Join us to discover how ING Bank increased banking loan application rates by 502% with AI-backed segmentation

2 Years of Digital Empowerment in a Glance!

Wednesday, November 22 | 1PM New York | 3 PM Brasilia

2 Years of Digital Empowerment In a Glance!

Wednesday, November 22 | 1PM New York | 3 PM Brasilia

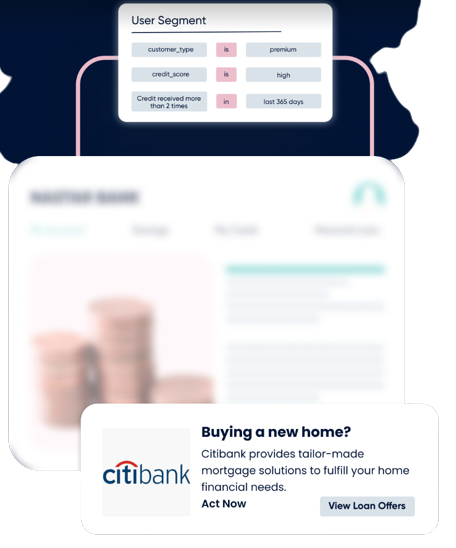

Ever since 2018, Insider is powering ING Bank to enhance omnichannel personalization resulting in increased personal loan application & credit card applications:

In this exclusive workshop with ING Bank and Insider — we dive into the tactics that ING Bank used to:

- Increase loan application

- Decrease form abandonment Rate

- Increased log-in rate

Join us in this exclusive chat with Emily Maddox (Banking & Finance – Global Digital Growth Director) for an inside view on ING Bank’s secret sauce for customer experiences.

Insider X ING Bank

ING Bank increases banking log-in rates by 21% with segmentation

Ing Bank’s decision to go with Insider was backed by Insider’s unified-channel approach — which allowed for ING Bank to deliver personalized banking experiences across all touchpoints. Insider further provided a unified customer profile which allowed ING Bank in gathering both web and mobile data in one single screen, in addition to being able to collect behavioral and real-time user data.

Read the success story

Insider for Banking & Finance

Strategies to drive revenue and customer loyalty for Financial Services

Proven strategies to build a loyal customer base by personalizing customers' omnichannel experience.

Read more!