From fashion products to masks and sanitizers—What’s next for fashion brands now?

As the world tries to find unity in crisis amidst the COVID-19 outbreak that has upended industries around the world, the fashion industry has been hit hard.

The fashion industry according to McKinsey is one of the world’s largest, generating over $2.5 trillion in global revenues, before the pandemic hit. The fashion industry—even before the crisis—has been battling with decreasing growth facing competition and shifting market dynamics. The onslaught of the pandemic has made the future look even more challenging.

Updated on Apr 16, 2020

The impact of the crisis for the fashion industry is not limited to lost revenue and sales but also entails unemployment and financial hardship for people across the value chain—from those harvesting the fibers to make textiles to shop assistants selling the finished products.

According to The State of Fashion 2020 Coronavirus Update by McKinsey, the global revenue for the fashion industry (apparel and footwear) is expected to drop by 27% to 30% this year.

Based on Insider’s Global COVID-19 Benchmarks, the fashion industry has witnessed a decline in overall sessions, conversion rate and revenue across regions.

From Luxury Products to Hand Sanitizers: The Agility of Fashion Brands

As the world grapples with this new reality, fashion powerhouses around the world are taking on the battle against the pandemic in a crucial pivot from producing clothes to manufacturing protective masks, gowns, and other supplies.

Bvlgari, for example, is manufacturing 6,000 bottles of hand sanitizers per day to assist the fight against the Coronavirus, L’oreal and LVMH are also producing hand sanitizers as a response to combat the shortage of supplies.

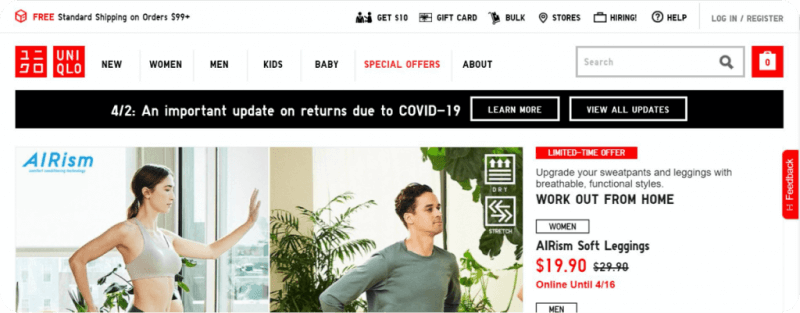

UNIQLO, Prada, Jockey, Dior, New Balance and many such fashion brands are dedicating their workshops to producing N95 masks and other medical supplies such as gowns and gloves in an effort to meet the growing demand for these essentials.

Levi’s has been hosting its virtual concert series live on Instagram with artists like Snoop Dogg, Sigrid, Kali Uchis, Burna Boy and donating $10,000 per performance to a charity picked by the artists—in addition to $3 million for communities that are vulnerable and at-risk.

How Are Shoppers Behaving Right Now?

The increasing trend to prioritize necessary items over discretionary items and with widespread store closures and social distancing—for an industry reliant on the offline store traffic—is bad news.

Online sales have also declined—almost 20% in Europe, 30% in the US, and 15-25 % in China.

This trend is expected to continue for the rest of 2020 due to the negatively impacted global economy and decreasing revenue trends as well as increased unemployment or reduced-pay affecting consumers.

The personal luxury goods segment is expected to pick up in 2021. Consumers are expected to return to paying full price for quality goods as was the case post 2008-09 financial crisis.

Overall, the fashion industry will take time to recover from the economic, financial and social impact of the pandemic.

What’s Next for Fashion Marketers?

For now, the consumer concerns around prioritizing essentials over discretionary spending will mean that, as a fashion marketer, you need to anticipate a drop in fashion spending. In the apparel segment, however, home-wear and sports-wear items will see moderate purchases—although lower than the pre-pandemic numbers—owing to the global work from home trend and rise in adoption of home-fitness trends.

While previous growth strategies for 2020 have been rendered redundant in the face of the pandemic, the new market dynamics also presents you with unexplored opportunities—which can be a foundation for robust growth—once this blows over.

You will also need to factor in the shift in consumer behavior such as purchase dynamics, spending trends and revised interest trends. There is also a new normal that will emerge after the pandemic and fashion brands need to be prepared for it. Once the dust settles, the immediate challenge will be a recessionary market where consumers will spend cautiously and the demand may continue to remain low.

On the bright side, this also presents the fashion industry with a chance to re-evaluate and reset previous strategies and start afresh. This period of quarantine also presents you with a chance to reshape the dynamics of how experiences are delivered, namely offline vs. online, and adopting a digital-first strategy. In recent years growing consumer awareness has also resulted in antipathy towards non-environment-friendly companies and wasteful practices, resulting in a decline of wholesale and offline sales and an accelerated shift to online behavior.

For the fashion industry, there are two options—emerge as a revived player post the COVID-19 era or fade away.

In this blog, we’ll talk about the immediate situation and the threats the fashion industry is facing along with proven and realistic steps you can adopt right away to tackle the anxious market.

Tactics for Fashion Marketers — Immediate and Long Term

Consumer sentiments for the industry are at an all-time low—and with the discretionary nature of fashion-spending—you won’t be getting attention like before. That is not to say, new trends are shaping the industry even as you read this article and the leaders will scale-up, innovate and improve their digital presence to seize future opportunities and stay prepared to mitigate future risks.

Let’s look at what you can do right away:

1- Understand the Discount Mindset

56% of consumers state that their main reason for purchasing clothing during the crisis was special promotions. Across Europe and the US, 65% of consumers are reducing the spending on apparel as compared to other spendings.

In the wake of the economic uncertainty and financial restrictions, spending in this segment requires a strong motivator—and discounts are great motivators. You need to communicate your campaigns in an effective way to grab the attention of your customers.

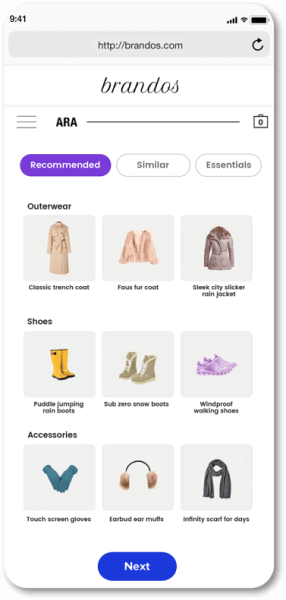

Implement a website overlay, hello bar or a welcome banner to inform your visitors about discounts. UNIQLO, a global apparel brand, has already optimized their website to cater to this need.

2- Embrace the Shift From Offline to Online

The need and demand for social distancing has closed offline stores and there is an increase in online shopping traffic. According to McKinsey, consumers are expected to spend more via online and social channels than offline during this time. Online is expected to witness an 18% increase in spending while social channels expect a 24% rise .

Within the online segment of the fashion industry, there has been a significant drop in traffic during February and March of 2020 as compared to 2019. However, this is slowly levelling off as more and more users are resorting to online purchases.

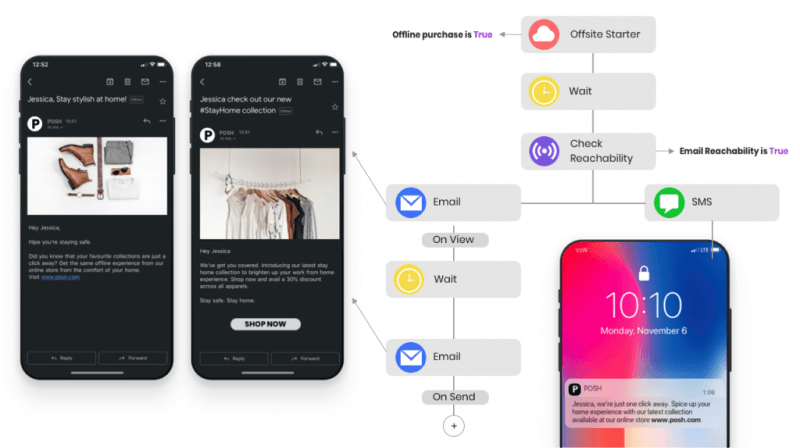

This presents a great opportunity for you to reach out to your offline shoppers and bring them online. Using tools like Insider’s Journey Builder, you can introduce much of your offline shoppers to your online channels—increasing your chances of engagement during this period.

3- Turn Your Inventory Into Opportunity

The drop in demand and spending around fashion will result in many companies having a massive pile-up of inventory. But smart strategy can help you turn this into an opportunity. Consider introducing a combination of discounts + free shipping to improve customer engagement online.

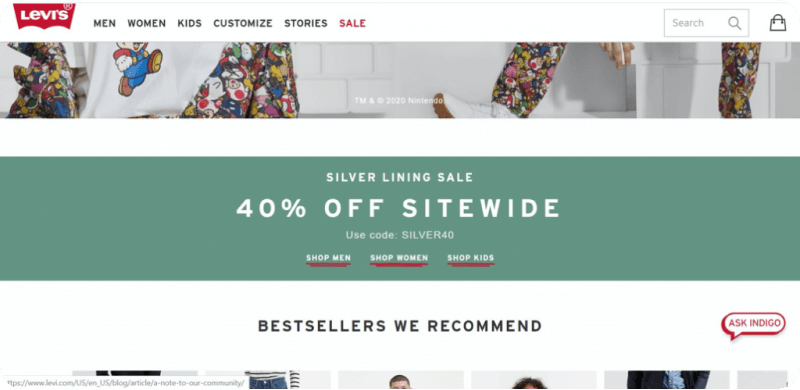

Bring out the best of spring’s colors with an attractive discount strategy and hard to resist minimum value offers for free shipping. Social distancing doesn’t have to be dull for you or your customers. Levi’s for example, has used a combination of spring inventory along with sales and worldwide free shipping on their site, along with a dedicated ‘SALE’ section.

4- Turn to the Immediate Trends

While the overall spending for fashion products have dropped, there are certain categories that continue to receive engagement—particularly the ones around home wear and sportswear apparel, due to rising work from home trends. There is also an increase in the download of home-workout apps that also generate a demand for apparel such as sweatshirts and track pants.

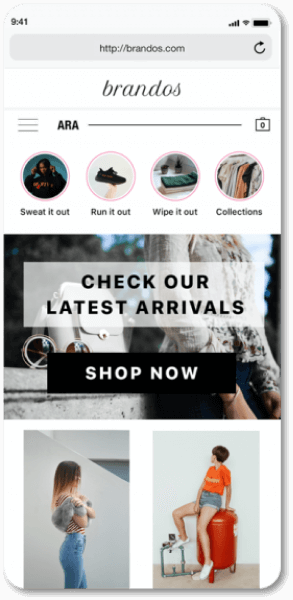

- Create #StayAthome Product Categories

The new stay-at-home social dynamics bring with it their unique requirements. You can tackle this by creating top-trending and relevant product collections crafted for the occasion. Then you can use products like Insider’s InStory to promote these collections on your website in the form of stories.

- Give Em’ What They’re Looking For

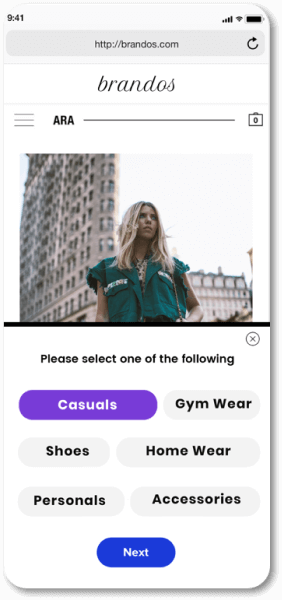

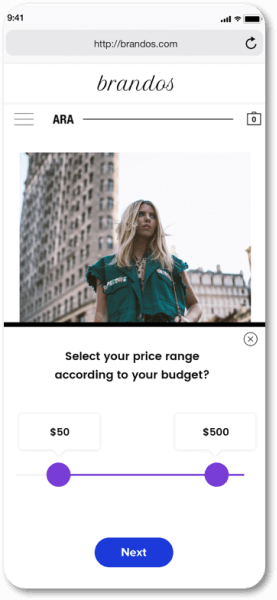

Shopping trends have clearly changed in the past month, which means that user behavior from the pre-COVID era may no longer be accurate. Time to start over and spot new trends. But would this mean you will have to wait for months to collect data on the new behavior?Certainly not.

With Insider’s Maven you can design and deliver this experience in a matter of minutes by asking the right questions. Find out exactly what your users are looking for and show them the most relevant recommendations.

5- Show That You Care About Your Community

This is a critical time for all of us. And it is the best time to show your support for the community and let them know that you’re thinking about more than just revenues. After all, we’re #InTThishisTogether.

Make sure you have a dedicated community page where you announce updates on the most recent developments in your operations and the measures you have in place to take care of your workers, staff and customers. Your customers need to see you as a friend or a partner during this difficult time, rather than just a brand that they shop when they need to.

6- Announce Changes In Shipping and Return Policies

In the new market dynamics, driven by restrictions and minimal infrastructure available at your disposal, logistics and transportation around the world has surely taken a hit, leaving shipping and return policies open to reforms. Make sure to communicate this to your customers. Bring it to their attention by using hello bars or dedicated banners on your website. Transparency is vital in building lasting relationships during this time.

Things to Look Out For

For the fashion industry, creating a long-term plan is now more vital than ever. Certain trends that have been shaping the industry, such as a shift to an online model, have been accelerated by the outbreak.

- Digital resilience

More and more consumers are moving online, and the COVID-19 situation seems to have accelerated this trend. This trend will continue even after things will get back to normal. Initial data has shown that apparel sales were still down by 50-60% even after stores had opened in China.

Brands that will survive the immediate aftermath of the pandemic will have made rapid, innovative approaches to respond to the new emerging trends. Brands looking to secure their future ahead of the immediate danger period will need to adapt to the new market conditions and take on the new trends emerging from this reshuffle.

Those brands that were already struggling before the pandemic will most likely be financially devastated, but at the same time, those with resources to spare will need to innovate quickly and capitalize on emerging trends to secure a long-term position in the new post-COVID-19 era market.

- The Need to Innovate

While being a dynamic industry in terms of the products offered, the fashion industry as a whole has been lagging behind in terms of innovation.

To cope with new restrictions and overcome the damaging impact of the pandemic while adapting to a new economic and consumer market order, brands must introduce new tools and strategies across the value chain. Fashion players must harness these innovations and scale up those that work in order to make radical and enduring changes to their organizations—and to the wider industry—after the dust settles.

What’s Next?

While these short term measures are important in weathering out this storm, the fashion industry is at a crucial junction. As a fashion marketer, you need to think about long-term strategies and adopt sustainable tactics that look beyond the immediate future.

The lockdown and social distancing measures will gradually lift, but the markets won’t bounce back to normal the next day. Some of the biggest hurdles that you face once the pandemic rolls over are

- A lethargic market – cautious about spending

- A rapid and continued rise in digital traffic (digital channels are less profitable than physical retail)

- Financial struggles from an extended lockdowns

- Growing inventory and rising costs of getting back into operations

Most experts estimate—based on previous experience—that it may take up to two years for demand to pick up and fully-restored consumer confidence in spending.

This doesn’t mean that the industry is doomed to fail, in fact evidence shows that new opportunities arising for this change are underway and the resilient players can get back on track. So keep your spirits up, take the right steps to adapt to the future of the industry and tune in to our blog to discover our best-practices and reports to stay ahead of the game!