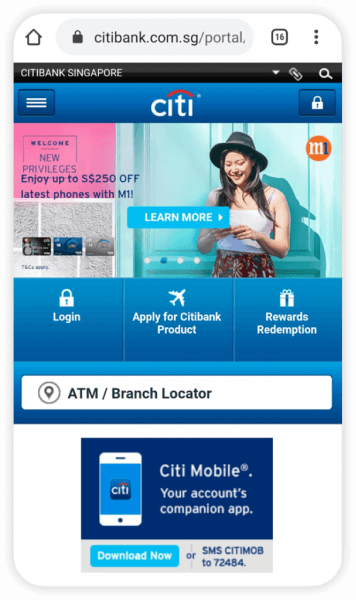

It’s also important to display personalized banners including products and services your customers may need to navigate the crisis. For example, check out Citibank’s personalized banner promoting different ways to utilize their online banking.

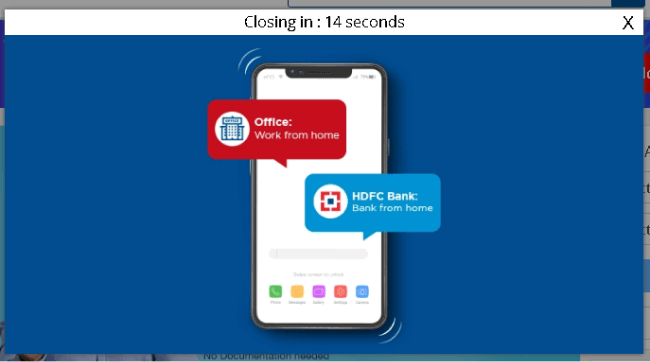

6. Leverage Overlays for Improved Engagement

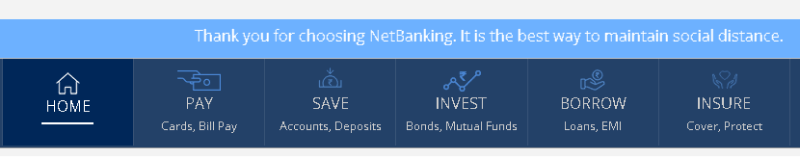

Dynamic overlays on your website can easily catch the attention of users—especially during COVID times. Refer to the image below to see how a bank can utilize overlays to promote mobile banking.

7. Use Text Banners for Promotions and Location-Based Announcements

You can make use of small-sized dynamic banners and include messaging to highlight social distancing related measures, re-opening of specific branches in the location of the user or the local emergency customer care number.. This can also be used to announce the availability of 24/7 customer care and digital support for business users, priority banking etc.

8. Give Tailored Advice for the Vulnerable

The effect of the crisis can vary with different customers—some more vulnerable than others. Banks can utilize customer data platforms (CDP) to gather 360 degree information about their customers and segregate the vulnerable ones like self-employed, high-debt, old-age customers, etc. Synching a CDP with your existing CRM system can help you reach out to them with tailored products and helpful advice.

Educate Users About Online Banking

9. Design Smart Banners to Increase Mobile App Downloads

Most banks nowadays have robust mobile apps capable of doing pretty much anything that is possible via a branch. You can place a smart banner on your web pages to enable users to directly click and download your mobile app.

10. Disincentivize Branch Visits

Encourage your customers to stay home and use online banking for everyone’s safety. Leverage your branch locator pages, ATM listings in Google and more to drive users who are potential branch visitors to online channels.

11. Deliver Digital Banking Education

If you already have a knowledge base to educate your users about digital banking capabilities—this may be the best time to make these pages more accessible. This can be a mobile banking or digital banking guide on how to make use of existing digital channels. Use retargeting options to reach out to customers who have not made any transactions even after learning about digital channels.

12. Create COVID-Sensitive Products & Services

Unlike in the past, banks are diversified to address different needs of the customer. In the times of crisis these are some of the immediate steps you can consider:

While these initiatives can be of real help to the customers, banks need to make sure it reaches to the right beneficiaries. Utilizing interest clusters and predictive audiences based on AI are some of the proven ways banks can explore.

13. Leverage the Power of Storytelling

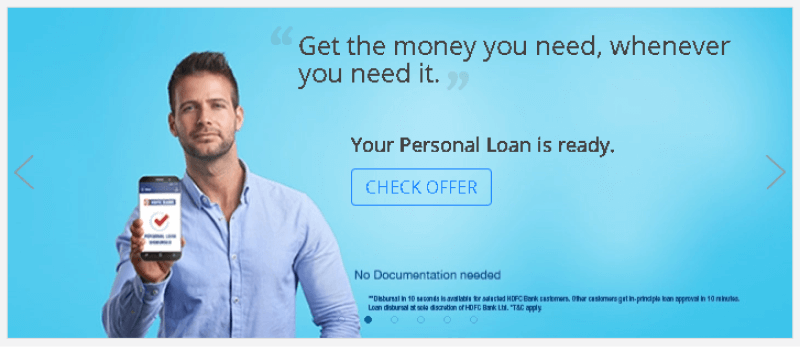

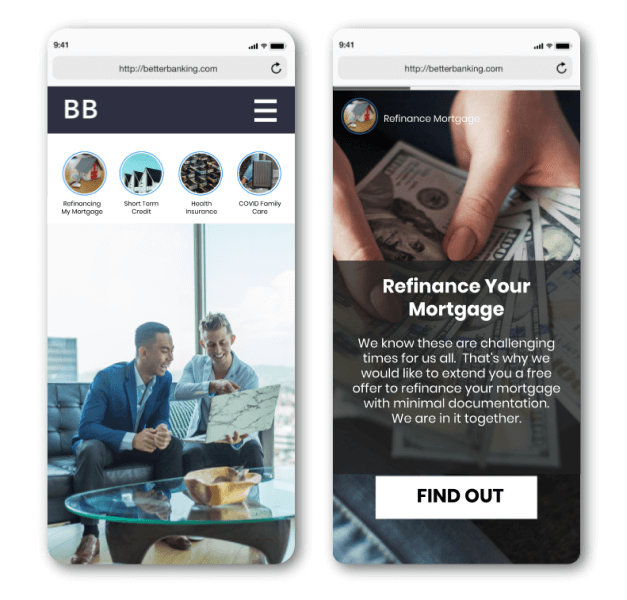

Banks can package their existing products to help their customers during crisis.They can promote products like refinancing mortgage loans, short term personal credits without documentation, health insurance policies and more. Using highly-engaging personalized stories, just like you would see them on social media, on your websites, you can help visitors discover the products they need immediately much faster.

14. Bring Back Customers With Tailored Product Recommendations for Retail Banking Strategies

Trying to sell something by taking advantage of the crisis should be avoided at any cost. However, this doesn’t mean banks should overlook those ways in which banking and insurance products can help their customers during the crisis. For example, reach out to those customers without any proper insurance coverage with suitable insurance product recommendations.

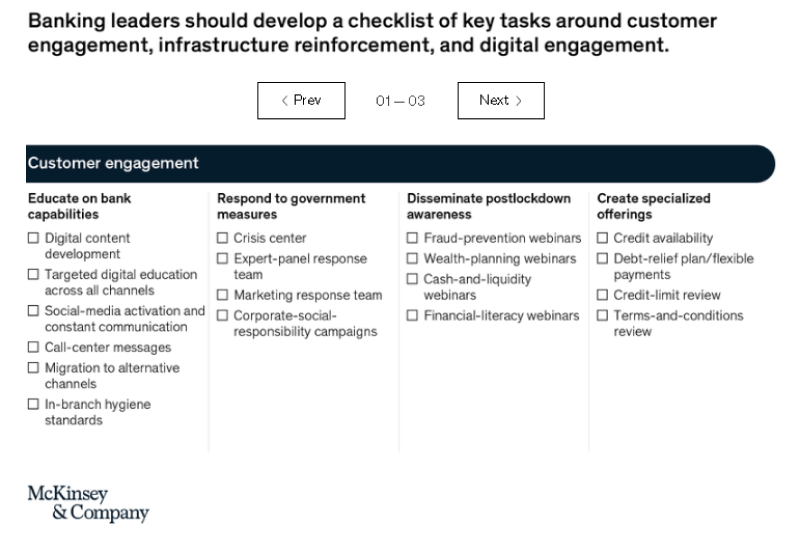

15. Lead Community Initiatives via Banking Communities

We already have great examples from China on how banks can engage and lead the community outreach. A recent checklist by McKinsey lists the additional tasks banking leaders should undertake during the COVID-19 crisis. This includes digital banking education, spreading lockdown awareness, responding to government measures and helping the public with personal credit support.

Focus on Employee Reachout via Digital Channels

16. Keep your employees safe and informed

While it is important to keep in touch with your customers during this period, it is also vital to support your employees. Provide them with the necessary cross-training in digital technologies, infrastructure help, remote working tools and more.

Also use channels like email & messaging apps to continuously relay information about the COVID outbreak, changes in banking regulations from central banks and government advisories that affect banks. This gives your employees and customer service teams the much needed information while they engage with your customers via digital channels. Make use of workflow automation tools like Insider’s Architect wherever possible to do this efficiently and effectively.

Retail banking strategies being one of the main touchpoints and key essential service for billions of people around the globe need to rise above the crisis. Digital banking serves as the best bet for banks to navigate the crisis. Banks need to be more creative with digital services more than ever. Don’t forget that the world will go back to normal one day. Until then, we need to stay digital and stay safe.

To learn more about how Insider can help your business during the crisis with continuity and growth reach out to us and we’ll schedule a personalized demo with one of our digital growth experts.

Written by

Edwin Halim

Edwin is oversees Insider's customer success team in Indonesia and the Philippines. He has 6+ years of experience in digital marketing, with a special focus on multichannel CRM strategy, growth hacking, and A/B testing. Before Insider, Edwin was a technology consultant at Accenture and co-founded his own Digital Agency.